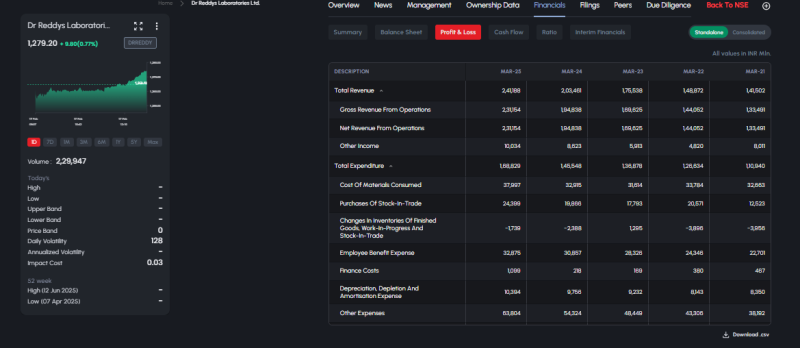

Hyderabad: Dr. Reddy's Laboratories Ltd. reported a robust financial performance for FY25, with total revenue rising to ₹2,41,188 million, compared to ₹2,03,461 million in FY24, reflecting solid year-on-year growth supported by strong operational momentum.

Revenue Momentum Continues

Gross revenue from operations stood at ₹2,31,154 million in FY25, up from ₹1,94,838 million in FY24. Net revenue from operations mirrored the same growth trajectory.

Other income also increased to ₹10,034 million from ₹8,623 million in the previous fiscal, providing additional support to overall earnings.

Expenditure Increases Amid Business Growth

Total expenditure during FY25 rose to ₹1,68,829 million, compared to ₹1,45,548 million in FY24.

Key cost components included:

Cost of materials consumed: ₹37,997 million (vs ₹32,915 million in FY24)

Purchases of stock-in-trade: ₹24,399 million (vs ₹19,868 million)

Employee benefit expenses: ₹32,875 million (vs ₹30,857 million)

Depreciation, depletion and amortisation: ₹10,394 million (vs ₹9,756 million)

Finance costs: ₹1,099 million (up from ₹218 million in FY24)

Other expenses increased significantly to ₹63,804 million from ₹54,324 million, indicating higher operational spending and possibly increased R&D and compliance-related investments.

Inventory Adjustments

Changes in inventories reflected a negative adjustment of ₹1,739 million in FY25, compared to a ₹2,388 million contraction in FY24, suggesting stable supply-demand dynamics.

Stock Performance

Shares of Dr. Reddy’s Laboratories were trading at ₹1,279.20, up 0.77% in the latest session, reflecting positive investor sentiment following steady financial growth.

Outlook

The company’s consistent revenue growth highlights resilient demand across domestic and international markets. However, rising operational expenses and finance costs will remain key monitorables. Investors will closely track margin sustainability, pipeline launches, and regulatory developments in key geographies.