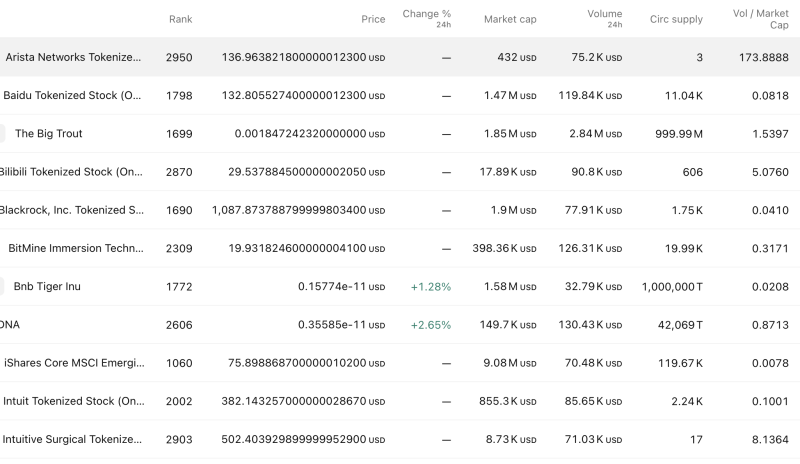

Top Percentage Gainers

DONA rose +2.65%, emerging as the session’s strongest mover, albeit on a modest market cap of $149.7K and volume of $130.4K.

BNB Tiger Inu advanced +1.28%, with a market cap of $1.58M, though trading activity remained limited at $32.79K in 24-hour volume.

Both moves reflect speculative interest rather than institutional-scale flows.

Tokenized Blue-Chip Exposure — Low Liquidity Theme

Several tokenized equity names traded without reported 24-hour percentage change, but volumes highlight the narrow participation:

Arista Networks Tokenized Stock — Price: $136.96, Market cap: $432, Volume: $75.2K

Baidu Tokenized Stock — Price: $132.80, Market cap: $1.47M, Volume: $119.84K

BlackRock Tokenized Stock — Price: $1,087.87, Market cap: $1.9M, Volume: $77.91K

Intuit Tokenized Stock — Price: $382.14, Market cap: $855.3K, Volume: $85.65K

Intuitive Surgical Tokenized Stock — Price: $502.40, Market cap: $8.73K, Volume: $71.03K

Despite exposure to established global corporates, trading depth remains limited, with several counters showing extremely low circulating supply — a key liquidity risk factor.

High Turnover Outlier

The Big Trout stands out with $2.84M in volume against a $1.85M market cap, resulting in a high Vol/Market Cap ratio of 1.53, indicating aggressive churn and short-term speculative positioning.

Similarly, Bilibili Tokenized Stock posted a notable Vol/Market Cap ratio of 5.07, suggesting concentrated trading despite its small capitalization.

Market Structure Insight

Liquidity is fragmented and thin.

High Vol/Market Cap ratios point to speculative churn rather than sustainable accumulation.

Circulating supply in several names remains extremely low, amplifying volatility risk.

Overall, activity in tokenized equities remains niche and momentum-driven, with microcaps leading percentage gains but institutional-scale conviction absent. Traders should factor in slippage risk and limited exit depth in these instruments.