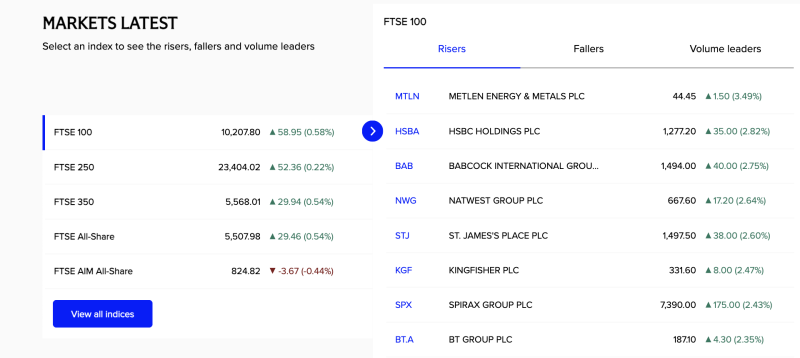

UK equity markets ended Tuesday’s session on a firm footing, with the FTSE 100 climbing 0.58% to 10,207.80, supported by gains in heavyweight banking, industrial and consumer stocks. Broader market indices also advanced, reflecting improved investor sentiment across large and mid-cap segments.

The FTSE 250 rose 0.22% to 23,404.02, while the FTSE 350 gained 0.54%. The FTSE All-Share added 0.54%, indicating broad-based participation. In contrast, the FTSE AIM All-Share slipped 0.44%, underperforming the main market amid selective selling in smaller growth stocks.

Banking Stocks Anchor the Upside

Financials emerged as a key driver of the rally. HSBC Holdings advanced 2.82%, while NatWest Group gained 2.64%, as investors rotated into large-cap banks on expectations of resilient earnings and stable interest-rate conditions.

Industrials and Consumer Names Gain Traction

Among the top gainers, Metlen Energy & Metals rose 3.49%, while Babcock International Group climbed 2.75%, reflecting renewed interest in infrastructure and industrial-linked stocks.

Consumer-facing names also posted steady gains, with Kingfisher up 2.47% and St. James’s Place rising 2.60%.

Stock-Specific Momentum

Spirax Group jumped 2.43%, benefiting from buying interest in engineering and automation-linked stocks.

BT Group added 2.35%, extending recent gains amid optimism around operational stability and cost controls.

Market Outlook

Tuesday’s session highlighted defensive strength in blue-chip stocks, with investors favouring established names over higher-risk AIM-listed companies. Analysts note that sustained gains in banks and industrials could keep the FTSE 100 supported in the near term, even as global markets remain sensitive to macroeconomic and policy cues.