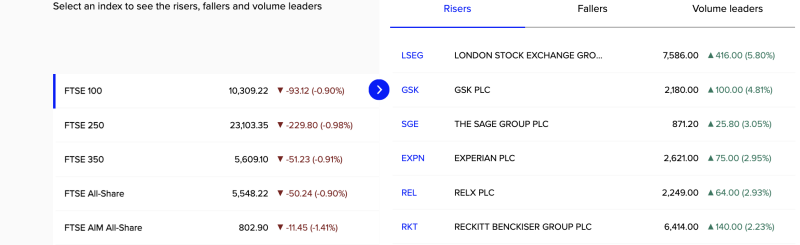

UK equity markets closed lower, with the FTSE 100 falling 93 points (-0.90%) to 10,309, mirroring broad-based weakness across major indices. The FTSE 250 (-0.98%), FTSE 350 (-0.91%), and FTSE All-Share (-0.90%) also declined, signalling risk aversion across large- and mid-cap stocks, while the FTSE AIM All-Share dropped a sharper 1.41%, reflecting pressure on smaller companies.

Despite the index-level decline, select heavyweight stocks posted strong gains. London Stock Exchange Group (LSEG) led FTSE 100 risers with a 5.8% jump, followed by GSK (+4.8%), Sage Group (+3.1%), Experian (+3.0%), and RELX (+2.9%), highlighting defensive and data-driven names attracting investor interest. Reckitt Benckiser also advanced 2.2%.

The session underscores a fragmented UK market: while macro and global cues dragged indices lower, stock-specific optimism in pharmaceuticals, data, and market infrastructure provided pockets of resilience within the FTSE 100.