Global equity markets came under sharp selling pressure on Tuesday as a broad risk-off mood gripped investors, dragging major US indices sharply lower while European markets, including the UK’s FTSE 100, closed in the red.

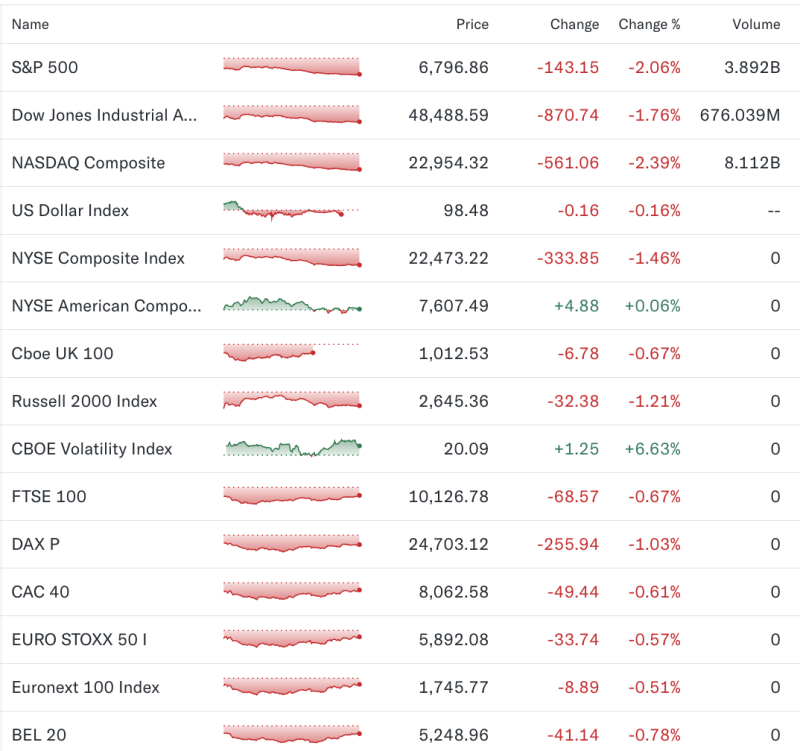

In the US, the S&P 500 fell 2.06% to 6,796.86, while the Nasdaq Composite plunged 2.39% to 22,954.32, led by heavy losses in large-cap technology stocks. The Dow Jones Industrial Average dropped 870.74 points, or 1.76%, to 48,488.59.

Market volatility spiked, with the CBOE Volatility Index (VIX) jumping 6.63% to 20.09, reflecting growing investor nervousness.

Big Tech, ETFs See Heavy Selling

Among the most actively traded stocks by dollar volume:

Nvidia (NVDA) slid 4.38%

Tesla (TSLA) declined 4.17%

Apple (AAPL) fell 3.46%

SPDR S&P 500 ETF (SPY) dropped 2.04%

Invesco QQQ Trust (QQQ) lost 2.12%

By share volume, Nvidia, ImmunityBio (IBRX) and INVO Fertility (IVF) remained among the most traded counters, reflecting heightened churn across sectors.

Sharp Stock-Level Moves

In US trading, select stocks saw extreme moves:

INVO Fertility (IVF) surged over 191%

Corvus Pharmaceuticals (CRVS) jumped 166%

Lavoro Ltd (LVROW) gained nearly 99%

On the downside:

NovaBay Pharmaceuticals (NBY) crashed over 55%

Synlogic (SYBX) fell 50%

Dermata Therapeutics (DRMAW) dropped 48%

European Markets Track Wall Street Lower

European equities mirrored the weak global sentiment:

FTSE 100 closed 0.67% lower at 10,126.78

Germany’s DAX fell 1.03%

France’s CAC 40 slipped 0.61%

EURO STOXX 50 eased 0.57%

Despite the broader decline, select UK stocks advanced, with Informa PLC, Haleon, Endeavour Mining, Rentokil Initial, Melrose Industries, Coca-Cola Europacific Partners, Rolls-Royce Holdings, and NatWest Group featuring among the FTSE 100 gainers.

Market View

Analysts attribute the synchronized global sell-off to rising uncertainty around growth and valuations, particularly in technology-heavy indices. With volatility rising and liquidity concentrated in mega-cap stocks, markets are expected to remain sensitive to macro data and earnings cues in the near term.