Trading activity on December 16, 2025 (4:15 PM ET) reflected a sharp contrast between retail-driven volume in low-priced stocks and institutional concentration in large-cap leaders and ETFs, according to exchange data.

Most Active by Share Volume

Low-priced and leveraged instruments dominated the session by sheer number of shares traded, indicating speculative and short-term trading interest.

SOXS (Direxion Daily Semiconductor Bear ETF) topped the list, trading 438.6 million shares, closing at $3.395, up $0.055.

SRXH (SRX Health Solutions) followed with 368.9 million shares, gaining $0.0659 to $0.3704.

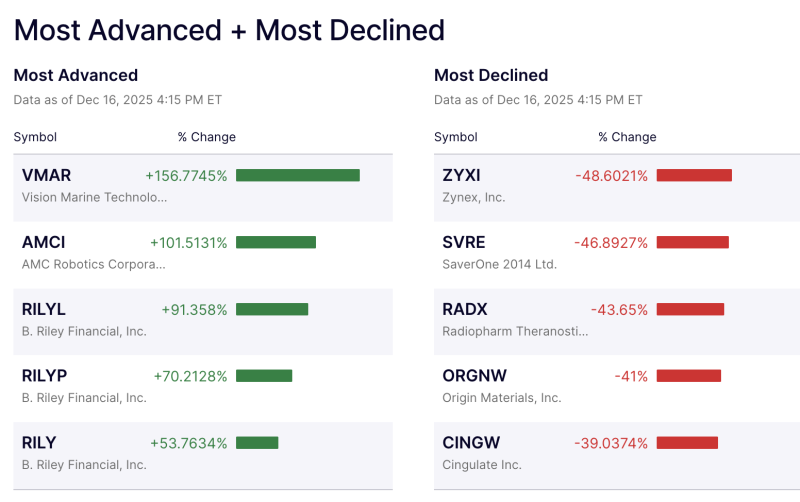

Vision Marine Technologies (VMAR), already among the session’s top gainers, saw 215.9 million shares traded, ending at $0.976, up $0.5959.

On the downside,

Paranovus Entertainment (PAVS) fell to $0.023, down $0.0133, with 204.6 million shares traded.

Inspire Veterinary Partners (IVP) declined $0.0028 to $0.05, with volume of 176.5 million shares.

The dominance of sub-$1 stocks highlights heightened retail participation and speculative momentum.

Most Active by Dollar Volume

By traded value, activity was concentrated in mega-cap stocks and index ETFs, reflecting institutional positioning.

SPDR S&P 500 ETF (SPY) led dollar turnover, closing at $678.85, down 1.88 points (-0.28%).

Tesla (TSLA) saw heavy inflows, rising $14.57 (+3.07%) to $489.88.

NVIDIA (NVDA) advanced $1.43 (+0.81%) to $177.72, maintaining its position as a core AI-sector holding.

Invesco QQQ Trust (QQQ) added $1.21 (+0.20%), ending at $611.75.

Broadcom (AVGO) gained $1.49 (+0.44%), closing at $341.30.