Commodity markets extended their risk-off move, led by an aggressive sell-off in precious metals, as tightening financial conditions and reduced safe-haven demand weighed heavily on prices.

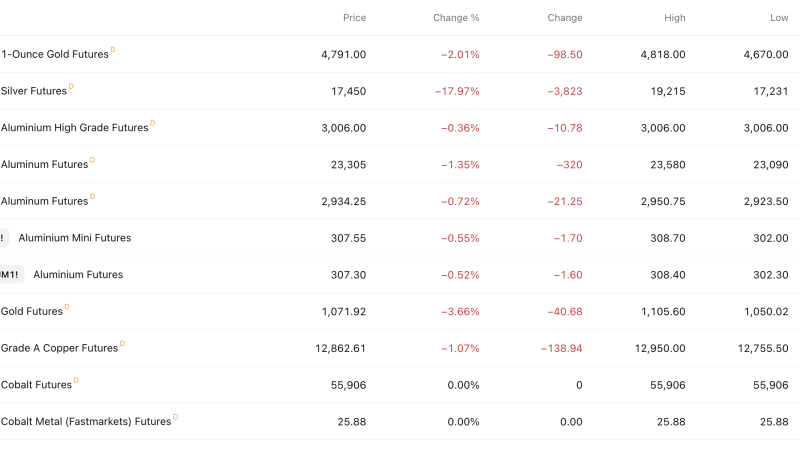

Silver futures collapsed 17.97% to 17,450, marking the sharpest single-session decline across the metals complex and signaling forced liquidation across leveraged positions. Gold futures fell in tandem, with 1-ounce gold down 2.01% to 4,791, while broader gold contracts slid 3.66%, breaking key short-term support levels.

Industrial metals followed suit but with milder losses. Aluminium futures declined between 0.36% and 1.35% across contracts, reflecting weaker global demand expectations rather than panic selling. Copper futures slipped 1.07% to 12,862, reinforcing concerns around slowing industrial activity and manufacturing momentum.

Cobalt prices remained flat, indicating selective price insulation tied to long-term supply contracts rather than spot demand strength.

The sharp divergence between precious metal liquidation and relatively contained industrial metal losses suggests this move is being driven less by physical demand destruction and more by macro-led deleveraging, higher real yields, and a pullback from defensive positioning.

With silver absorbing the brunt of the selling and gold losing momentum as a hedge, commodities are signaling tightening liquidity and rising caution across global risk assets.