US markets witnessed extreme divergence on Tuesday, with sharp rallies in select small-cap and biotech stocks even as heavyweight technology names and benchmark ETFs came under

pressure.

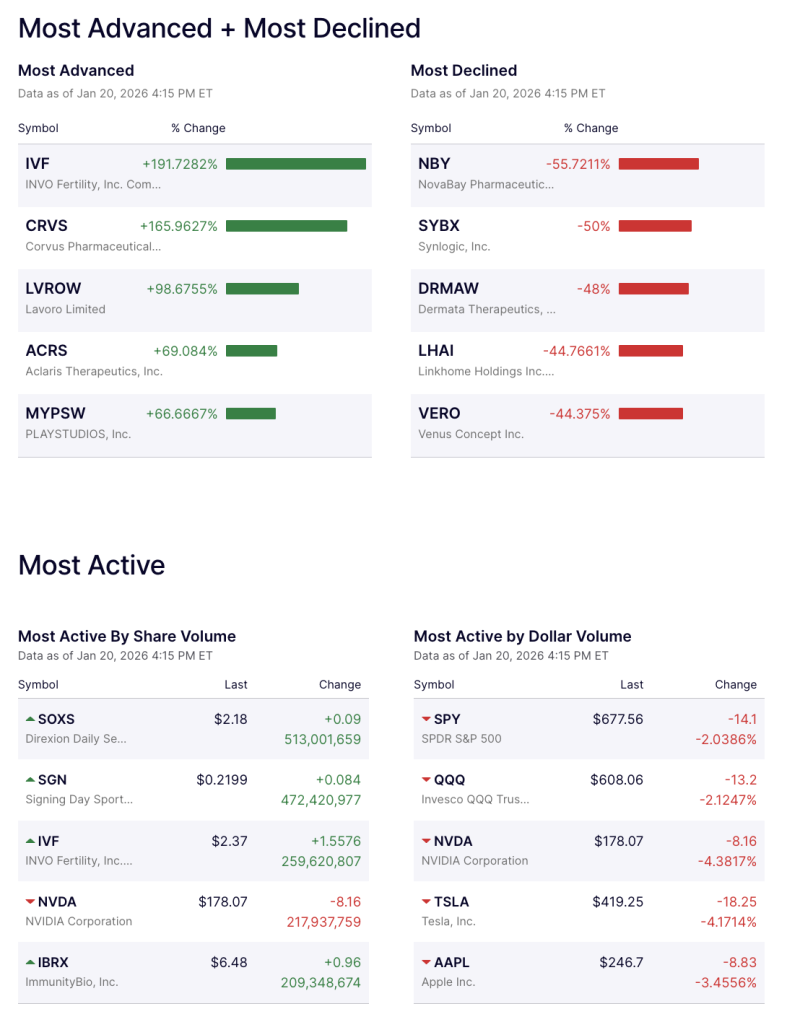

Top Gainers: IVF, CRVS Lead the Charge

Among the biggest gainers, INVO Fertility (IVF) surged an extraordinary 191.7%, topping the list of most advanced stocks amid heavy trading volumes. The rally was followed by Corvus Pharmaceuticals (CRVS), which jumped 165.9%, while Lavoro Limited (LVROW) climbed 98.6%.

Other notable gainers included Aclaris Therapeutics (ACRS), up 69.1%, and Playstudios (MYPSW), which advanced 66.7%, reflecting strong speculative interest in select healthcare and micro-cap counters.

Steep Declines: NBY, SYBX, DRMA Slide

On the downside, NovaBay Pharmaceuticals (NBY) plunged 55.7%, emerging as the worst performer of the session. Synlogic (SYBX) fell 50%, while Dermata Therapeutics (DRMAW) dropped 48%.

Other stocks under pressure included Linkhome Holdings (LHAI), down 44.8%, and Venus Concept (VERO), which declined 44.4%.

Most Active Stocks: SOXS, IVF, Nvidia in Focus

Trading activity remained elevated across both speculative and large-cap names.

Direxion Daily Semiconductor Bear ETF (SOXS) topped the volume charts with over 513 million shares traded, reflecting bearish sentiment in the semiconductor space.

INVO Fertility (IVF) also featured among the most active stocks by volume, highlighting strong retail participation.

Meanwhile, Nvidia (NVDA) saw heavy turnover with over 217 million shares traded, even as the stock closed lower.

Dollar Volume Leaders: SPY, QQQ, Nvidia See Selling

By dollar volume, selling pressure was concentrated in index heavyweights.

The SPDR S&P 500 ETF (SPY) fell 2.04%, while the Invesco QQQ Trust (QQQ) declined 2.12%, signaling broad weakness in growth stocks.

Among individual stocks:

Nvidia (NVDA) dropped 4.38%

Tesla (TSLA) slid 4.17%

Apple (AAPL) declined 3.46%

Market Snapshot

The session underscored heightened volatility on Wall Street, with speculative buying driving sharp gains in select small-cap names, while risk-off sentiment weighed on large-cap technology stocks and benchmark indices.

-vs-rohit-rahal-(tmd).jpg)