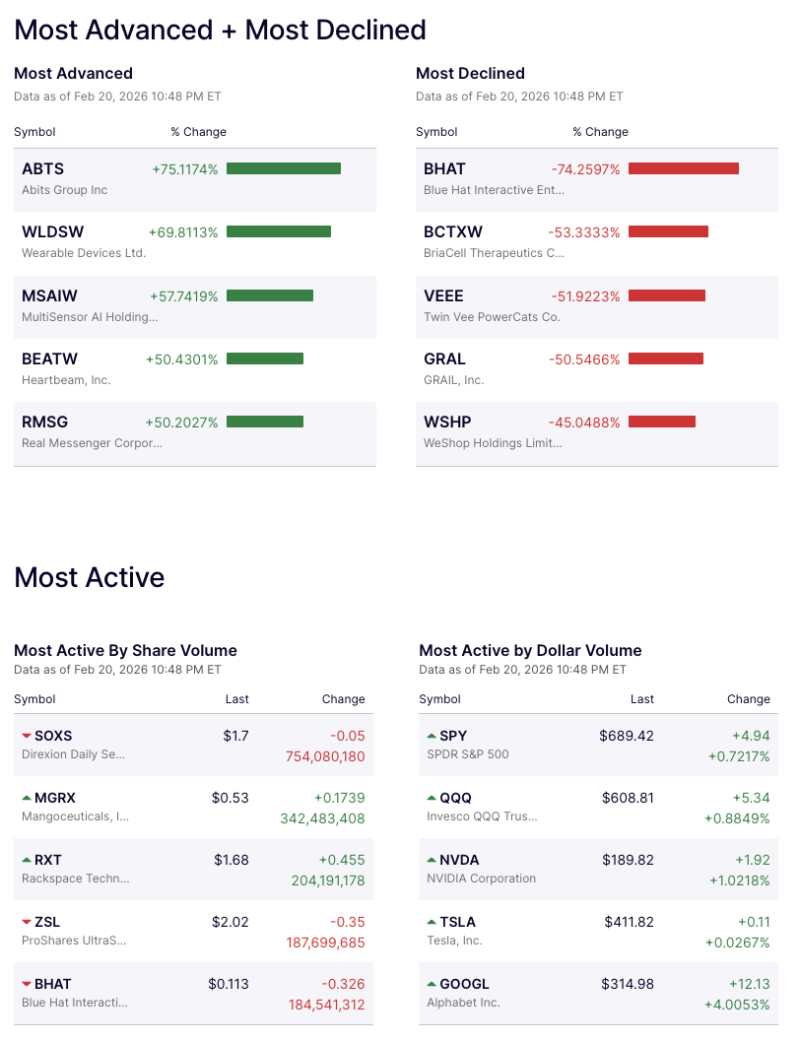

U.S. equities saw significant volatility in individual names on Thursday, with several micro- and small-cap stocks posting outsized moves, while major ETFs and large-cap technology names dominated trading activity.

Data as of Feb. 20, 2026 (10:48 PM ET).

Most Advanced

Small-cap and emerging technology stocks led the session’s percentage gainers:

Abits Group Inc. (ABTS) soared 75.11%, marking the day’s biggest advance.

Wearable Devices Ltd. (WLDSW) jumped 69.81%.

MultiSensor AI Holdings (MSAIW) gained 57.74%.

Heartbeam, Inc. (BEATW) rose 50.43%.

Real Messenger Corp. (RMSG) climbed 50.20%.

The gains suggest speculative momentum and elevated retail participation in lower-priced equities.

Most Declined

On the downside, several names recorded steep losses:

Blue Hat Interactive Entertainment (BHAT) tumbled 74.26%, the sharpest decline of the session.

BriaCell Therapeutics (BCTXW) dropped 53.33%.

Twin Vee PowerCats Co. (VEEE) fell 51.92%.

GRAIL, Inc. (GRAL) declined 50.55%.

WeShop Holdings (WSHP) slid 45.05%.

The magnitude of declines indicates heavy selling pressure in select speculative counters.

Most Active – By Share Volume

Trading volume was concentrated in leveraged ETFs and low-priced equities:

Direxion Daily Semiconductor Bear ETF (SOXS) traded over 754 million shares, down $0.05 to $1.70.

Mangoceticals, Inc. (MGRX) saw 342 million shares exchanged, rising $0.1739 to $0.53.

Rackspace Technology (RXT) advanced to $1.68 on volume exceeding 204 million shares.

ProShares UltraShort Silver (ZSL) declined to $2.02.

Blue Hat Interactive (BHAT) also featured among the most actively traded names following its steep drop.

Most Active – By Dollar Volume

Large-cap ETFs and tech giants dominated dollar turnover:

SPDR S&P 500 ETF Trust (SPY) rose 0.72% to $689.42.

Invesco QQQ Trust (QQQ) gained 0.88% to $608.81.

NVIDIA Corp. (NVDA) climbed 1.02% to $189.82.

Tesla Inc. (TSLA) edged up 0.03% to $411.82.

Alphabet Inc. (GOOGL) advanced 4.01% to $314.98, one of the stronger moves among mega-cap tech.

Market Takeaway

While headline indices saw steady activity, the session was marked by sharp swings in smaller-cap stocks alongside sustained institutional flow into major index ETFs and large-cap technology shares. The divergence highlights continued risk appetite in both speculative and blue-chip segments of the market.