Global equities closed broadly higher on Thursday, with European markets leading gains, supported by easing volatility and firm investor sentiment across sectors.

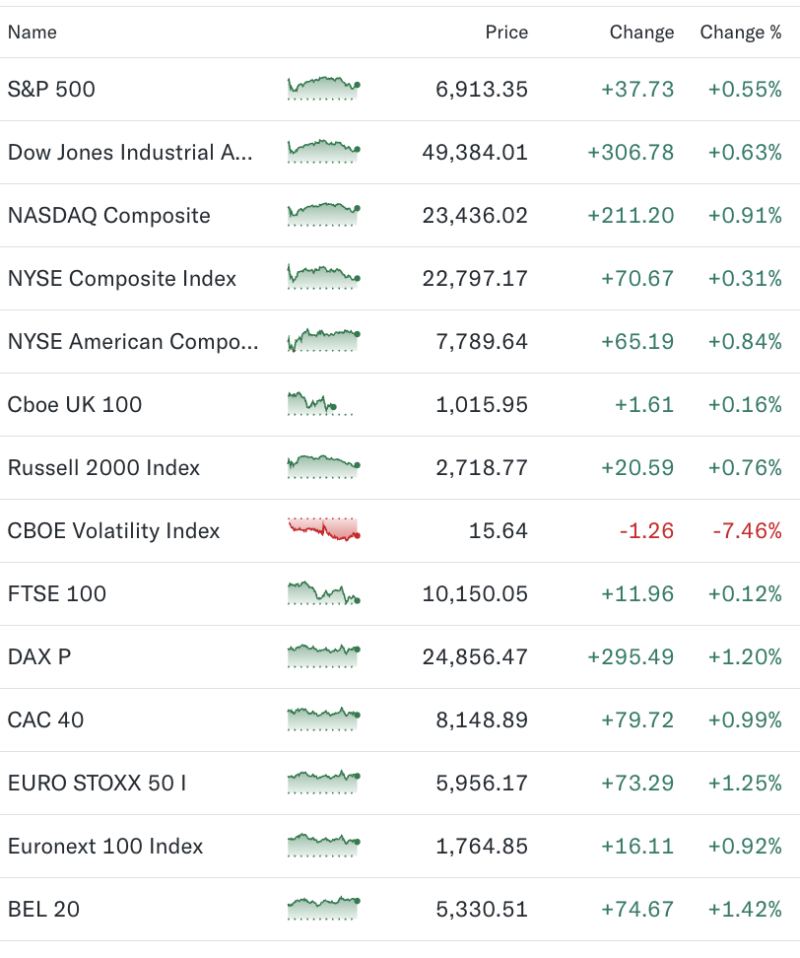

In the United States, benchmark indices posted steady advances. The S&P 500 rose 0.55% to 6,913.35, while the Dow Jones Industrial Average added 306.78 points, or 0.63%, to close at 49,384.01. The NASDAQ Composite outperformed, gaining 0.91% to 23,436.02, driven by strength in technology and growth stocks. The Russell 2000, tracking small-cap stocks, climbed 0.76% to 2,718.77.

Market confidence was reflected in a sharp decline in volatility, with the CBOE Volatility Index (VIX) dropping 7.46% to 15.64, indicating reduced near-term risk concerns.

Europe Leads the Rally

European equities delivered stronger relative performance. Germany’s DAX surged 1.20% to 24,856.47, while France’s CAC 40 advanced 0.99% to 8,148.89. The pan-European EURO STOXX 50 gained 1.25%, and the Euronext 100 rose 0.92%, reflecting broad-based buying across industrial, financial, and healthcare stocks.

The UK’s FTSE 100 edged up 0.12% to 10,150.05, underperforming continental peers but remaining in positive territory. The Cboe UK 100 added 0.16%.

Belgium’s BEL 20 emerged as a standout, jumping 1.42%, marking one of the strongest performances among major European indices.

Market Outlook

The synchronized rise across global equities, combined with falling volatility, suggests improving risk appetite among investors. European markets continue to attract attention due to relatively attractive valuations, while US indices remain supported by resilient earnings expectations.