Attributed to Rohan Bhargava, Co-Founder of CashKaro

The Union Budget 2024 brings substantial changes to personal finance that will benefit a large number of taxpayers. The increase in the standard deduction from ₹50,000 to ₹75,000 and the revision of the tax slab limit for the 5% tax rate from ₹5 lakh to ₹7 lakh will significantly enhance disposable income. These changes will provide much-needed financial relief to the middle class and boost overall consumption.

Furthermore, the proposal to increase the deduction of employer expenditure towards NPS from 10% to 14% of the employee's salary will improve social security benefits for the workforce. The revamp of the capital gains tax regime will impact investment decisions and financial planning, ensuring a more balanced and fair approach to taxation. These measures collectively contribute to a more robust and financially secure environment for individuals and families across India.

--------------------------------------------------

Attributed to Swati Bhargava, Co-Founder of CashKaro

The Union Budget 2024 is a significant step forward for India's growth, focusing on empowering women in the workforce, supporting employee welfare, and driving innovation. The allocation of over ₹3 lakh crore for schemes benefiting women and girls, along with new initiatives like skilling programs and salary support for first-time employees, highlights the government's commitment to gender inclusivity and employment generation.

For startups, the abolition of the angel tax for all investors is a significant boost, fostering a more vibrant and innovative startup ecosystem. The reduction of the TDS rate on e-commerce transactions from 1% to 0.1% is a crucial step for digital businesses, easing the tax burden and encouraging growth. Additionally, the comprehensive review of the customs duty structure over the next six months and the proposal to decriminalize TDS delays up to the filing of the tax date reflect a forward-thinking approach to taxation. Overall, these measures will propel India towards a brighter, more innovative future, driving economic growth and development across various sectors.

Aman Trehan, Executive Director, Trehan Iris, says, ""The Union Budget 2024-25, presented by Finance Minister Nirmala Sitharaman, has ignited a sense of optimism within the real estate fraternity. The substantial capital expenditure of Rs. 10 lakh crore earmarked for infrastructure development is a testament to the government's commitment to fostering a conducive environment for growth. As real estate developers, we are particularly enthused by the emphasis on ease of doing business and the incentives aimed at job creation. These measures will undoubtedly catalyze investment and spur innovation in the sector. Moreover, the focus on housing and urban development aligns perfectly with our vision of creating vibrant, livable communities. We are confident that this budget will serve as a catalyst for the real estate industry, propelling it towards new heights of success and sustainability."

“We applaud the Indian government's visionary Budget 2024, particularly its transformative approach to travel and tourism. The focus on developing iconic spiritual and cultural destinations resonates deeply with our commitment to offering diverse and enriching travel experiences. The tax relief for cruise operators is a welcome move, fostering growth in this exciting sector. We are particularly encouraged by the emphasis on enhancing beach destinations, which aligns perfectly with our portfolio of coastal properties. This budget sets the stage for India to truly shine as a premier global travel destination, boosting international tourism and showcasing the country's unique attractions.”

By William Hall, Vice-President of Marketing & Digital: RCI EMEA, APAC & India.

The budget announced is women friendly as it focuses on women development and supporting women across sectors. The budget has done a remarkable job by providing schemes worth ₹3 lakh crore benefitting women and girls. We are in alignment with the government vision of providing a platform to today's women. In sync with the government's vision of women of today to be financially independent and thrive in careers and business

can be achieved only if we create a holistic support system for their development. Through the Shecosystem we are providing women with they have access to the Knowledge, Networks and Capital enablement they require to achieve their goals. We are confident that we will definitely help build women entrepreneurs and increase women participation in the work force." - Deeksha Ahuja, Founder, Encubay

Please find appended quote from Mr. Prashant Kumar, MD & CEO, YES BANK:

Quote: This Budget gets full marks for the choice of areas that the government would want to support in its effort to gradually move India towards its ultimate Viksit stage. This Amrit Kaal has come to India due to its strong demographic dividend and the large number of youths joining the employment force. This needed interventions on all aspects – not only to provide formal education to the youth, but also to encourage the perfect skill mapping. Of note is the support being provided in the budget to MSMEs to scale up and compete with the world by enabling funding to the segment. Doubling the limit for Mudra loans also need to be called out as this will enable small businesses to develop.

Please find appended quote from Mr. Rajan Pental, Executive Director, YES BANK:

Quote: "We welcome the significant measures introduced in the Union Budget, by the Honourable Finance Minister, to bolster MSMEs and the manufacturing sector, enhancing their growth prospects and global competitiveness. The launch of the Credit Guarantee Scheme, which provides term loans up to ₹100 crore without requiring collateral, will notably reduce risk for banks and expand their lending opportunities, facilitating greater investment in essential machinery and equipment.

The new credit assessment model, which leverages digital footprints, represents a transformative shift in evaluating MSME creditworthiness. This innovation will streamline the credit process and extend support to MSMEs that lack formal accounting systems, making credit access more inclusive and efficient. Additionally, the enhancement of Mudra loan limits to ₹20 lakh and the provision for continued credit support during periods of stress are designed to stabilize borrowers and reduce the likelihood of non-performing assets. These measures will help maintain operational continuity and foster growth.

The reduction of the TReDS onboarding threshold to ₹250 crore will significantly improve MSME liquidity by facilitating the conversion of trade receivables into cash. Meanwhile, SIDBI's expansion to cover 168 major MSME clusters will broaden credit access and strengthen financial inclusion. Overall, these strategic measures are expected to drive substantial MSME growth, spur innovation, and fortify India's economic resilience. For the banking sector, these changes present valuable opportunities for increased engagement with MSMEs, while mitigating risk and enhancing financial stability."

Please find appended quote from Mr. Indranil Pan, Chief Economist, YES BANK:

Quote: The Budget takes a leaf out of the strategic direction to sustainable growth that has been penned by the Economic Survey. Thus, even with one eye on the fiscal consolidation, the government announced structural measures to boost employment – not only in terms of numbers but also quality, addressed the need to scale up MSMEs through credit facilitation to the sector – even for MSMEs that do not strictly have a formal accounting system. To aid small business, the mudra loan limits have also been enhanced. We believe that this is a budget for the longer term while near term consumption boost comes through providing benefits to income taxpayers. The Budget also promises structural reforms in the factors of production and use market forces to boost the growth story. Equity market participants may not have been happy with the Budget as the STT, LTCG tax rates go up. However, this was government's way of casting its tax net wider. We see a reduction in the market borrowing programme by Rs 120 bn while net T-bill issuance is lowered by Rs 1 tn over the interim Budget. The reduction in the net T-bill issuance may aid domestic liquidity and push down short-term rates while long tenor rates may remain sticky.

Tanuushka K Lal Chief Operating Officer Kosmoderma Healthcare Pvt. Ltd.-The union budget by our honorable Ms.Sitharaman is quite promising for the beauty and healthcare sector as it involves a significant reduction in the import taxes on raw materials needed for the beauty industry. This policy change is expected to lower costs for businesses in these sectors, making it more feasible for smaller enterprises and MSMEs (Micro, Small, and Medium Enterprises) to thrive. By alleviating the financial burden associated with raw material imports, the budget aims to support growth, innovation, and competitiveness within the beauty and healthcare industries.

Ashish Tandon, Founder and CEO, Indusface-"We at Indusface commend the government for recognizing the critical role of technology and innovation in driving economic growth. The budget's emphasis on the development of Digital Public Infrastructure applications across various sectors such as credit, e-commerce, education, health, law and justice, logistics, MSME services delivery, and urban governance demonstrates a forward-thinking approach. However, while these initiatives are promising, we believe that a more pronounced focus on cybersecurity is essential. As digital transformation accelerates, robust cybersecurity measures are crucial to safeguard our nation's digital infrastructure. We urge the government to allocate dedicated resources and policies to bolster our cybersecurity framework, ensuring that our technological advancements are secure and resilient."

Jateen Trivedi, VP Research Analyst - Commodity and Currency, LKP Securities-

"Gold prices witnessed a minor recovery at ₹68,775 in MCX after a significant fall following the budget announcement of a 6% duty cut. This cut caused a drop of about ₹4,200, as prices fell from ₹72,700 to ₹68,500 on budget day, marking one of the biggest falls in rupee terms. The duty cut has aligned Indian gold prices with Comex prices by removing the premium. Going forward, Comex gold movements will be crucial, especially as the rupee has stabilized with speculation subsiding. The broad trend in gold remains positive, although volatility is expected to continue."

Mr. Masood Mallick, CEO, Re Sustainability Limited (ReSL)

"At Re Sustainability, we applaud the government’s continued focus on environmental sustainability and endorse the creation of the critical mineral mission. This mission, with its emphasis on extended producer responsibility, technology advancement, workforce development, and appropriate financing mechanisms bolsters industry efforts to recycle critical minerals. These initiatives foster a circular economy and lessen our nation’s reliance on imported critical minerals.

Furthermore, the government’s plans to expand solid waste management projects and services to 100 major cities underscore its commitment to enhancing the quality of life for the burgeoning urban population. These comprehensive efforts signal a promising future for sustainable development in our country."

Vishal Puri, Co-Founder, Spalba, a leading provider of venue management technology said, "We applaud the government's initiatives to boost tourism through improved connectivity and a simpler tax regime for foreign shipping companies. These steps will significantly enhance the attractiveness of India as a top tourist destination and drive economic growth.

However, while these measures are a positive step forward, it is equally crucial to address the needs of our tech and SaaS industries. The growth and sustainability of these sectors depend heavily on robust IP protection and innovation incentives. By strengthening IP frameworks, streamlining patent processes, and providing R&D incentives, the government can foster a secure environment that nurtures technological advancements. This will prevent the outflow of valuable intellectual capital and ensure holistic growth across all sectors."

The FY25 budget offers a mix of promising initiatives and missed opportunities for the hospitality and startup sectors. Infrastructure development, like new airports and sports facilities in Bihar, will boost tourism, and developing Nalanda as a tourist center is a positive step. However, more direct support for startups in the hospitality tech space would have accelerated growth and innovation. The abolition of Angel Tax simplifies investments, but additional targeted incentives for tech startups are needed. Overall, the budget lays a solid foundation, but there's room for more focused support to maximize industry growth, said Sibasish Mishra, Founder, Bookingjini.

Mr. Rohit Gupta, Vice President-Finance, HRIPL on the Union Budget 2024-2025:

“The Union Budget 2024-2025 is strategically designed to boost consumption and stimulate demand across various sectors. A key focus is on enhancing the agriculture sector and rural economy, while continuing to emphasize women empowerment, employment generation, and youth skill development. The MSME sector benefits significantly from an increased Mudra loan limit from INR 15 to 20 lakhs and the introduction of a credit guarantee scheme in the manufacturing sector. Rationalized taxes for individuals are set to increase disposable income, further driving consumption and fueling demand for products and services.”

Kumardeep Dutta Choudhury Director, Medical Oncology, Max Hospital Shalimar Bagh, New Delhi

"The exemption of customs duties on cancer drugs such as Trastuzumab Deruxtecan, Osimertinib, and Durvalumab will have a profound impact on patients battling cancer. These medications are crucial in the treatment of various types of cancer, with Trastuzumab Deruxtecan specifically targeting certain breast cancers, Osimertinib used for specific lung cancers, and Durvalumab for urothelial carcinoma and other cancers. By eliminating the customs duties, the cost of these drugs will decrease, making them more accessible to patients who need them. This move not only reduces the financial burden on patients and their families but also ensures that more individuals can benefit from these advanced therapies, potentially improving survival rates and quality of life for many cancer patients in India."

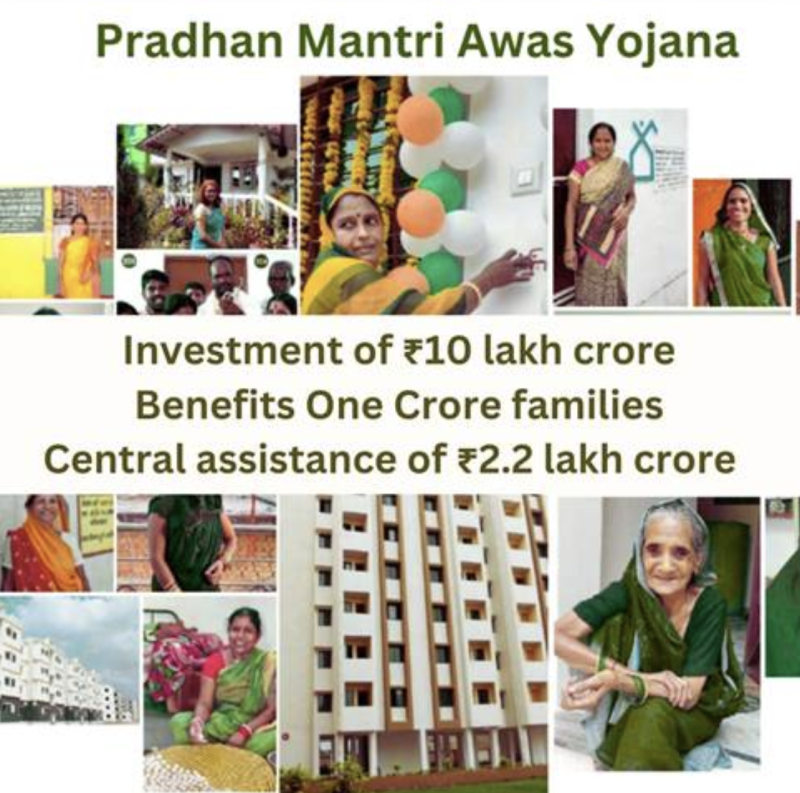

"We highly support this year's Union Budget's provision towards the Indian real estate sector. The allocation of Rs 10 lakh crore under the PM Awas Yojana, Urban 2.0, and the Rs 2.2 lakh crore push for affordable housing will notably increase homeownership among the urban poor and middle class. The budget's significant investment in infrastructure, amounting to Rs 11.11 lakh crore or 3.4% of India's GDP, showcases strong fiscal support poised to propel economic growth and development throughout the nation. Apart from this, the budget's enhancements in Mudra loans and the removal of the angel tax will undoubtedly boost MSMEs and encourage entrepreneurship. Also, promoting states to reduce stamp duties on homes bought by women marks a significant step toward achieving gender parity in real estate ownership. Additionally, this year's Union Budget provides a solid foundation for the real estate industry, especially in Metro Cities and Bihar where housing shortages and infrastructure development are major concerns. With Rs 2.66 lakh crore allocated for rural development, including the construction of three crore more houses, areas like Bihar will greatly benefit, boosting economic growth and improving overall living conditions. However, it is concerning that the indexation benefit for real estate sales has been eliminated. In short, the 2024 Union Budget places India on a path of sustainable prosperity by presenting a comprehensive plan to address housing affordability, infrastructure development, and economic inclusion."-- says Mr. Abhishek Raj, Founder & CEO of Jenika Ventures.

Please find the appended quote: Amrit Acharya, co-founder & CEO, Zetwerk

“The government's dedication to empowering MSMEs through various initiatives deserves praise. These initiatives, like the Credit Guarantee Scheme, will grease the wheels of manufacturing by simplifying access to loans for critical machinery and equipment purchases. Additionally, Digital Footprints for Credit Assessment will open financing doors for MSMEs without formal accounting systems. The MUDRA scheme's increased loan limit empowers successful entrepreneurs to scale their businesses, while expanding the TReDS platform improves MSME working capital by facilitating easier conversion of receivables into cash. Zetwerk works with over 10,000 small manufacturing partners and these were some genuine issues which were plaguing their growth.

The Employment Linked Incentive is a game-changer, offering a helping hand to new employees and motivating manufacturers to create jobs. This will significantly boost the economy and address the manufacturing sector's talent shortage.

The development of "plug and play" industrial parks in nearly 100 cities with complete infrastructure is a positive step towards creating a more manufacturing-friendly environment. Measures like reduced customs duty on mobile phones and components, abolishment of angel tax for startups, and the expansion of exemptions for solar cell and panel manufacturing will all contribute to propelling domestic manufacturing and innovation. At Zetwerk, we are committed to building a pan-India manufacturing footprint across electronics, renewables and aerospace & defence sectors and be a key player in India's growth story. We believe the budget's measures will create a more supportive environment for manufacturing, empowering businesses like ours to flourish."

Amrit Acharya, Co-founder & CEO

Amrit Acharya is the co-founder & chief executive officer of Zetwerk. He brings diverse experience in the field of technology, manufacturing, and investments gathered in his previous stints with ITC Ltd in India and McKinsey in the US. Amrit has a degree in Electrical Engineering from IIT-Madras and an MBA from Haas School of Business, University of California. He is from Bhubaneswar, Odisha.

Quote on Infrastructure from Jagannarayan Padmanabhan, Senior Director & Global Head, Transport, Mobility and Logistics, Consulting, CRISIL Market Intelligence and Analytics

"Targeted interventions and making the states a focal point for Infra development is one of the key themes. Increased focus on Cities and their all-round development has taken centerstage. Development of Industrial parks, cities as growth hubs, transit oriented development scheme, brownfield development of cities water and sanitation are some of the key announcements in this regard. The allocation to infrastructure ministries has been maintained as in the interim budget. Expending the allocated budgets will be key for this year."

Mr Pankaj Sharma, President, The Lexicon Group.

I am particularly impressed with the Budget's emphasis on skill development, industrial internships and cross-sector collaboration. The Prime Minister's Package will serve as a game-changer for educational institutes and industrial organisations, because the win-win situation for the emplower and interns is the boost that our sector truly needed. A projection of providing internships to one crore Indian youth is an ambitious project, which can be successfully completed if we all collaborate towards a common vision of realising the potential of our young learners. Furthermore, the plan for upgradation of 1000 Industrial Training Institutes will herald accessibility and bridge the gaps between students, educators and companies.

I am also very appreciative of the government's schemes for the education of girls and support for working women. The Lexicon Group is largely run by women who make up for 80% of our workforce and have more than 90% women in senior leadership roles. We offer our whole-hearted support to our government's initiative towards building gender equity both in educational institutes as well as organisations.

However, I am disheartened to see a lack of focus on K-12 institutes, which serve as the foundational bricks in the development of young children. As school leaders, we were hoping to receive greater support towards expanding the educational infrastructure to wider communities where high quality education is inadequate. Additionally, centralised incentives for teachers would have inspired more young men and women to enter the education sector. A more holistic support for School Education would have truly made the 2024 Budget a success story for Indian education.

Mr. Abhinandan Lodha – Chairman, The House of Abhinandan Lodha, says, "The 2024-2025 Budget is a growth-centric blueprint with profound implications on employment and employability through real estate, infrastructure, and tourism. This budget marks a significant shift towards holistic growth, focusing on affordable housing. The allocation of ₹2.2 lakh crore for constructing one crore houses in urban areas and two crore houses in non-urban areas demonstrates the government's commitment to improving living standards. This initiative will generate substantial employment opportunities and bolster ancillary industries. The ₹1.5 lakh crore incentive for infrastructure development will enhance connectivity and drive growth across states. The PM Awas Yojana, with a budget of ₹10 lakh crore, alongside the rationalization of stamp duties, digitization of land records using GIS, and introduction of unique land parcel identification numbers for rural areas, reflect a forward-thinking approach. Additionally, the ₹10 trillion allocation for tourism and cultural corridor development will stimulate local economies. These measures are poised to invigorate the real estate sector, setting the stage for a robust economic future."

Mr. Navneet Ahluwalia, Head of Division, Human Resources & Administration, FUJIFILM India

"We applaud the 2024-25 Union Budget for its forward-thinking approach to education, skill development, and promoting women-led development. The introduction of the internship opportunity scheme is commendable, significantly enhancing youth skills and motivation, and bridging the gap between academic learning and real-world application.

The substantial allocation for AI-enabled learning demonstrates a strong commitment to innovation, transforming traditional methods and ensuring students are prepared for a tech-driven future. Additionally, several employment schemes are set to boost skill development. Scheme A offers one month's wage to new workforce entrants across all sectors. Scheme B incentivizes additional employment in manufacturing, directly benefiting employees and employers with EPFO contributions, expected to aid 30 lakh youth. Scheme C covers additional employment in all sectors, with the government reimbursing employers up to Rs 3,000 monthly for two years per additional employee, aiming to create 50 lakh jobs.

The Budget's allocation of over Rs 3 lakh crore for schemes benefiting women and girls underscores the government's commitment to enhancing women's roles in economic development. The establishment of working women hostels, collaboration with industries for creches, and women-specific skilling programs promote higher workforce participation. These initiatives ensure a supportive environment for women, fostering empowerment and economic independence.

With Rs 1.48 lakh crore dedicated to education, employment, and skilling, the budget reflects a comprehensive approach to building a robust educational infrastructure. This investment will improve education quality, expand learning access, and foster skill development nationwide. By prioritizing skilling and promoting women's participation, the government is equipping youth and women with the tools needed to succeed in a rapidly evolving job market.

Overall, the 2024-25 Union Budget paves the way for a brighter, more skilled future for our youth and a more inclusive, empowered future for women, ensuring they are well-prepared to meet the demands of a dynamic and competitive world."

Reactive Statement on Budget Allocations that will help Child Welfare in 2024

The recently presented Budget 2024-2025 demonstrates a significant commitment to improving the lives of children through comprehensive allocations in education, health, and child welfare.

Over ₹3 lakh crore allocated for schemes benefiting women and girls ensures that these crucial segments of the population receive support for education, healthcare, and economic participation. Additionally, the launch of the Pradhan Mantri Janjatiya Unnat Gram Abhiyan is set to benefit 5 crore tribal people, which includes a significant number of children, by improving their socio-economic conditions.

Additionally, the allocation of ₹1.48 lakh crore for education ensures significant investment in infrastructure, quality of education, and skill development. The budget speech also mentioned a centrally sponsored scheme that aims to skill 20 lakh youth over five years by upgrading 1000 Industrial Training Institutes (ITIs). Upgrading ITIs and skilling initiatives prepare youth for employment, reducing unemployment and driving economic progress. This skilled workforce can attract global businesses and enhance India's competitiveness.

Although specific child health allocations are not detailed, the focus on inclusive healthcare ensures that children and adults receive necessary medical services. Healthy children grow into productive adults, reducing future healthcare burdens and increasing societal productivity.

The Budget 2024-2025 reflects a robust commitment to fostering the well-being and development of children through targeted investments. Strategic allocations in child welfare will lay a solid foundation for achieving a Viksit Bharat. These investments are not just expenditures but critical enablers of a developed, equitable, and prosperous India.

Sunil Agarwal, Director, Vinod Cookware:

"The Union Budget 2024 is commendable for its strategic focus on strengthening Micro, Small, and Medium Enterprises (MSMEs), which form the backbone of our economy. The allocation of INR 100 crore to the Credit Guarantee Scheme and the enhancement of the Mudra Loan limit to INR 20 lakh are decisive steps toward empowering small businesses. As for the manufacturing industry, the provision allowing MSMEs to acquire machinery without collateral is particularly noteworthy, as it paves the way for enhanced productivity and growth.

Moreover, the reduction in Goods and Services Tax (GST) rates and the simplification of compliance procedures underscore the government's commitment to fostering a cohesive business environment. The planned expansion of the Small Industries Development Bank of India (SIDBI) with 24 new branches by 2025 is guaranteed to further support MSME clusters across the country. These measures collectively enhance the ease of doing business and provide a strong foundation for economic development.

From the consumer's standpoint, the new tax regime is expected to result in a reduction in income tax for salaried employees, offering significant relief to the middle class. This reduction in the tax burden is anticipated to increase savings and lead to a rise in consumer retail demand.

We see these initiatives as a positive catalyst for growth and innovation. The expansion of Vinod Cookware is poised to benefit from these developments, further elevating our commitment to quality and customer satisfaction."

The NPS proposals in Budget 2024 take significant steps towards the Government's goal of making India a pensioned society by 2047.

The extra 4% contribution under the corporate NPS scheme offers salaried employees additional tax savings and boosts their retirement funds. This change also helps companies streamline their contributions exclusively towards NPS, making management simpler.

NPS Vatsalya is another notable innovation. It allows parents or guardians to contribute to a child's pension from birth, ensuring a strong foundation for future retirement savings through compounded returns.” - Mr. Sriram Iyer - CEO, HDFC Pension.

Cyient DLM's results for the quarter met expectations in terms of revenues, while margins and profitability were better than estimates. The order pipeline remains robust, with several large deals in advanced stages expected to materialize in the second half of FY24, consistent with earlier guidance from management. Although the year-on-year growth in the order book has been slow and has declined, there is optimism for improvement in the coming quarters as order inflows strengthen. During the quarter, Cyient DLM welcomed four new global clients in the semiconductor, defense, and Med-Tech sectors, which bodes well for long-term visibility and growth prospects. We maintain a positive outlook on Cyient DLM due to its strong parent company support, established client relationships complemented by new additions, a resilient order book, healthy order inflows, a robust pipeline, and specialized capabilities in high-growth areas. The stock has seen a correction from its peak levels and presents compelling value prospects at reasonable valuations. Our estimates remain unchanged, and we reiterate a Buy rating on the stock with an unchanged price target of ₹851.