New York, Feb 18, 2026: U.S. equities closed with a mixed undertone as sharp rallies in micro-cap and biotech counters reflected speculative risk appetite, while institutional capital largely remained anchored in mega-cap technology and benchmark ETFs.

Momentum Corner: Small-Caps Steal the Show

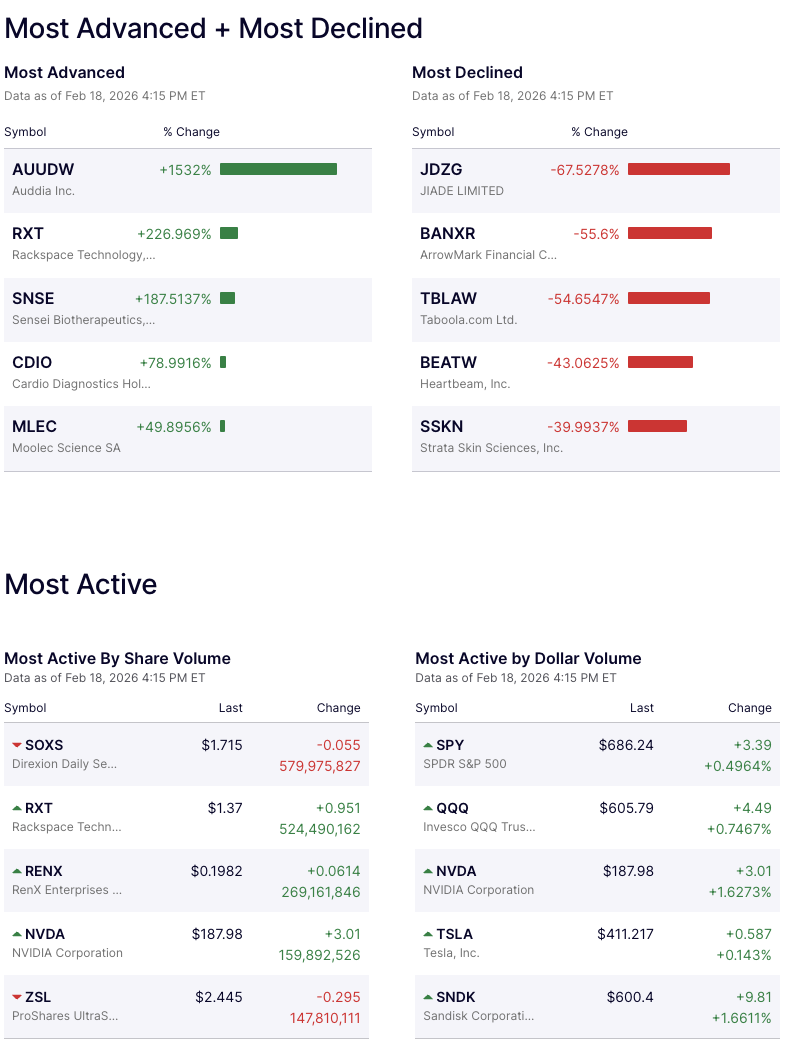

Among the session’s biggest movers, Auddia Inc. delivered an extraordinary multi-fold surge of over 1500%, largely attributed to low-float and warrant-driven volatility rather than fundamental triggers. Cloud services player Rackspace Technology soared nearly 227% amid heavy speculative participation, while biotech names including Sensei Biotherapeutics and Cardio Diagnostics Holdings posted strong double-digit gains on momentum buying.

Market participants noted that the day’s top gainers were overwhelmingly concentrated in high-beta micro-cap stocks, signalling short-term risk-on sentiment led by retail traders.

Pressure Zone: Sharp Cuts in High-Beta Counters

On the downside, JIade Limited plunged over 67%, while ArrowMark Financial and Taboola.com Ltd. witnessed steep declines exceeding 50%. Losses were also pronounced in healthcare technology and dermatology-focused names, underlining profit-booking in overheated segments.

Heavy Trading: Where the Volume Concentrated

Trading activity was dominated by leveraged and momentum instruments, with SOXS leading share turnover. Rackspace Technology featured prominently among the most actively traded stocks, reinforcing the speculative nature of its rally. Meanwhile, NVIDIA Corporation continued to see robust participation, reflecting sustained institutional interest in the AI-driven semiconductor theme.

Big Money Trail: Institutions Stick with Core Leaders

In terms of dollar volume, benchmark ETFs and mega-cap technology names attracted the bulk of institutional flows. SPDR S&P 500 ETF Trust and Invesco QQQ Trust posted steady gains, signalling continued confidence in the broader market. Chip giant NVIDIA Corporation advanced over 1.6%, extending its leadership in the AI trade, while Tesla Inc. remained largely range-bound with marginal gains.