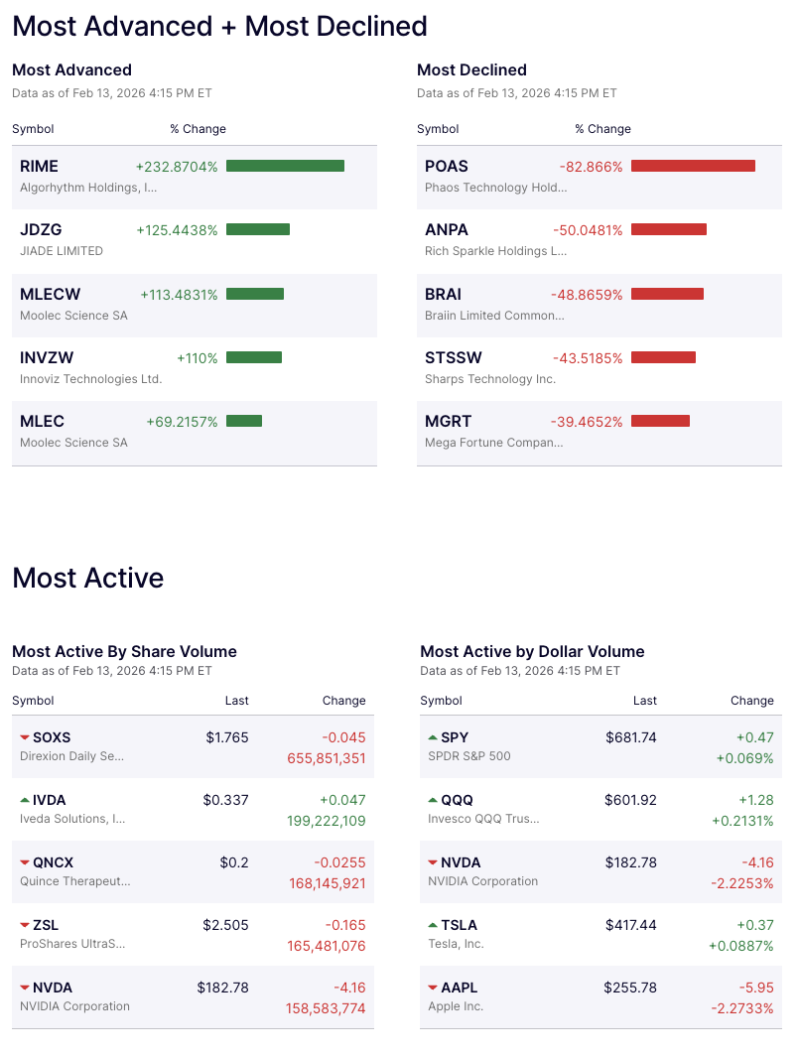

US equities delivered extreme moves across microcaps and heavyweights, with select stocks posting triple-digit gains while others saw deep corrections. Trading activity remained concentrated in major ETFs and tech leaders.

Top Gainers — Momentum Explosion

RIME (Algorhythm Holdings) surged +232.87%, emerging as the session’s biggest winner.

JDZG (JADE Limited) jumped +125.44%, supported by strong speculative buying.

MLECW (Molec Science SA) advanced +113.48% in high-volatility trading.

INVZW (Innoviz Technologies) climbed +110%, reflecting strong investor interest.

MLEC (Molec Science SA) gained +69.21%, continuing its upward momentum.

Outcome: Aggressive risk-on sentiment dominated select microcaps, driving outsized percentage gains.

Top Losers — Heavy Sell-Off

POAS (Phaos Technology) plunged −82.87%, the sharpest decline of the day.

ANPA (Rich Sparkle Holdings) dropped −50.05% amid sustained selling pressure.

BRAI (Brain Limited) slipped −48.87% in volatile trade.

STSSW (Sharps Technology) fell −43.52%.

MGRT (Mega Fortune Company) declined −39.47%.

Outcome: Weak fundamentals and liquidation pressure triggered deep drawdowns across select counters.

Most Active by Share Volume

SOXS traded 655.85M shares, closing at $1.765 (−0.045).

IVDA saw 199.22M shares, ending at $0.337 (+0.047).

QNCX recorded 168.15M shares, closing at $0.20 (−0.0255).

ZSL posted 165.48M shares, finishing at $2.505 (−0.165).

NVDA (NVIDIA) traded 158.58M shares, closing at $182.78 (−2.25%).

Outcome: High retail participation and leveraged ETF activity dominated turnover.

Most Active by Dollar Volume

SPY (S&P 500 ETF) closed at $681.74 (+0.069%).

QQQ (Nasdaq-100 ETF) ended at $601.92 (+0.21%).

NVDA (NVIDIA) settled at $182.78 (−2.25%).

TSLA (Tesla) finished at $417.44 (+0.088%).

AAPL (Apple) closed at $255.78 (−2.27%).

Outcome: Institutional flows remained concentrated in benchmark ETFs and mega-cap tech stocks.

Market Takeaway

The session reflected a barbell market structure — speculative microcaps delivered explosive gains and losses, while institutional capital rotated steadily through index ETFs and large-cap technology names. Volatility is likely to remain elevated in the near term.