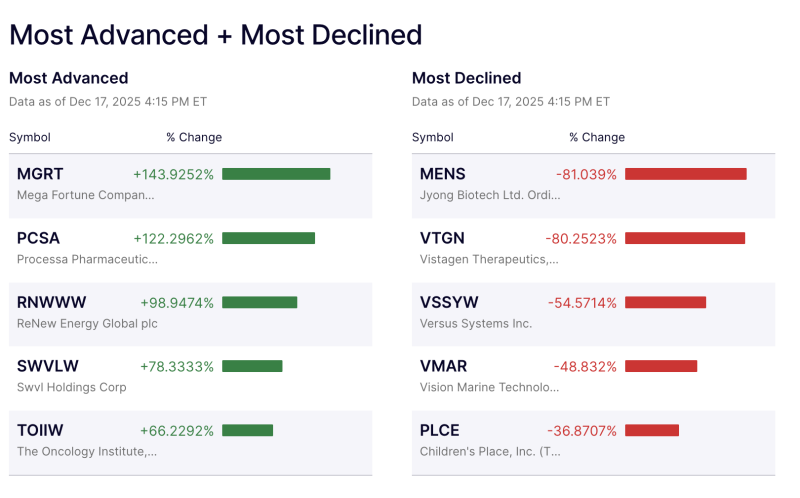

U.S. markets delivered a dramatic split session, with select small-cap and speculative stocks posting eye-catching gains, even as several biotech and consumer names suffered steep sell-offs. The contrast highlighted how risk appetite remains highly selective—and unforgiving.

Biggest Gainers: Speculation Back in Play

Leading the upside was Mega Fortune Company (MGRT), which surged more than 140% in a single session. Such a sharp move typically points to low-float dynamics, speculative buying, or company-specific developments that ignite momentum traders.

Close behind, Processa Pharmaceuticals (PCSA) jumped over 120%, underscoring how biotech stocks can swing aggressively on clinical updates, regulatory signals, or renewed investor positioning.

Other notable advancers included:

ReNew Energy Global (RNWWW), rising nearly 99%, reflecting renewed interest in renewable-linked plays.

Swvl Holdings (SWVLW), up more than 78%, as trading activity intensified in mobility and tech-linked names.

The Oncology Institute (TOIIW), which added over 66%, again highlighting the volatility inherent in healthcare and life sciences stocks.

Steep Decliners: Confidence Erodes Quickly

On the downside, losses were just as severe. Jyong Biotech (MENS) collapsed more than 81%, a move that suggests investor reaction to adverse news or concerns around business viability.

Also under heavy pressure:

Vistagen Therapeutics (VTGN), down over 80%, extending the theme of sharp biotech reversals.

Versus Systems (VSSYW), sliding more than 54% amid fading momentum.

Vision Marine Technologies (VMAR), which lost nearly half its value as sentiment turned sharply negative.

Children’s Place (PLCE), down close to 37%, reflecting ongoing challenges in the retail and consumer discretionary space.

What This Tells Investors

The session reinforced a familiar message: volatility is concentrated in smaller, speculative stocks, where gains and losses can be extreme within hours. While such moves can offer opportunity, they also carry elevated risk, particularly when driven by momentum rather than fundamentals.