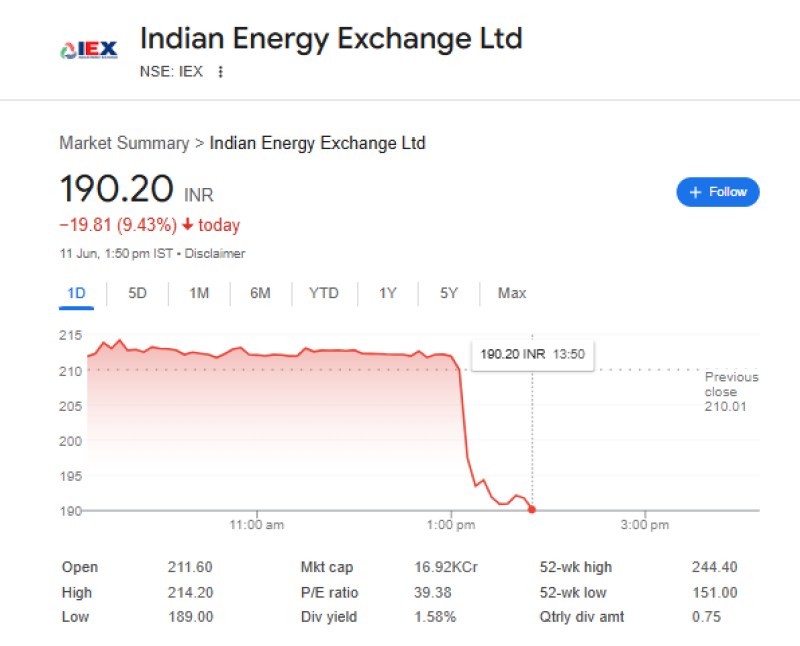

📉 Mumbai, June 11: Shares of Indian Energy Exchange Ltd (NSE: IEX) nosedived by over 9% in intra-day trading, hitting a low of ₹189—down from an opening price of ₹211.60. The stock closed at ₹190.76, triggering buzz across market forums and Google search trends as one of the day's most actively watched counters.

🔍 What’s Driving the Fall?

Market experts cite a mix of profit booking, valuation concerns, and sentiment shifts in power sector stocks amid broader market volatility. IEX’s P/E ratio of 39.49 had raised eyebrows over steep valuations, especially given the company’s slower volume growth in recent quarters.

📊 Key Metrics:

Day’s Range: ₹189.00 – ₹214.20

52-Week Range: ₹151.00 – ₹244.40

Market Cap: ₹16,940 crore

Dividend Yield: 1.57% (Quarterly: ₹0.75)

⚡ Why It Matters:

IEX is India’s largest power trading platform and a bellwether for the energy sector. A sharp correction like this sends signals about institutional sentiment and may impact confidence across renewable and power exchange-linked stocks.

💬 Market Talk:

Retail investors are abuzz with questions: “Is this a dip worth buying or a sign of deeper correction?” Others are watching closely to see if regulatory changes or volume trends emerge that could affect IEX’s future earnings.

📈 What Next?

Analysts suggest keeping an eye on volume recovery, regulatory policy updates, and quarterly results, which will likely determine the stock’s medium-term trajectory.

.jpeg)