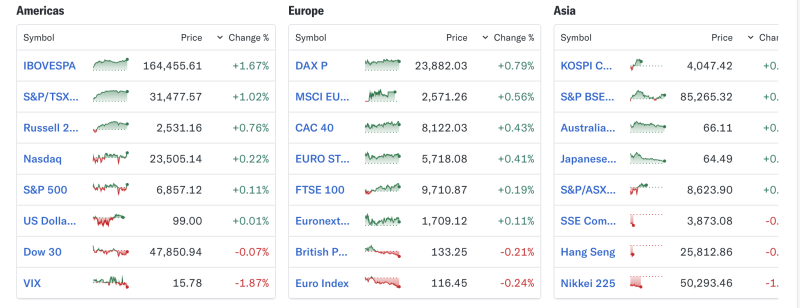

Global equity markets displayed a mixed but largely positive trend on Thursday, with strong gains across the Americas and Europe offset by mild weakness in parts of Asia.

Americas: Strong Gains Led by Brazil and Canada

The Americas region posted the day’s strongest performance:

Brazil’s IBOVESPA surged +1.67%, extending its upward momentum on robust commodity and financial sector buying.

Canada’s S&P/TSX climbed +1.02%, supported by energy and materials stocks.

Russell 2000 added +0.76%, reflecting improving sentiment in U.S. small-cap equities.

Nasdaq gained +0.22%, while the S&P 500 ticked up +0.11%, powered by steady buying in growth and tech names.

In contrast, the Dow 30 edged down -0.07%, reflecting selective profit-taking in blue-chip industrials.

Volatility eased further as the VIX declined 1.87% to 15.78, signaling calmer investor sentiment.

Europe: Broad-Based Gains Across Major Markets

European markets maintained steady upward momentum:

Germany’s DAX rose +0.79%, leading regional gains.

MSCI Europe advanced +0.56%, signaling broad investor confidence across sectors.

CAC 40 climbed +0.43%, while the EURO STOXX 50 added +0.41%.

The FTSE 100 gained +0.19%, with modest strength in banking and consumer sectors.

Minor declines were seen in British Pound Index (-0.21%) and the Euro Index (-0.24%), reflecting slight currency market adjustments.

Asia: Mixed Performance with Notable Weakness in Japan

Asian markets ended mixed, with pockets of strength offset by declines in key indices:

KOSPI Composite rose +0.64%, supported by tech and chipmaker stocks.

S&P BSE Sensex (India) gained +0.51% amid domestic buying in financials and IT.

Australia ASX All Ordinaries inched up +0.24%.

Japan’s Nikkei 225 fell sharply by -1.14%, weighed down by a slump in exporters and tech shares.

Hang Seng dropped -0.31%, reflecting continued pressure on China-linked equities.

Shanghai SSE Composite slipped -0.07%, indicating range-bound sentiment in mainland Chinese markets.

Market Outlook

Despite regional divergences, global equities remain largely supported by easing inflation prints, resilient corporate earnings, and lower volatility. Analysts expect continued sector-specific rotations as investors navigate central bank cues and year-end portfolio positioning.