Global Startup Funding Comparison (Mid-December 2025)

🇺🇸 United States – Mega Rounds & Market Leaders

| Company | Funding Raised | Round | Sector | Key Focus |

|---|---|---|---|---|

| Databricks | $4B | Series L | AI / Data | Enterprise data & AI infrastructure |

| Cyera | $400M | Growth | Cybersecurity | AI-driven data security |

| Radiant | $300M | Series D | Clean Energy | Portable nuclear microreactors |

| Tebra | $250M | Growth (Equity + Debt) | Healthtech | AI practice management |

| Imprint | $150M | Series D | Fintech | Brand-linked credit cards |

| HawkEye 360 | $150M | Series E | Spacetech | Satellite RF intelligence |

| Chai Discovery | $130M | Series B | Biotech / AI | AI molecular modeling |

| Ambros Therapeutics | $125M | Series A | Biotech | Pain management drugs |

| Mythic | $125M | Growth | Semiconductors | Energy-efficient AI chips |

| Atavistik Bio | $120M | Series B | Biotech | Precision therapeutics |

🇬🇧 United Kingdom – Applied AI, Health & Climate Tech

| Company | Funding Raised | Round | Sector | Key Focus |

|---|---|---|---|---|

| PolyAI | £64M | Series D | AI | Enterprise voice & chat agents |

| Cellular Origins | £29.8M | Series A | Biotech | Robotic cell therapy manufacturing |

| Fuse Energy | £52.35M | Growth | Greentech | Home batteries & grid tech |

| Ben | £20.8M | Series B | HR Tech | Global benefits platform |

| Sequence | £15M | Series A | AI / Fintech | Billing & revenue automation |

| Ankar | £15M | Series A | AI / Legaltech | Patent automation |

| Workbooks | £16.6M | Growth | SaaS | Mid-market business software |

| Yonda Tax | £11.2M | Growth | Fintech | Cross-border tax automation |

| GlycanAge | £6.51M | Growth | Healthtech | Ageing biomarkers |

| Iconic | £10M | Seed | Gaming / AI | Voice-AI gaming |

| IVFmicro | £3.5M | Pre-Seed | Healthtech | IVF microfluidics |

| A&B Smart Materials | £1.5M | Pre-Seed | Climate Tech | Biodegradable materials |

| Future Greens | £500K | Seed | Climate Tech | Waste-to-energy bioreactors |

🇮🇳 India – Growth Momentum & Sector Diversity

| Company | Funding Raised | Round | Sector | Key Focus |

|---|---|---|---|---|

| MoEngage | $180M | Series F | SaaS / MarTech | AI customer engagement |

| Digantara | $50M | Series B | Spacetech | Space debris monitoring |

| Moxie | $15M | Growth | D2C | Clean beauty & wellness |

| StockGro | $13M | Series B1 | Fintech | Gamified investing |

| Qucev | ~$14.5M | Series B | EV Infrastructure | EV charging networks |

| WorkIndia | ~$10.7M | Series B | HR Tech | Blue-collar hiring |

| Tagbin | $10M | Growth | Agri-IoT | Smart logistics monitoring |

| Oben Electric | ~$9.5M | Pre-Series B | EV | Electric motorcycles |

| Virohan | ~$7.5M | Series B (Ext.) | Edtech / Health | Medical skilling |

| Sisir Radar | $7M | Series A | Defense Tech | Advanced radar systems |

| Underneat | $6M | Pre-Series A | D2C | Inclusive apparel |

| Alimento Agro Foods | ~$5.76M | Series A | Foodtech | Sustainable packaged foods |

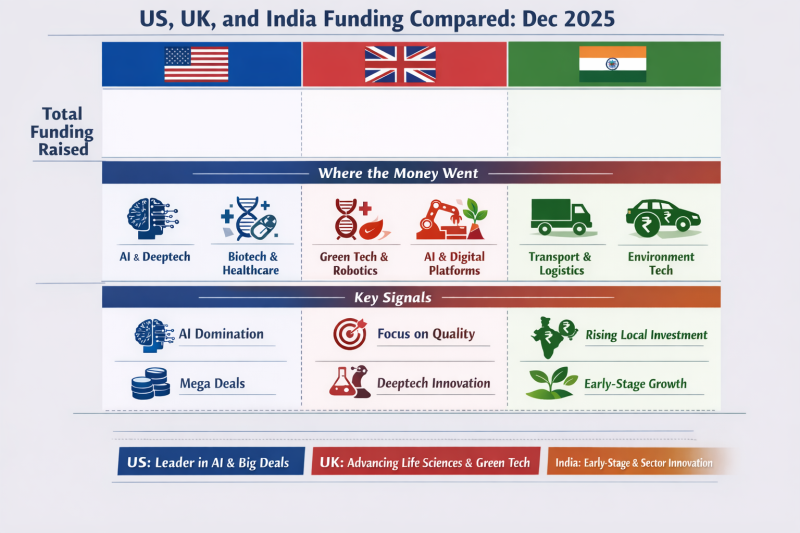

📊 Market Snapshot Comparison

| Region | Total Raised | Deals | Dominant Theme |

|---|---|---|---|

| United States | $5.7B+ | 10 | Mega-round dominance |

| United Kingdom | £257M | 20 | Applied & revenue-ready tech |

| India | $363M | 29 | Growth-stage scale + diversity |