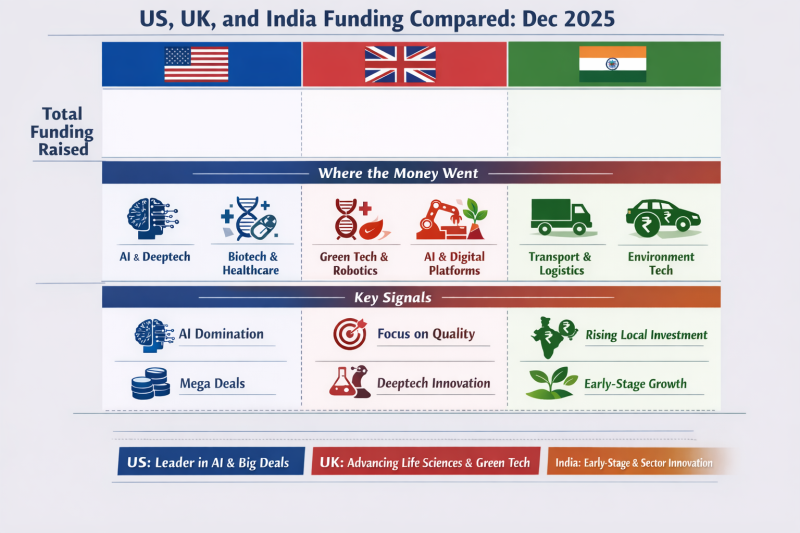

As 2025 heads into its final stretch, startup funding activity across the United States, the United Kingdom, and India reveals three sharply contrasting investment narratives. While capital continues to flow globally, where the money goes, how big the bets are, and what investors prioritize vary significantly by geography.

The United States: Mega-Rounds and Market Dominance

The U.S. funding ecosystem closed the week with overwhelming force. Just 10 deals generated over $5.7 billion, underscoring how American venture capital remains heavily concentrated around category leaders and late-stage giants.

Databricks’ historic $4 billion Series L at a $134 billion valuation alone dwarfed entire national ecosystems elsewhere. The broader U.S. pattern was clear:

Capital favored scale, defensibility, and infrastructure-level platforms

AI and data dominated, but cybersecurity, nuclear energy, healthcare software, and space intelligence also attracted nine-figure checks

Investors showed comfort with capital-intensive, long-horizon bets, from portable nuclear reactors to satellite intelligence networks

Signal: U.S. VCs are not diversifying risk—they are doubling down on winners. The market is less about experimentation and more about fortifying global champions.

The United Kingdom: Depth, Diversity, and Applied Innovation

In contrast, the UK delivered a breadth-driven funding story. Across 20 startups, £257 million was deployed, reflecting confidence in applied, revenue-generating technologies rather than moonshots.

UK capital gravitated toward:

Enterprise AI agents solving billing, HR, IP, and customer service workflows

Healthtech and biotech platforms transitioning from lab to clinic

Greentech hardware with short commercialization cycles, such as energy storage and waste-to-energy systems

Pragmatic fintech and insurtech tools focused on compliance and automation

Unlike the U.S., no single round dominated. Instead, the UK ecosystem showed balanced momentum across early, growth, and late stages, with strong regional participation beyond London.

Signal: The UK is positioning itself as a deployment market—where AI, healthtech, and climate solutions are operational, monetizable, and enterprise-ready.

India: Growth-Stage Gravity with Early-Stage Undercurrents

India delivered the surprise acceleration of the week. Funding jumped 177% week-on-week, reaching $363 million across 29 deals, despite year-end seasonality.

The market had a clear center of gravity:

MoEngage’s $180 million Series F accounted for nearly half the total, reinforcing India’s strength in export-ready SaaS

Spacetech (Digantara), EV infrastructure (Qucev, Oben Electric), and defense-tech continued to benefit from policy alignment and strategic interest

A healthy spread of D2C, fintech, workforce platforms, and skilling startups highlighted domestic consumption and employment themes

India stood out for its deal volume and sector diversity, even as overall ticket sizes remained modest compared to the U.S.

Signal: Indian investors are backing scale with discipline—favoring companies that can combine global relevance with local execution efficiency.

Funding Snapshot: A Side-by-Side View

| Market | Total Raised | No. of Deals | Dominant Theme | Investor Mindset |

|---|---|---|---|---|

| United States | $5.7B+ | 10 | AI, data infrastructure, security, energy | Winner-takes-all, mega-round concentration |

| United Kingdom | £257M | 20 | Applied AI, healthtech, greentech | Balanced, revenue-focused deployment |

| India | $363M | 29 | SaaS, spacetech, EVs, consumer brands | Growth-led with early-stage depth |