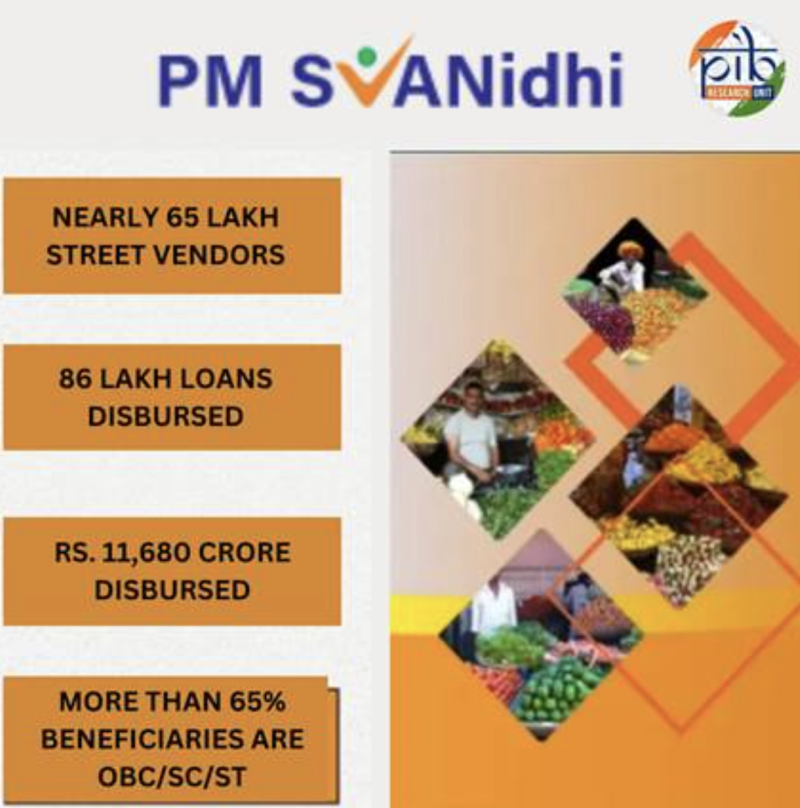

Joyshree Das Verma, National President, FICCI FLO, said, "This year's budget marks a significant stride towards enhancing women‘s role in India’s economic development. The allocation of more than Rs 3 lakh crores for women-specific schemes and skilling programs underscore the government's commitment to women-led development and enhancing economic inclusivity. The government is creating a supportive environment for women professionals through market access to women-led Self Help Groups and the establishment of working women's hostels and creches in partnership with businesses. Furthermore, the reduction in duties for properties purchased by women and the introduction of the NPS Vatsalya scheme, which promotes long-term savings for minors, exemplify the government's commitment to an inclusive financial landscape for women and their families. Schemes like PM Vishwakarma, PM SVANidhi, Mudra Yojana and Lakhpati Didi are a testament to the transformative impact of targeted financial support for women. FICCI FLO stands poised to collaborate closely with the government to ensure these initiatives translate into tangible benefits for women entrepreneurs. Together, we can accelerate the momentum towards gender equality and inclusive growth, enabling women entrepreneurs to thrive and contribute significantly to the nation's economy".

Akshay Munjal, Founder & CEO, Hero Vired.

"I applaud the Government's strong emphasis on education, skilling, and employment in the Union Budget 2024. Amid growing concerns about the impact of AI on job creation, the substantial allocation of Rs. 1.48 lakh crore for these sectors demonstrates a significant commitment to developing India's human capital. The introduction of various schemes to promote skilling and job creation is poised to significantly boost economic growth. Additionally, the comprehensive scheme providing internship opportunities in 500 top companies to 1 crore youth over five years, funded partly through CSR, is a welcome initiative. This will give the youth valuable exposure to real-life business environments and diverse professions, further enhancing their employment prospects while ensuring a future-ready workforce."

The Co-Founder of BOP Realty, Gaurav Mavi expressed his support for the current budget by identifying its notable focus on rural development. He comments, "The entire budget is praiseworthy with special mention to its strong emphasis on rural development which is vital because around 70 percent of our population resides in rural areas. This area has been overlooked for some time, so it's encouraging to see that attention is finally being focused on it."

Mr. Mavi also appreciated the government initiative of building 3 crore houses under Pradhan Mantri Awas Yojana. He said, "Funds allocation for 3 crore additional houses under the Pradhan Mantri Awas Yojana is a laudable step in addressing housing shortage and improving lives of many people."

Mr. Mavi added "The realty sector benefitted greatly from fiscal stimulus such as reduction in stamp duty and development premium to decrease unsold inventory, strengthen developers' financials and begin fresh supply cycles. Also, I was expecting the cut down on GST on new homes from 5% to zero percent. Doing so would make new homes more affordable and could very well be included in the budget."

Mr. Sunil Shekhawat, CEO of SanchiConnect.

The Union Budget brings hope for DeepTech start-ups through increased funding for R&D and innovation, which is crucial for those with disruptive ideas and longer fundraising cycles. With entrepreneurial experience since 2012, I recognise the challenges DeepTech start-ups encounter. The budget's strategy of combining financing, regulation, and skilling into one comprehensive approach is a masterstroke.

Central to this approach is the ₹1,000 crore Venture Capital fund for the space economy, which will significantly boost India's spacetech sector. Additionally, the abolition of the angel tax for all investors is set to attract more funding, thereby easing financial burdens on investors. Furthermore, the emphasis on skilling under CSR, particularly through internships, is a brilliant move that benefits both students and corporates. The 2024 budget exemplifies India's forward-thinking approach, creating a supportive environment for start-ups, driving innovation, and equipping the workforce with essential skills.

Sirajuddin Ali , founder and CEO, Malitra India-

Promising commitment and infusion of 26000 crore of fund for road connectivity shall certainly bring EV to rural part of India. It will also lead a sharp push toward the vision of make in zinda and EV instead of fossil based mode of communication.There will be a certain push to Electrical vehicle charger industry as well due road connectivity increase.

Mr. Pankaj Kalra, CEO, EOGEPL-

“The Union Budget's emphasis on energy transition and sustainability is commendable. It highlights the importance of balancing economic growth with environmental sustainability through appropriate energy transition pathways. We remain confident about India's energy future and eager to collaborate with the government on policies that ensure energy security, affordability, and accessibility, thereby supporting our Nation's growth aspirations.”

Khadim Batti, Co-Founder & CEO, Whatfix -

“The Union Budget 2024 is a significant step forward for the tech and startup ecosystem. Its pro-development stance directly addresses key industry expectations. We applaud the government's progressive vision to foster a more dynamic and innovative startup landscape across the nation.

The abolition of the Angel Tax is a critical move, providing much-needed relief to startups during the funding winter. Simplifying FDI and overseas investment rules, along with promoting the Indian rupee for global transactions, will further bolster investor confidence.

We are thrilled to see the startup ecosystem’s expectations realized with the revised ESOP taxation structure. This change will incentivize talent retention and significantly boost employee morale. Streamlined regulations, transfer pricing, and employment procedures will create a more conducive environment for businesses to thrive.

We are particularly impressed by the government’s strategic focus on human capital development. The proposed skilling of 20 lakh youth and the upgrade of 1,000 industry training institutes are pivotal steps towards creating a future-ready workforce. By aligning education with emerging technologies and industry demands, the budget positions India to become a global talent hub. This strategic investment will undoubtedly catalyze job creation, drive economic growth, and strengthen India's position in the global value chain.

Overall, this budget reinforces our belief in India's potential to become a $7 trillion economy by 2030. The Indian SaaS industry is well-positioned to flourish under these supportive policies. We are excited to contribute to India's digital transformation and global leadership.”

Dr. Jaskiran Arora, Dean- Education Quality, BML Munjal University -

"The budget marks a pivotal moment for India's education sector, reflecting a robust commitment to enhancing opportunities for the youth. The allocation of Rs. 1.48 lakh crore for education, employment, and skilling underscores a strategic shift towards holistic development. The introduction of financial support for loans up to ₹10 lakhs for higher education, particularly for those excluded from existing government schemes, is a game-changer. The e-vouchers offering a 3% annual interest subvention for one lakh students will make higher education more accessible and affordable, potentially transforming countless futures.

The proposal to open working women hostels in collaboration with industry underscores a strong commitment to supporting female workforce participation and creating a more inclusive environment for women.

The budget's focus on upskilling, with a revised Model Skilling Loan scheme and the upgrading of 1,000 industrial training institutes, reflects a clear intent to enhance employability. By aiming to skill 20 lakh youth over the next five years, this budget sets the stage for a more skilled, competitive workforce, ultimately driving economic growth and innovation"

Mr. Rohit Mali, Director, Firefly Fire Pumps commented “I am thrilled with the Budget 2024-2025 announcements that demonstrate a visionary commitment to MSMEs and labor-intensive manufacturing, essential pillars for India's economic growth. The comprehensive package of financial, regulatory, and technological support signals a transformative era for MSMEs, enabling them to scale operations and compete globally.

Moreover, the Credit Guarantee Scheme for MSMEs in manufacturing, leveraging digital footprints for credit assessment, and measures to support MSMEs during stress periods are game changers that will foster innovation, expand access to credit, and sustain entrepreneurial resilience. Enhancements in Mudra Loans, mandatory onboarding on TReDS, and SIDBI branch establishments in MSME clusters will unlock working capital, improve credit access, and extend critical support nationwide.

In essence, this budget lays down a robust roadmap for MSMEs, propelling us towards the vision of ‘Viksit Bharat’. We at Firefly Fire Pumps are excited to align our efforts with these initiatives, fostering an environment where MSMEs can thrive and contribute significantly to India's economic renaissance.”

“The government’s continued focus on infrastructure development is a positive move. After the 11 Lakh Cr capex announcement in the interim budget, the government expects the states to carry on the policy thrust. On the manufacturing side, the increase in BCD from 10 to 15 percent on PCBA of specified telecom equipment will enhance localization, spur domestic manufacturing, and create an ecosystem of augmented manufacturing capacity in the country. This is in line with the government’s goal towards Atmanirbhar Bharat.” - Mr Jasbir Singh, Chairman & CEO, Amber Enterprises

MMTC-PAMP:

“Gold in India is more than just a precious metal. Indian consumers have an emotional connect with the yellow metal, the significance of which comes to the fore on special occasions. Given this cultural context, today’s development in the union budget of a reduction in duty on gold to 6 % is a welcome move, one which is expected to drive down retail price of the metal and stymie the grey market. This in turn is expected to set off a virtuous cycle of increased consumption and contribute substantially to the exchequer and facilitate the growth of India as a precious metals hub.”- Mr Vikas Singh, Managing Director & CEO of MMTC-PAMP.

Cosmo First

“India’s packaging industry is growing at a healthy pace and is contributing significantly through the export route to the exchequer. There is a need to enhance skills for youth, innovation, and R&D support for the sector. We welcome the focus in the budget on creating job opportunities in the manufacturing sector and this coupled with support to the employers will propel the industry to new heights. Further, the introduction of credit guarantee scheme for MSMEs and facilitating term loans to MSMEs for purchase of equipment without collateral or guarantee will go a long way to enhance access to capital in the sector” – Mr Pankaj Poddar, Group CEO, Cosmo First

RHI Magnesita India Ltd

“The Government’s continued commitment to infrastructure as a priority area for ‘Viksit Bharat’ highlights the sectors significance as growth driver. With a capital expenditure of over 11 lakh crore rupees already announced in the interim budget, representing 3.4% of GDP, the refractory industry looks forward to playing an important role in India's next phase of economic transformation. Furthermore, announcements made for the ‘next gen reforms’ such as economic policy framework are welcome as these will support in achieving the nations economic goals with the ethos of ‘Make-in-India”. -Mr. Parmod Sagar, MD & CEO, RHI Magnesita India Ltd.

Mr. Rustom Kerawalla, Founder and Chairman of VIBGYOR Group of Schools -

"The 2024 Union Budget represents a transformative moment for the education sector in India. I am deeply encouraged by the government's allocation of Rs 1.48 lakh crore towards education, employment, and skilling. This significant investment stands as a testament to our collective commitment, as a nation, to reshaping the future of education.

Building on the increased funding from the 2023-24 Budget, which focused on enhancing facilities, digital resources, and rural education, the current budget shifts focus towards improving educational infrastructure, creating job opportunities, and advancing skill development. Notably, funding for the PM SHRI initiative, aimed at transforming government schools into model institutions, has surged from Rs 2,800 crore to Rs 6,050 crore, reflecting a substantial increase of Rs 3,250 crore. This enhanced funding will ensure that every student has access to high-quality resources and opportunities.

Additionally, the government's support for skill development initiatives, including the ambitious plans to impact 4.1 crore youth over the next five years, underscores a dedication to preparing a future-ready workforce. This will play a crucial role in creating a well-rounded educational experience and equipping students with the tools they need to succeed in an evolving global landscape. We at VIBGYOR Group of Schools are excited to be part of this transformative journey and look forward to contributing to these impactful changes."

Anand Kumar Bajaj, Founder, MD & CEO, PayNearby

"The Government has taken significant steps in this Union Budget to realize its dream of a 'Viksit Bharat' by focusing on nine key priorities, with India's rural heartland taking centre stage. The expansion of essential banking services, in the underpenetrated regions of the Northeastern region will help bring underserved populations into the financial ecosystem. PayNearby remains committed to making banking, credit, assurance (insurance + asset), and e-commerce services accessible to Bharat through its agent banking business by leveraging the Distribution-as-a-Service model."

"We are pleased with the Union Budget 2024-25's strong focus on employment and education, particularly the allocation of Rs 1.48 crore and the Rs 2 lakh crore package for five schemes aimed at creating jobs and providing skilling to 4.1 crore youth. This significant investment will drive economic growth and progress by enhancing job creation, improving higher education access, and expanding skill development programs. The budget's initiatives, including employment-linked schemes, ITI upgrades, internships, and women's hostels, lay a solid foundation for a skilled and future-ready workforce. By addressing critical areas of employability and inclusivity, these measures will promote a more dynamic and capable workforce. At the Wadhwani Foundation, we are committed to collaborating with the government to ensure these initiatives effectively prepare India's youth for the job market and contribute to national growth."

From Ajay Kela, President & CEO, Wadhwani Foundation

Commenting on the Union Budget, Md. Sajid Khan, Director-India, ACCA (Association of Chartered Certified Accountants), said, "The Union Budget for FY25 marks a significant milestone in the government's ongoing efforts to drive India towards a 'Viksit Bharat' by 2047. Building on the momentum from the interim budget, the FY25 Union Budget demonstrates the Indian government's sustained commitment to skilling, education, and employment with a substantial allocation of Rs 1.48 lakh crore towards these critical areas. As India continues on this growth trajectory, the role of skilled accountants will be crucial in driving business innovation, ensuring financial sustainability, and navigating emerging technologies in fintech, AI and sustainable accounting practices. Additionally, the introduction of a new assessment model for MSME credit, leveraging digital footprints, has the potential to unlock financing opportunities for this vital sector.

We are encouraged by the government's efforts to create a future-ready workforce in accounting and finance, equipped with the skills needed to navigate emerging technologies and drive business innovation. Overall, this budget strikes a balance between short-term growth imperatives and long-term strategic vision, and we believe it will have a positive impact on India's economy."

Mr. Shashank Sharma, Founder, Chairman & CEO, Sunsure Energy Pvt. Ltd., in-line with the budget announcement today by Finance Minister, Nirmala Sitharaman, for your ease of reference.

"This budget sends a strong signal that India's renewable energy transition is accelerating. While the increase in basic customs duty on glass imports will result in higher input costs for domestic power producers in the short term, this is a necessary long-term measure to strengthen the domestic supply chain, especially given our ambitious goal of achieving 50 GW of renewable energy annually.

The Finance Minister also emphasized enhancing the availability of capital for climate adaptation and mitigation. This initiative will help industries secure climate finance on favourable terms, creating a supportive ecosystem for the green energy transition.

It is heartening to see that India continues to strengthen the renewable energy sector as evidenced by several positive announcements in the union budget that demonstrate the government's commitment to energy security, sustainability, and achieving the ambitious Net Zero 2070 vision.

The PM Surya Ghar Muft Bijli Yojana is a game-changer, bringing the benefits of clean energy to millions of households and showcasing our commitment to an inclusive energy future.

Developing a roadmap to shift hard-to-abate industries like steel and cement from energy efficiency targets to emission targets is essential for India to reach its net zero goals. While energy efficiency reduces consumption, it doesn't address all greenhouse gas emissions. Emission targets ensure a comprehensive reduction approach, tackling emissions from industrial processes through RE adoption.

Dr. Yajulu Medury, Vice Chancellor, Mahindra University

"An increase in the budget allocation for the education sector is a positive development. It indicates a commitment to make education more affordable and accessible. Many private institutions already support research-based education through substantial subsidies. The new internship scheme could also encourage industries to offer paid opportunities, addressing the issues of unpaid internships. While this budget reflects a hopeful step towards stabilizing and enhancing education, especially after the challenges posed by the pandemic, we look forward to more support in research and competency-building."

Inara Dhrolia, Co-Founder, Rivona Naturals:

''The Union Budget 2024-25 offers significant benefits to women entrepreneurs, MSMEs, and the personal care sector. More than ₹3 lakh crore has been earmarked for programs to benefit women and girls, enhancing their socio-economic status. For MSMEs, the Mudra loan limit has been increased to ₹20 lakh from the current ₹ 10 lakh. The Budget also introduces a flexible tax structure and incentives for sustainable practices, which encourage growth and innovation. Together, these initiatives provide promotion and support for women entrepreneurs and small businesses.''Real Estate Post Budget Quote: Mr. Sanjeev Srivastva, Chairman & Founder of Assotech Group, a leading real estate company.

"The 2024 Union Budget marks a pivotal moment for the real estate sector, and as the Chairman & Founder of Assotech Group, I am both encouraged and excited by the government's strategic initiatives. The substantial allocation of Rs 50,000 crore towards infrastructure development is poised to invigorate our industry, enhancing both urban and rural landscapes.

Moreover, the introduction of PM AWAS Yojana Urban 2.0 with a significant investment of Rs 10 lakh crore into urban housing underscores the government's commitment to addressing the country's urban housing needs. This initiative will provide a substantial boost to the real estate market, fostering growth and creating new opportunities for developers and investors alike.

The revised income tax slabs, including potential savings of up to Rs 17,500 per year for taxpayers, coupled with an increased standard deduction to Rs 75,000, are expected to enhance consumer purchasing power. This is likely to translate into increased demand for residential and commercial properties, further stimulating the real estate sector.

Additionally, with the focus on infrastructure development and the burgeoning real estate boom in states like Orissa, which is experiencing rapid growth and urbanization, we at Assotech Group are poised to leverage these developments. The enhanced financial environment and supportive government policies will enable us to continue driving innovation and delivering exceptional value in real estate.

In essence, these budgetary measures collectively represent a transformative opportunity for the real estate sector, aligning perfectly with our vision of creating impactful and sustainable real estate solutions."

Media & Entertainment OTT: Kaushik Das, Founder and CEO of AAO NXT, East India's premier OTT platform:

"The 2024 Union Budget presents a forward-thinking approach, especially in the realms of technology, regional development, and digital innovation. The reduction of Basic Customs Duty on mobile phones and related components to 15% is a significant step that will lower costs and enhance accessibility to digital devices, which is crucial for platforms like AAO NXT. Additionally, the government's commitment to supporting the development of regional storytelling and the tourism sector, including backing the development of Nalanda in Bihar and extending support to Odisha's tourism, aligns perfectly with our vision to showcase Odisha's rich cultural heritage through digital content.

Moreover, the initiative to set up a ₹1,000 crore venture capital fund for space economy highlights the government's dedication to fostering innovation and technological advancement. This, coupled with the enhanced focus on employment-linked skilling programs and the emphasis on energy security, will undoubtedly create a conducive environment for startups and established companies alike. These measures will not only boost the regional OTT landscape but also propel us towards our goal of making AAO NXT a global platform for localized content.

Overall, the budget's focus on promoting digital infrastructure, regional development, and innovation reflects a robust framework for sustainable growth and positions India as a leader in the digital entertainment space."

Martech Sector Post Budget Quote: Mr. Apurv Modi, Managing Director & Co-Founder of ATechnos Group

"The Union Budget 2024 focuses on nine key priorities and demonstrates a comprehensive approach to India's growth and development. I am excited about the emphasis on Innovation, R&D, and Next Generation reforms. These priorities align perfectly with the digital revolution that's reshaping our economy.

The focus on Manufacturing and Services, coupled with Urban Development and Infrastructure, creates fertile ground for technological advancements. We see immense potential for digital solutions to drive efficiency and innovation across these sectors.

Also, the budget introduces a new mechanism to facilitate the continuation of bank credit to MSMEs during their stress period. This is a crucial step in ensuring that MSMEs, which form the backbone of our economy, receive the necessary financial support to navigate challenging times. The introduction of a new MSME guarantee plan to enable loans up to ₹100 crore further underscores the government's commitment to supporting small businesses. The increase in the limit of Mudra loans from ₹10 lakh to ₹20 lakh is another significant measure that will empower small businesses and entrepreneurs, enabling them to expand their operations and contribute to economic growth.

In the taxation domain, the removal of the Angel Tax on all classes of assets is a welcome move, promoting a more favorable investment climate. The standard deduction limit has been increased to ₹75,000 from ₹50,000, providing much-needed relief to taxpayers. Additionally, the lowest slab in the new tax regime has been increased to ₹3 lakh from ₹2.5 lakh.

Moreover, the government's decision to allocate ₹2 lakh crore for job creation over the next five years is a significant step towards addressing unemployment and fostering economic stability.

The synergy between these priorities and the digital realm will be key. Whether leveraging AI for better urban planning, using IoT for energy management, or developing innovative solutions for employment generation, the digital sector stands ready to contribute significantly to realizing this vision."

Hospitality Post Budget Quote: Sohail Mirchandani, Chief Operating Officer & Co-Founder of Ekostay, a homestay venture:

"The 2024 Union Budget brings transformative changes that hold great promise for the hospitality and homestay sector. As a co-founder of EKOSTAY, I am particularly excited about the implications of these developments for our business.

The government's substantial allocation of Rs 50,000 crore towards infrastructure development, including a major boost to urban infrastructure through the PM AWAS Yojana Urban 2.0, will significantly enhance connectivity and accessibility. This is especially beneficial for the homestay industry, as improved infrastructure will make our unique, personalized accommodation options more accessible to travelers.

Furthermore, the emphasis on the 'Make in India' initiative and the Production Linked Incentive (PLI) scheme will likely foster economic growth and improve consumer spending power, which could lead to increased demand for experiential stays like ours.

Overall, these budgetary measures are set to support and elevate the homestay sector, providing EKOSTAY with exciting opportunities to expand and offer even more exceptional experiences to our guests."

Mr. Sunil Agarwal, Co-founder and Chairman, Joy Personal Care (RSH Global) on the Union Budget 2024-25 presented in the parliament today by Finance Minister Nirmala Sitharaman for your reference.

Quote - Mr. Sunil Agarwal, Co-founder and Chairman of Joy Personal Care (RSH Global)

“We welcome the government's budget, which prioritizes women-led development with an allocation of over Rs 3 lakh crore for schemes benefiting women and girls. This will further empower women, promote inclusivity, and enhance their role in driving economic growth.

Rationalizing tax slabs will also augment consumer purchasing power, stimulating economic expansion and consumer spending. Furthermore, the infrastructure development plan for urban and rural markets will have a dual benefit. It will not only create new income opportunities for rural consumers but also enable FMCG players like us to expand and strengthen our distribution networks in rural, semi-urban, and urban areas, unlocking new markets and opportunities for growth.

We are optimistic that the budget will have favourable economic impact, driving consumer demand and accelerating India's growth trajectory. We are committed to collaborating with the government to leverage this momentum and collectively contribute to the nation's progress.”

Vijay Navaluri, Co-founder & Chief Customer Officer, Supervity.

The 2024-25 Union Budget places a strong emphasis on technology and innovation, which is crucial for the growth of the AI and tech sectors. The abolition of the Angel Tax for investors is a significant move that will bolster the startup ecosystem, encouraging more investments and fostering innovation. It will significantly improve startup funding sentiment while boosting morale of deep tech and AI startups to take bigger bets. The focus on skilling and employment are steps in the right direction, creating a conducive environment for tech companies to thrive. The allocation of funds for research and development, particularly in the space economy and renewable energy, indicates the government's commitment to supporting cutting-edge technologies. Supervity AI is excited about these developments and looks forward to contributing to India's journey towards becoming a global tech leader.