Cryptocurrency markets saw an aggressive risk unwind, with a synchronized sell-off across majors, altcoins, and DeFi, wiping out billions in market value in a single session.

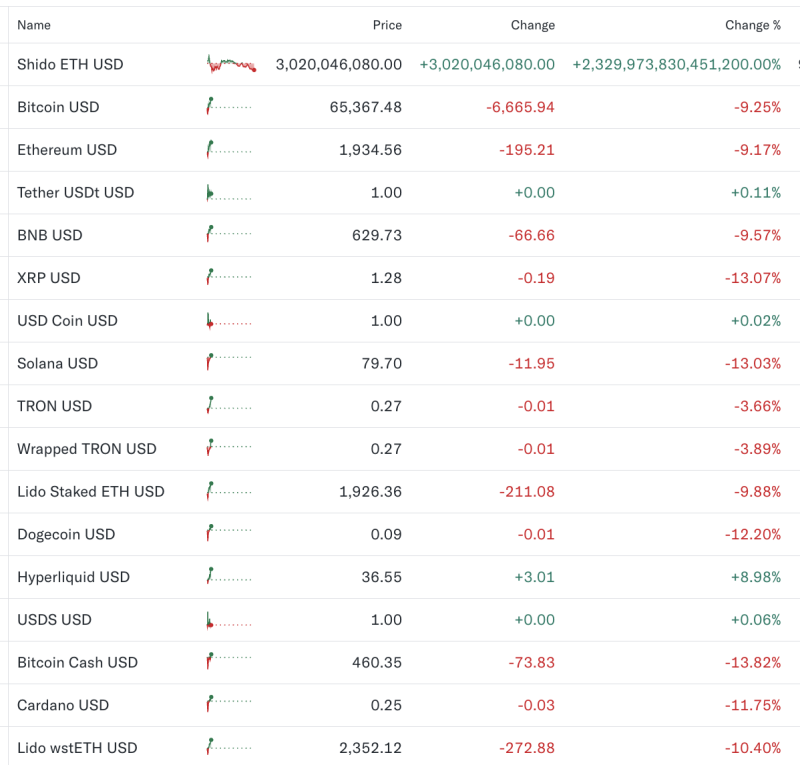

Bitcoin plunged 9.25% to $65,367, breaking short-term support, while Ethereum slid 9.17% to $1,934, triggering forced liquidations across leveraged positions. The drawdown intensified in altcoins, where losses stretched into double digits: XRP collapsed 13.07%, Solana sank 13.03%, Bitcoin Cash slid 13.82%, and Dogecoin dropped 12.2%.

Pressure spilled into the Ethereum ecosystem as well. Lido stETH fell 9.88% and wstETH dropped 10.4%, signaling stress in staking, DeFi collateral, and yield strategies. BNB declined 9.57%, while Cardano fell 11.75%, confirming broad-based deleveraging rather than token-specific weakness.

Capital rotated rapidly into safety, with USDT, USDC, and USDS holding firm at $1, underscoring a defensive shift within crypto rather than full capital exit. Hyperliquid stood out, rising nearly 9%, driven by short-covering and speculative flows, but remained an isolated exception.

The scale and speed of the sell-off point to macro-driven risk aversion, aligning with equity market declines, elevated volatility, and tightening global liquidity. With major assets breaching key technical levels, crypto is now firmly in “risk-off” territory, and near-term direction hinges on whether institutional flows stabilise or further liquidation pressure emerges.