Global equity markets closed largely higher, driven by a strong rally on Wall Street, sharp stock-specific moves in the US, and firm cues from the UK market, while volatility cooled significantly.

US Markets: Indices Rally, Volatility Drops

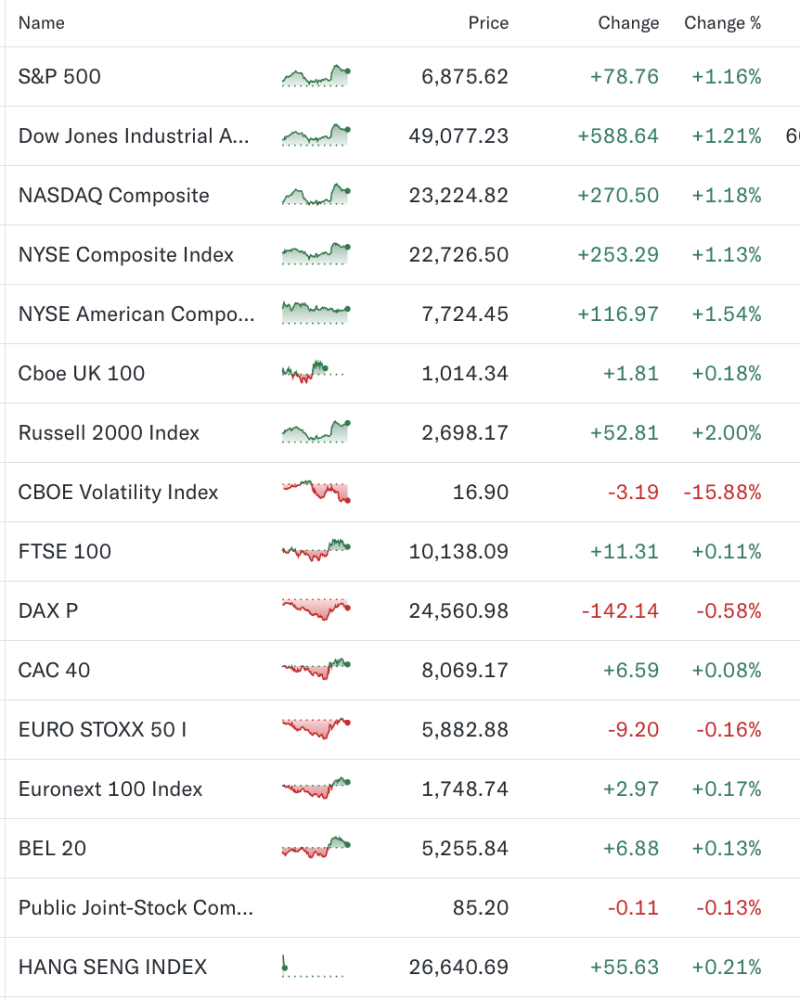

US benchmark indices ended sharply higher, reflecting renewed risk appetite among investors. The S&P 500 gained 1.16% to close at 6,875.62, while the Dow Jones Industrial Average rose 588.64 points, or 1.21%, to 49,077.23. The Nasdaq Composite advanced 1.18% to 23,224.82, supported by buying in technology and semiconductor stocks.

The rally coincided with a sharp decline in market fear, as the CBOE Volatility Index (VIX) dropped nearly 16% to 16.90, indicating easing uncertainty.

Top US Stock Movers: Extreme Swings

Among individual stocks, Namib Minerals (NAMM) surged over 130%, emerging as one of the session’s biggest gainers, alongside U.S. GoldMining (USGOW) and Global Interactive Technologies (GITS). On the downside, IO Biotech (IOBT) plunged nearly 60%, while Venus Concept (VERO) and UY Scuti Acquisition Corp (UYSCR) also saw steep declines.

Most Active US Stocks

Trading activity remained heavy in key names. Intel, NVIDIA, and Tesla featured prominently by volume and value, while ETFs tracking broader and leveraged segments also saw heightened participation. NVIDIA continued to attract strong interest amid sustained momentum in AI-related stocks.

UK Markets: FTSE 100 Edges Higher

In Europe, the FTSE 100 closed marginally higher, rising 0.11% to 10,138.09. Mining and consumer stocks led gains, with Rio Tinto, Burberry Group, Bunzl, Anglo American, and JD Sports Fashion among the top performers, each advancing between 4% and 5%.

Mid-cap and broader UK indices also ended in the green, with the FTSE 250 up 0.49% and the FTSE AIM All-Share gaining close to 1%, indicating broader participation.

Global Markets Snapshot

Elsewhere, global markets showed mixed but stable trends. France’s CAC 40 and the Euronext 100 posted modest gains, while Germany’s DAX underperformed. In Asia, the Hang Seng Index ended slightly higher, tracking positive global cues.

Overall, strong gains in US equities, cooling volatility, and selective strength in UK stocks supported global risk sentiment, even as pockets of sharp stock-specific volatility persisted.

Disclaimer:

This story is for informational purposes only and should not be construed as investment advice. Market movements are subject to risk and volatility.