Global equity markets closed largely higher, led by a strong rally on Wall Street, as investor sentiment improved and volatility declined sharply.

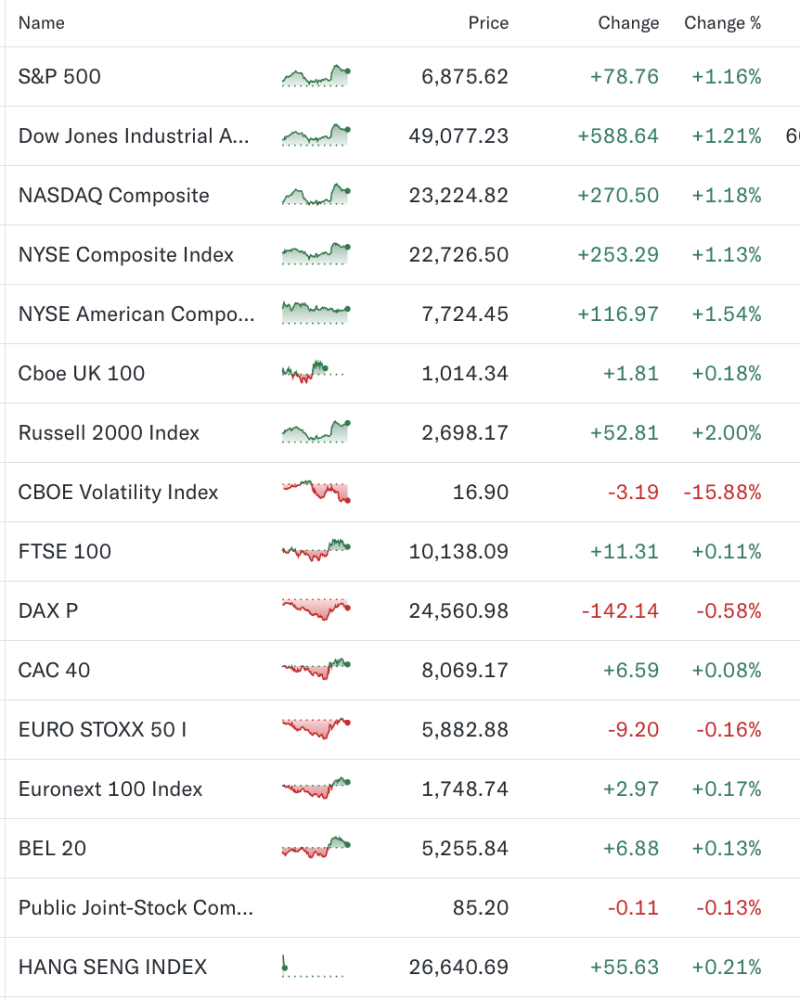

In the US, benchmark indices posted solid gains across the board. The S&P 500 rose 1.16% to 6,875.62, while the Dow Jones Industrial Average climbed 588.64 points, or 1.21%, to 49,077.23. The tech-heavy Nasdaq Composite advanced 1.18% to 23,224.82, supported by broad-based buying in growth and large-cap stocks.

The rally was accompanied by a sharp fall in market volatility, with the CBOE Volatility Index (VIX) plunging nearly 16% to 16.90, signalling easing investor anxiety.

Broader US Market Strength

The positive momentum extended beyond large caps. The Russell 2000 Index, which tracks small-cap stocks, jumped 2.00%, outperforming broader benchmarks. Meanwhile, the NYSE Composite gained 1.13%, indicating widespread participation across sectors.

European Markets Mixed

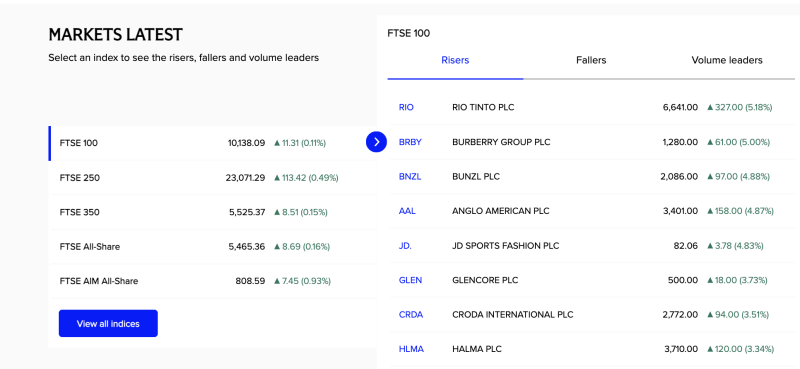

European equities showed a mixed trend. The FTSE 100 in the UK edged up 0.11% to 10,138.09, maintaining its upward bias. France’s CAC 40 added 0.08%, while Germany’s DAX slipped 0.58%, underperforming regional peers. The EURO STOXX 50 also closed marginally lower.

Asia Trades Firm

Asian markets ended modestly higher, with the Hang Seng Index rising 0.21% to 26,640.69, reflecting cautious optimism amid global cues.

Overall, global equities benefited from easing volatility and strong US market momentum, even as select European indices lagged amid region-specific pressures.

Disclaimer:

This report is for informational purposes only and does not constitute investment advice. Market data is subject to change.