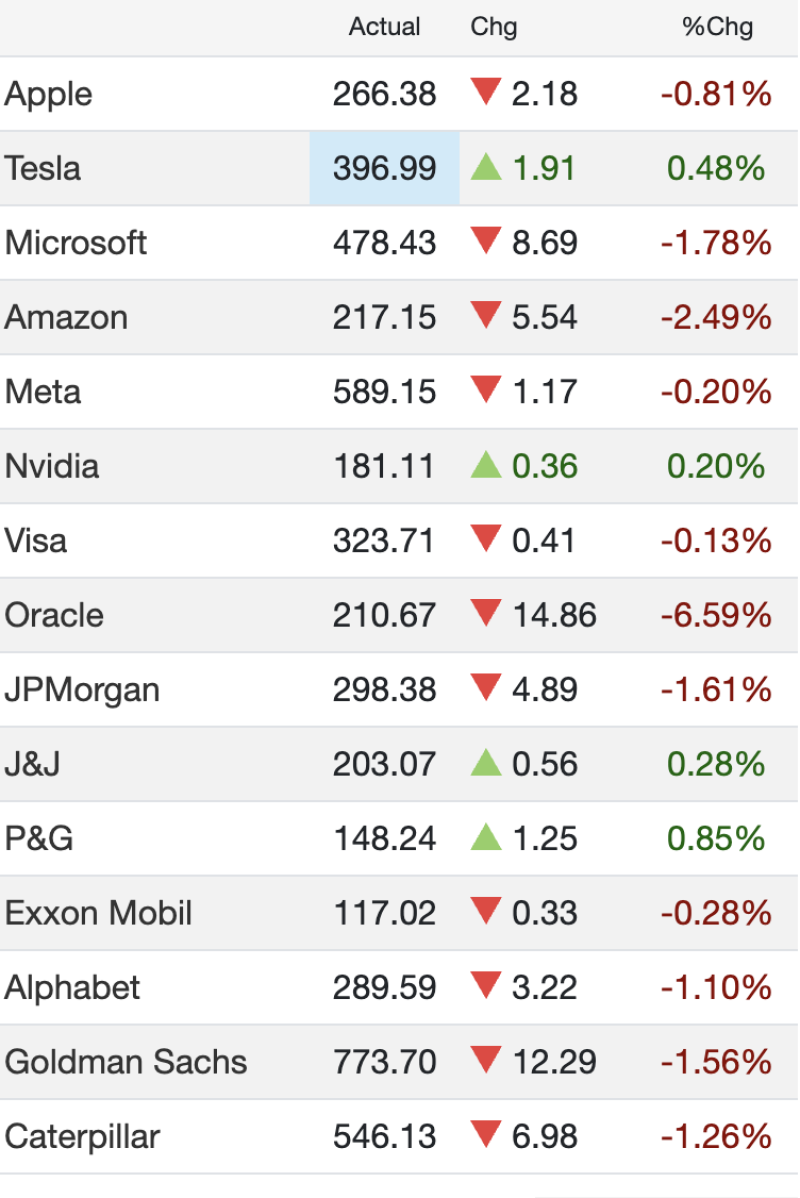

US stock markets delivered a mixed performance as major technology names came under fresh selling pressure, while select defensives and consumer names managed to hold steady. The latest session reflected heightened investor caution ahead of key macro announcements and persistent worries around stretched tech valuations.

Tech Stocks Lead Declines

Large-cap technology stocks saw broad weakness:

Microsoft dropped 1.78% to $478.43

Amazon slid 2.49% to $217.15

Meta dipped 0.20% to $589.15

Alphabet shed 1.10% to $289.59

The sharpest fall came from Oracle, which plunged 6.59% to $210.67, making it the biggest loser in the basket and highlighting renewed investor concerns over enterprise cloud momentum.

Apple, JPMorgan, Goldman Sachs See Pressure

Blue-chip stocks also traded lower:

Apple slipped 0.81% to $266.38

JPMorgan declined 1.61%

Goldman Sachs fell 1.56%

Exxon Mobil eased 0.28%

Caterpillar also ended significantly lower, down 1.26% after recent strength linked to US industrial spending optimism.

Winners: Tesla, Nvidia, P&G, J&J

Amid the broader weakness, a few stocks bucked the downtrend:

Tesla rose 0.47% to $396.93

Nvidia inched up 0.24% following a volatile session

Procter & Gamble (P&G) gained 0.85%, the best performer in the list

Johnson & Johnson (J&J) added 0.28%

These gains indicate selective defensive buying as markets weigh global uncertainty and upcoming policy signals.

Market Mood: Risk-Off Bias Persists

The overall pattern suggests investors continue to rotate out of high-valuation tech plays and into relatively stable defensives. With macroeconomic visibility still limited, caution is likely to remain elevated in the near term.