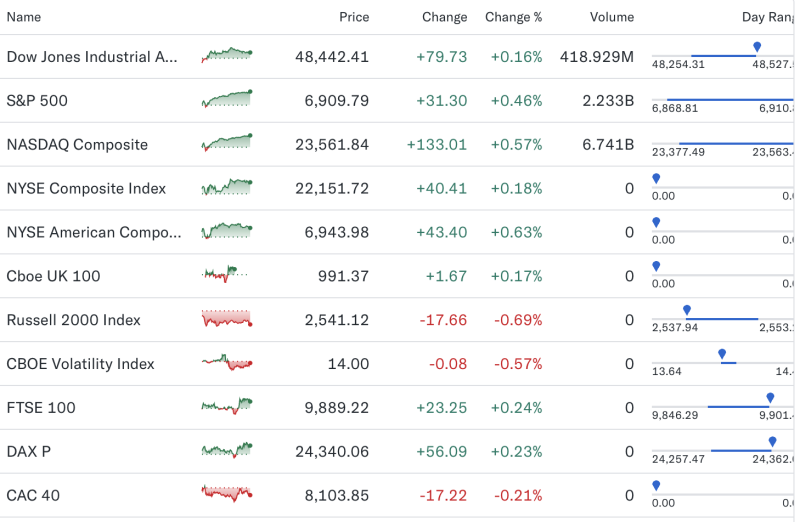

Global Markets, Dec 24, 2025 — Major global equity indices traded mostly higher, led by gains in US technology stocks and steady momentum across European benchmarks, while small-cap shares underperformed amid cautious risk appetite.

🌍 Global Indices at a Glance

Dow Jones Industrial Average rose 0.16% to 48,442

S&P 500 added 0.46%, extending record-level momentum

NASDAQ Composite outperformed, climbing 0.57%, supported by tech buying

NYSE Composite gained 0.18%

NYSE American Composite advanced 0.63%

US markets benefited from sustained optimism around earnings visibility and cooling volatility.

📉 Small-Caps and Volatility

Russell 2000 slipped 0.69%, reflecting pressure on smaller companies

CBOE Volatility Index (VIX) eased 0.57% to 14, signaling continued investor calm

Analysts note that declining volatility suggests confidence in near-term market stability, even as select segments face profit-taking.

🇪🇺 Europe Mixed but Resilient

FTSE 100 (UK) rose 0.24%, supported by mining and energy stocks

DAX (Germany) gained 0.23%, tracking industrial and export-heavy shares

CAC 40 (France) fell 0.21%, underperforming regional peers

European markets reflected mixed sectoral cues, with commodities offering support while consumer and luxury stocks remained subdued.

📊 Market Perspective

Global equities continue to show selective strength, with large-cap and technology-led indices outperforming. Small-caps and cyclical stocks remain more sensitive to valuation concerns and year-end positioning.