US equity markets witnessed sharp divergences on Tuesday, with several low-priced and microcap stocks posting outsized gains, even as a separate set of counters saw steep declines. Trading activity remained heavy in benchmark ETFs and large-cap technology stocks, underscoring mixed investor sentiment.

Sharp Gainers Dominate Advancers List

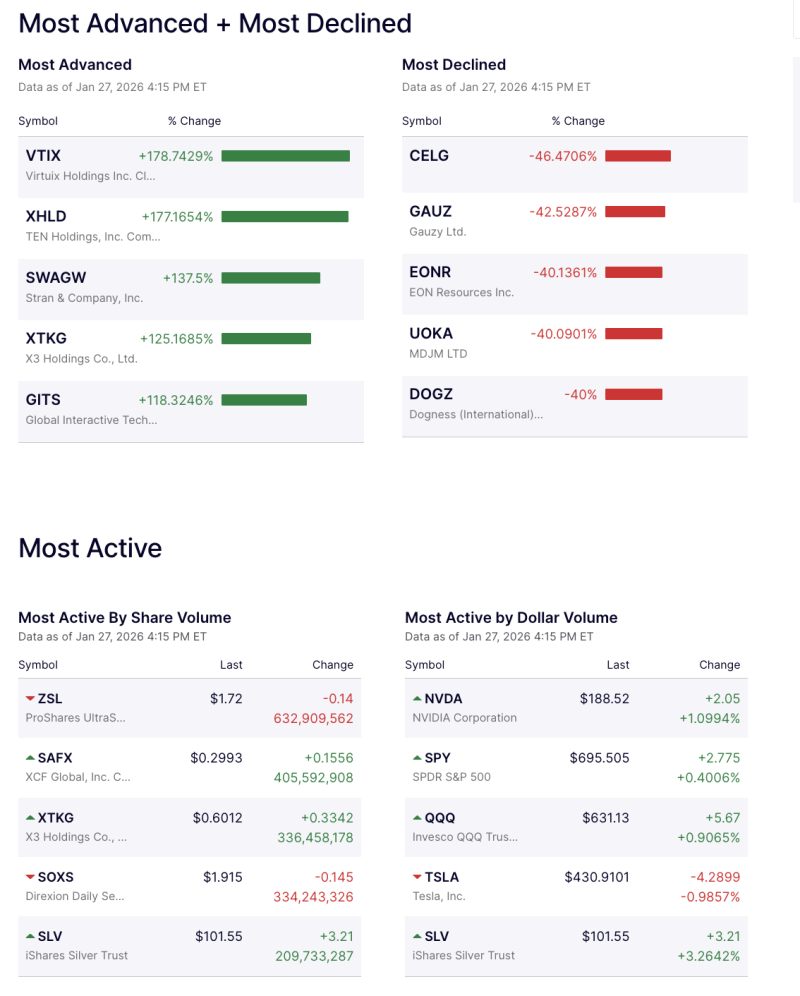

Among the top gainers, Virtuix Holdings Inc. (VTIX) surged 178.74%, emerging as the biggest percentage gainer of the session. It was followed closely by TEN Holdings Inc. (XHLD), which jumped 177.17%.

Other notable movers on the upside included:

Stran & Company (SWAGW): up 137.5%

X3 Holdings Co. (XTKG): up 125.17%

Global Interactive Technologies (GITS): up 118.32%

The sharp rallies suggest speculative interest and aggressive short-term positioning, particularly in small and thinly traded stocks.

Heavy Losses Among Decliners

On the downside, CELG led the losers with a sharp 46.47% decline. Other stocks witnessing significant sell-offs included:

Gauzy Ltd. (GAUZ): down 42.53%

EON Resources Inc. (EONR): down 40.14%

MDJM Ltd. (UOKA): down 40.09%

Dogness International (DOGZ): down 40%

The magnitude of losses points to profit booking, negative stock-specific triggers, or heightened volatility in select names.

Trading Activity Remains Robust

In terms of share volume, ProShares UltraShort Silver ETF (ZSL) topped the list, with over 632.9 million shares traded, despite a decline of $0.14 to $1.72. SAFX and XTKG also saw heavy volumes, indicating strong speculative participation.

By dollar volume, heavyweight names dominated activity:

NVIDIA (NVDA) traded at $188.52, rising 1.09%, emerging as the most actively traded stock by value.

SPDR S&P 500 ETF (SPY) gained 0.40% to $695.51.

Invesco QQQ Trust (QQQ) advanced 0.91% to $631.13.

Tesla (TSLA) slipped 0.99% to $430.91, standing out among major decliners.

iShares Silver Trust (SLV) rose over 3.26%, reflecting renewed interest in precious metals.