Mr. Anshuman Panwar, Co-Founder, Creditas Solutions.

“RBI has been very pragmatic in its approach towards handling the Covid crisis. While RBI has not announced a blanket moratorium today, stressed borrowers have been given a choice to opt for resolution if required. This will ensure that only those who genuinely need restructuring of their loans will approach the banks. At the same time, it will help counter financial stress in the system. As an integral part of India’s banking system with technology led delinquency management, Creditas will also continue to guide individual borrowers on timely payments and opting for resolution mechanism if required, as mandated by RBI.”

Mr. Rajesh Sharma, Managing Director, Capri Global Capital Ltd said, “Today’s fiscal announcement by RBI announcement has come at an opportune time and shows a certain amount of optimism in the hardship of an unfortunate pandemic. The targeted announcement by the central bank shows an ambitious effort to strengthen the Indian economy. Opening a one-time restructuring window for individuals and MSME till September 2021 will give an impetus to scale up their business without worrying about financial destitution. Also, the extension window for the earlier availed borrower would ease liquidity challenges and facilitate meeting the objective of inclusive growth. Additionally, On-tap liquidity of Rs 50,000 crore at repo rate and qualification of priority lending is focusing on strengthening the health infrastructure of the country.”

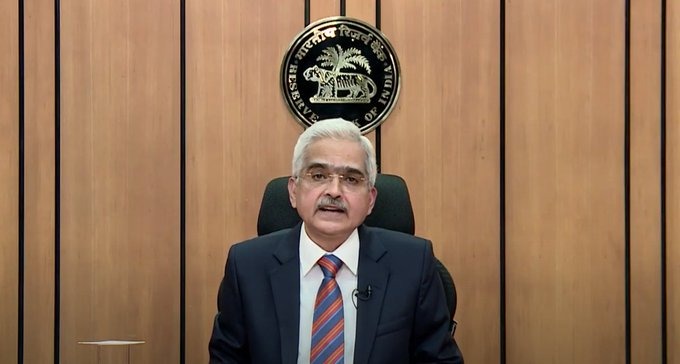

Great Lakes Institute of Management’s Professor Vidya Mahambare has shared her views on the RBI Governor’s speech and its impact.

“RBI’s liquidity enhancing measures announced today are aimed at encouraging banks to lend to targeted sectors such as healthcare and small borrowers. With sufficient liquidity already available with banks it is not clear as to why the flow of funds to these sectors would increase with minor incentives. The extension of availing the loan restructuring for SMEs is a welcome step. Also announced was the next round of purchases of outstanding government securities by the RBI later this month which should lower the pressure on G-sec yield and thus on the lending rates in general.”

";