Aditya Birla Sun Life Insurance (ABSLI), the life insurance subsidiary of Aditya Birla Capital Limited (ABCL), has launched one-of-its-kind comprehensive life insurance solution under the aegis ABSLI Wealth 360 Solution. It aims to provide best of both the worlds -capital protection along with potential gain from the market upside- to the customers, ensuring that they create adequate corpus to meet their and their family’s future financial needs.

ABSLI Wealth 360 Solution is a combination of traditional non-participating plan and a unit linked insurance plan. The offering provides a comprehensive solution that will give the policyholder potentially better returns through market linked investments and offer minimal risk with a guarantee on the capital. It helps to gain from market upside and create tax free wealth corpus. This plan not only provides one’s dependents with financial security in the unfortunate event of death, but also invests one’s money in equities to generate substantial corpus while providing an individual with a 100% capital guarantee. Moreover, this comprehensive solution keeps one free from multi – managing different plans and is a one-stop solution that caters to one’s insurance and investment needs along with capital guarantee.

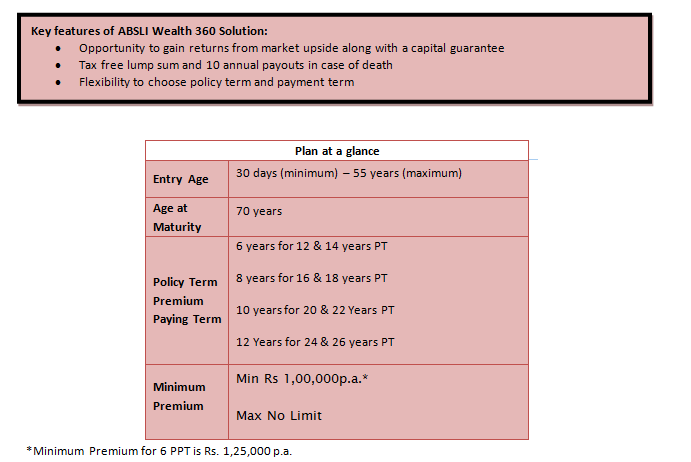

ABSLI Wealth 360 Solution has two main benefits. Firstly, Maturity Benefit, where one will get back the total premiums paid as a guaranteed sum plus the fund value. Secondly, Death Benefit, here in case of unfortunate death of the policyholder during the policy term, the nominee will get lump sum to take care of immediate expenses along with 10 installments to take care of recurring expenses. The solution enables customers to plan their finances as per their life’s milestones, thereby providing the best for oneself and their family in the years to come. This product can be beneficial for those who want to grow their wealth with bare minimum risk i.e. people who have medium to low appetite to take market risks and want guaranteed returns.

Commenting on the launch, Kamlesh Rao, MD & CEO, Aditya Birla Sun Life Insurance said, “Building and sustaining wealth corpus for life’s important milestones like retirement has emerged as one of the biggest uncertainties amongst people today. Amidst turbulent market conditions, safeguarding one’s hard earned money while growing it, is becoming increasingly difficult. A solution that offers capital guarantee along with an opportunity to gain from market linked returns may be a perfect solution, if one does not want to risk the invested capital. To bridge this gap and provide customers with one-of-its-kind solution, we have introduced a unique combination of life insurance plans which provides potential gain from stock market with guarantee of a traditional instrument, besides offering life insurance protection. We believe that our distinctive product will cater to suit financial goals of individuals who are looking to multiply their wealth with minimal risks.”

*Minimum Premium for 6 PPT is Rs. 1,25,000 p.a.

";