Global equity markets witnessed a sharp sell-off on Tuesday, led by steep losses on Wall Street, as investors turned risk-averse amid rising volatility and broad-based selling across technology and growth stocks.

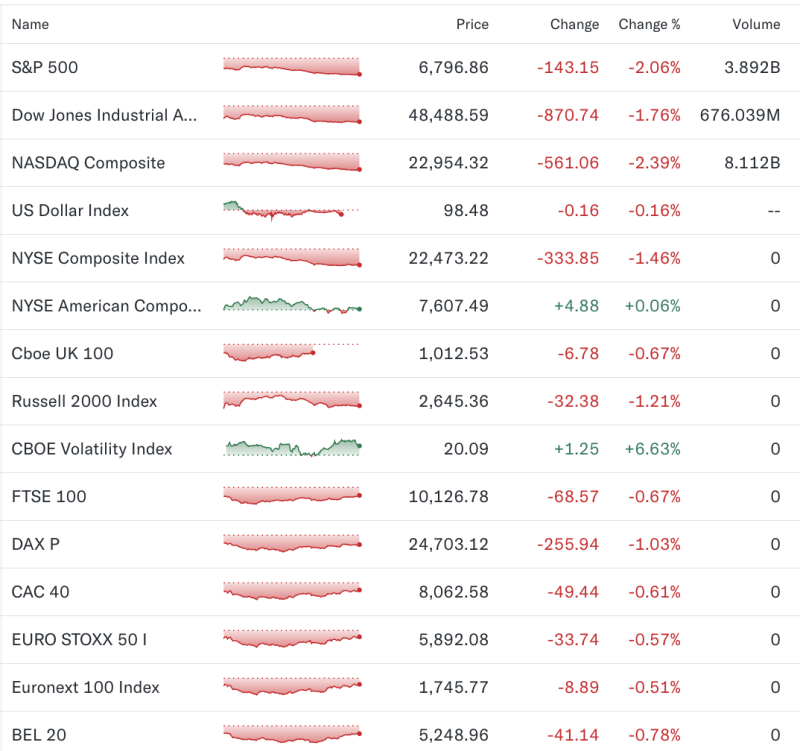

In the US, the S&P 500 fell 2.06%, shedding 143.15 points to close at 6,796.86, while the Nasdaq Composite plunged 2.39% to 22,954.32, marking the sharpest decline among major indices. The Dow Jones Industrial Average dropped 870.74 points, or 1.76%, to 48,488.59.

The sell-off was accompanied by a surge in market volatility, with the CBOE Volatility Index (VIX) jumping 6.63% to 20.09, signalling heightened investor anxiety.

US Market Snapshot

NYSE Composite Index declined 1.46% to 22,473.22

Russell 2000 Index, a key small-cap gauge, slipped 1.21%

US Dollar Index edged marginally lower by 0.16%, offering little relief to risk assets

Trading volumes remained elevated, with the Nasdaq Composite seeing over 8.1 billion shares traded, reflecting aggressive repositioning by investors.

Europe Mirrors US Weakness

European equities tracked US markets lower in late trade:

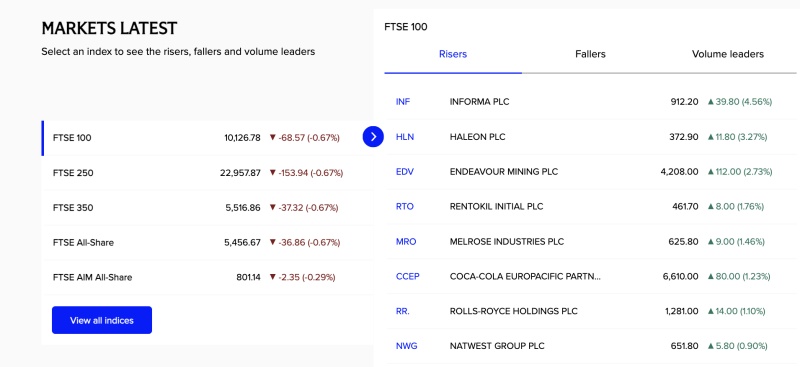

FTSE 100 closed 0.67% lower at 10,126.78

Germany’s DAX slipped 1.03%

France’s CAC 40 fell 0.61%

EURO STOXX 50 declined 0.57%

Euronext 100 dropped 0.51%

Belgium’s BEL 20 eased 0.78%

Market Outlook

The synchronized decline across US and European indices underscores a global risk-off sentiment, with investors reassessing valuations in high-growth sectors amid macroeconomic uncertainty. Analysts note that sustained volatility could keep markets under pressure in the near term, especially if earnings or macro data fail to provide reassurance.