London equities traded with a positive bias, as the FTSE 100 inched higher, supported by broad-based buying across mining, consumer and industrial stocks.

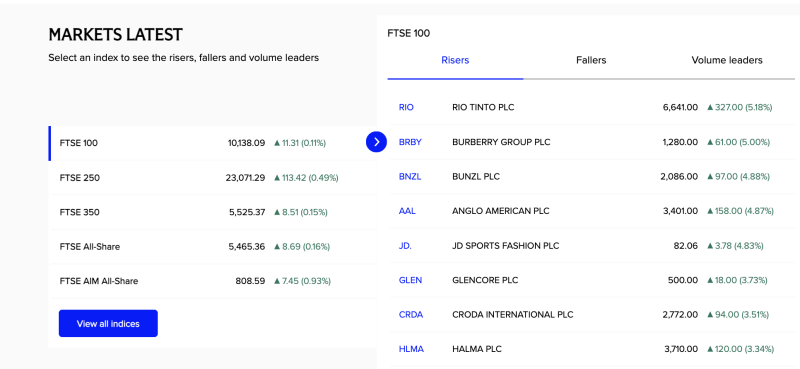

The FTSE 100 index rose 0.11% to 10,138.09, while gains were more pronounced in the broader market. The FTSE 250 advanced 0.49%, and the FTSE AIM All-Share outperformed with a 0.93% rise, indicating stronger risk appetite among investors.

Top Gainers on the FTSE 100

Mining and commodities stocks led the rally, with Rio Tinto Plc emerging as the top gainer, climbing over 5%. Anglo American Plc also posted strong gains, rising nearly 4.9%, while Glencore Plc advanced close to 3.7%, tracking firmness in commodity prices.

In the consumer space, Burberry Group Plc jumped around 5%, while JD Sports Fashion Plc gained nearly 4.8%, reflecting renewed interest in discretionary names. Bunzl Plc, Croda International Plc, and Halma Plc also featured among the notable advancers, each posting gains of over 3%.

Broader Market Performance

The FTSE 350 and FTSE All-Share indices closed higher, underscoring steady participation across sectors. Market breadth remained positive, with cyclical stocks outperforming defensives during the session.

Overall, the UK market showed resilience, with strength in mining and consumer stocks helping the FTSE indices close in positive territory amid selective stock-specific buying.

Disclaimer:

This news is for informational purposes only and does not constitute investment advice. Investors should consult their financial advisors before making any investment decisions.