The first week of December showed renewed confidence across major startup ecosystems. The US returned to mega-round activity with billion-dollar cheques; the UK recorded a strong £195.7M week across 18 companies; and India witnessed steady but debt-dominant funding of $234M.

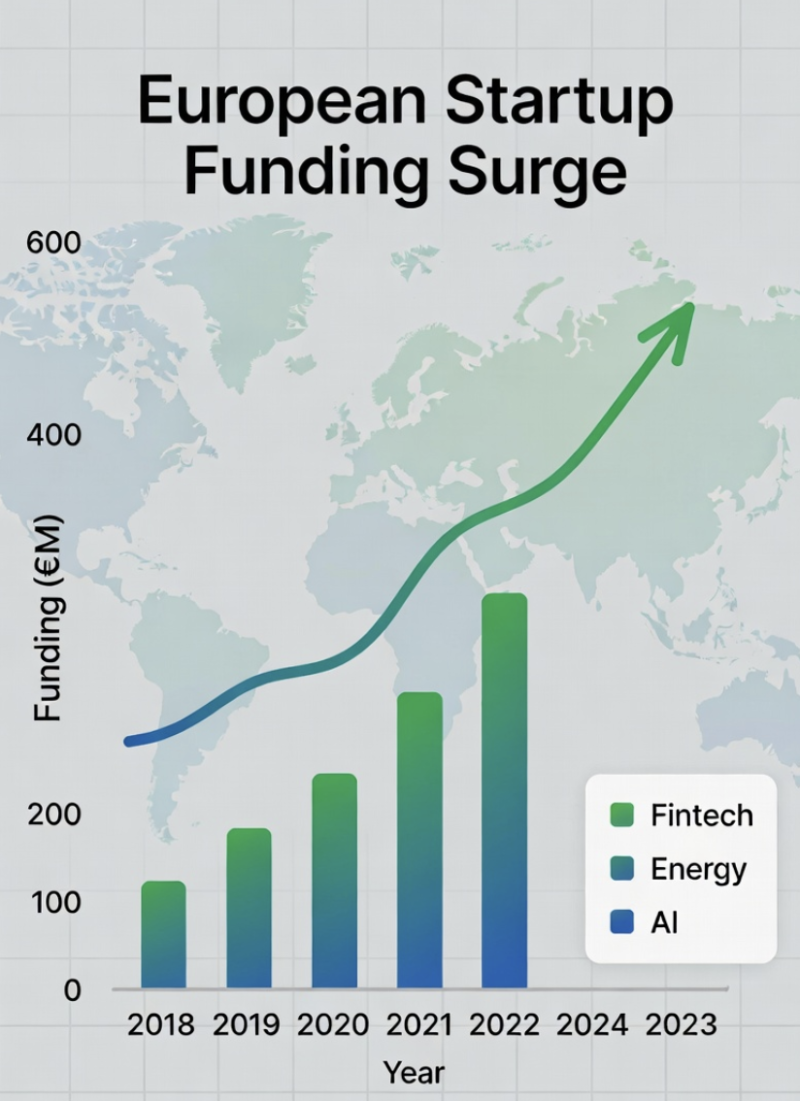

Despite macro caution, investors are doubling down on AI automation, fintech infrastructure, biotech innovation and energy technologies, signalling selective but strong conviction.

United States: Mega Deals Are Back

Top 10 Deals | Total: $2.52 Billion

The US saw its strongest week in months, led by Kalshi’s massive $1B raise. Defense tech, AI infrastructure, cybersecurity and biotech received the largest cheques.

Top Deals

Kalshi — $1B | Predictions Market

Castelion — $350M | Defense Tech

Eon — $300M | AI Cloud Data

Curative — $150M | Health Insurance

Angle Health — $134M | AI Health Benefits

7AI — $130M | Cybersecurity

Protego Biopharma — $130M | Biotech

Triana Biomedicines — $120M | Biotech

Antithesis — $105M | Simulation Testing

Axiado — $100M | AI Server Chips

Hot sectors: AI infra, defense tech, simulation, biotech

🇬🇧 United Kingdom: A Strong Start to December (£195.7M Raised)

Total Funding: £195.7M | 18 startups | 78 participating investors

AI, fintech, biotech/healthtech, greentech and SaaS led the funding momentum.

AI: Automation Pushes Deeper Into Workflows

AI startups embedding automation within enterprise, underwriting, telemetry and search optimisation attracted strong investor interest.

Key AI Deals

BuiltAI — £4.5M (Seed): Automating commercial real-estate underwriting; expanding to US & UK.

Track Titan — £4M: AI telemetry-based driver coaching; global scaling ahead.

Searchable — £4M: Visibility measurement inside AI search engines (ChatGPT, Claude).

Ascentra Labs — £1.5M: Automating PE diligence & consulting workflows; preparing US entry.

Theme: Vertical AI + cross-border scalability.

Fintech: Cross-Border Infrastructure Dominates

Money movement, embedded liquidity and multi-currency systems saw strong interest.

Key Fintech Deals

Sokin — £37.8M Series B: Scaling multi-currency accounts & cross-border payments.

Bourn — £3.5M: NatWest-backed receivables-based Flexible Trade Account for SMEs.

Theme: Big bets on financial infra + bank–fintech collaboration.

Biotech & Healthtech: IP & Commercial Trials Drive Investment

Deep IP, clinical validation and manufacturing readiness were major themes.

Key Biotech / Healthtech Deals

BSF Enterprise — £15M: Lab-grown leather, cornea trials, cell-culture media scale-up.

yuv — £9.5M Series A: Smart hair-colour dispensing devices; US launch prep.

HotHouse Therapeutic — £2.9M: AI-optimised plant-based vaccine adjuvants moving toward preclinical partnerships.

Greentech: AI-Enabled Materials & Energy Systems

From thermoelectric materials to renewable-energy planning tools.

Key Greentech Deals

Modo Energy — £25M Series B: AI valuation platform for batteries & electrification assets.

Mater-AI — £1.5M: AI discovery of thermoelectric materials converting waste heat to electricity.

Feasibly — £200K: AI geospatial product for renewable-energy site assessment.

SaaS & Edtech: Structured Capital Surges

Credit and growth-debt funding supported SaaS roll-ups and AI-led learning products.

Key SaaS / Edtech Deals

Shop Circle — £75.1M Credit Facility: SaaS acquisitions & AI-infused GTM systems.

Oneday — £3.2M Growth Debt: AI mentor-layer for entrepreneurship degree programs.

🇮🇳 India: $234M Raised, Debt Leads the Week

Total: $234M | 17 deals

Funding dipped slightly from the previous week, with a heavy tilt toward debt financing. Equity remained selective, but growth-stage companies saw healthy interest.

Top Indian Deals

Apraava Energy — $92M

Ultraviolette — $45M

StockGro — $16.6M

Finfactor — $15M

Modulus Housing — $7.83M

Ayekar — $6.5M

Moonrider — $6M

Hot sectors: EVs, fintech, energy transition, agritech

🌐 Global Takeaways

US: Mega-round momentum is back; large cheques for AI, defense, biotech.

UK: Strong £195.7M week led by AI, fintech, SaaS, greentech; London remains a powerhouse.

India: Debt-heavy funding landscape but resilient early- and mid-stage activity.

AI automation & deeptech remain the strongest global investment theme.

Late-stage confidence is returning across markets.