MSCI Inc. (NYSE:MSCI), a leading provider of critical decision support tools and services for the global investment community, announced the results of the February 2024 Index Review for the MSCI Equity Indexes- including the MSCI Global Standard, MSCI Global SmallCap and MSCI Micro Cap Indexes, the MSCI Global Value and Growth Indexes, the MSCI Frontier

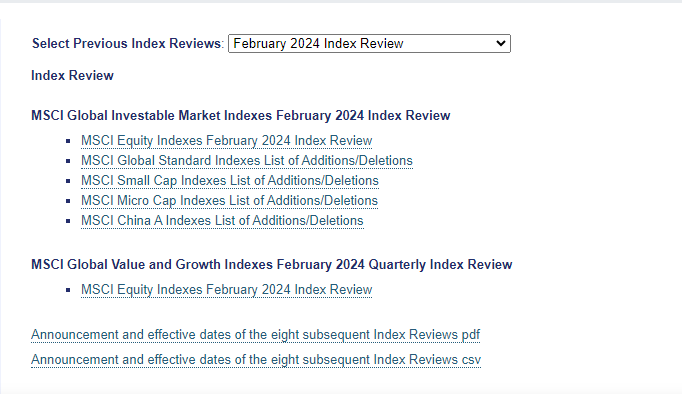

Markets, and MSCI Frontier Markets Small Cap Indexes, the MSCI Global Islamic and MSCI Global Islamic Small Cap Indexes, the MSCI Pan-Euro and MSCI Euro Indexes, the MSCI US Equity Indexes, the MSCI US REIT Index, the MSCI China A Onshoreindexes and the MSCI ChinaAll Shares Indexes.All changes will be implemented as of the close of February 29, 2024. These changes have been posted on the Index Review web page on MSCI's web site at https://www.msci.com/index-review.

MSCI Global Standard Indexes: Twenty-four securities will be added to and 101 securities will be deleted from the MSCI ACWI Index. The three largest additions to the MSCI World Index measuredby full company market capitalization will be Samsara A (USA), Corebridge Financial (USA) and Applovin Corp A (USA). The three largest additions to the MSCI Emerging Markets Index measured by full company market capitalization will be MideaGroup Co A (HK-C) (China),Punjab National Bank (India) and Union Bank Of India (India).

MSCI Global SmallCap Indexes: There will be 189 additions to and 118 deletions from the MSCI ACWI Small Cap Index.

MSCI Global Investable Market Indexes: There will be 161 additions to and 167 deletions from the MSCI ACWI Investable Market Index (IMI).

MSCI Global All Cap Indexes:There will be 126 additions to and 104 deletions from the MSCI World All Cap Index.

MSCI Frontier Markets Indexes: There will be nine additions to and eleven deletions from the MSCI Frontier MarketsIndex. The three largest additionsto the MSCI Frontier MarketsIndex measured by full company market capitalization will be Casablanca Travaux Generaux De Construction De SA (Morocco), Telekom Slovenije dd (Slovenia) and FPT Securities JSC (Vietnam). There will be 41 additionsto and 21 deletions from the MSCI Frontier MarketsSmall Cap Index.

In light of currently observed market accessibility issues, MSCI will not implement changes as part of this Index Review for any securities classified in Bangladesh, Egypt, or Kenya for the MSCI Bangladesh, MSCI Egypt, and MSCI Kenya Indexes or impacted compositeindexes.

In addition,MSCI will reclassify Nigeria from FrontierMarket status to Standalone Marketstatus in one step coinciding with this Index Review. To facilitate index replicability at the time of the reclassification, the Nigerian securities will be deleted from the MSCI Frontier Markets Indexes at lowestsystem prices of 0.00001 as of the close of February 29, 2024.

MSCI Global IslamicIndexes: Twenty-nine securities will be addedto and 31 securities will be deletedfrom the MSCI ACWI Islamic Index. The three largest additions to the MSCI ACWI Islamic Index measured by full company market capitalization will be Servicenow (USA), Mondelez International A (USA) and Acwa Power Company(Saudi Arabia). Therewill be two additions to and one deletion from the MSCI Gulf Cooperation Council (GCC) Countries ex Saudi ArabiaIMI Islamic Index.

MSCI US EquityIndexes: There will be no securities added to and one securitydeleted from the MSCI US Large Cap 300 Index.

Four securities will be addedto and four securities will be deletedfrom the MSCI US Mid Cap 450 Index. The three largest additions to the MSCI US Mid Cap 450 Index measured by full company marketcapitalization will be Enphase Energy,Affirm Holdings A and KarunaTherapeutics.

Four securities will be addedto and three securities will be deletedfrom the MSCI US Small Cap 1750Index. The three largest additions to the MSCI US Small Cap 1750 Index measured by full company market capitalization will be CableOne, Hertz GlobalHoldings and AgilonHealth.

There will be no additions to and no deletions from the MSCI US Micro Cap Index.

For the MSCI US Investable Market Value Index, there will be one addition or upward change in Value Inclusion Factor (VIFs), and one deletion or downward change in VIFs. For the MSCI US Investable MarketGrowth Index, there will be no additionsor upward changesin Growth Inclusion Factors (GIFs), and one deletion or downward change in GIFs.

MSCI US REIT Index: There will be no additions to and no deletions from the MSCI US REIT Index.

MSCI China A Onshore Indexes:There will be three additions to and 74 deletions from the MSCI China A Onshore Index. The three largest additions to the MSCI China A Onshore Index will be China Merchants Expressway Network Technology Holdings Co A, Sicc Co A and Smartsens Technology (Shanghai) Co A. There will be 159 additions to and 29 deletions from the MSCI China A Onshore Small Cap Index.

MSCI China All Shares Indexes:There will be four additions to and 76 deletions from the MSCI China All Shares Index. The three largest additions to the MSCI China All Shares Index will be Midea Group Co A, China Merchants Expressway Network Technology Holdings Co A and Giant Biogene Holding. There will be 185 additions to and 62 deletions from the MSCI China All Shares SmallCap Index.

.jpg)