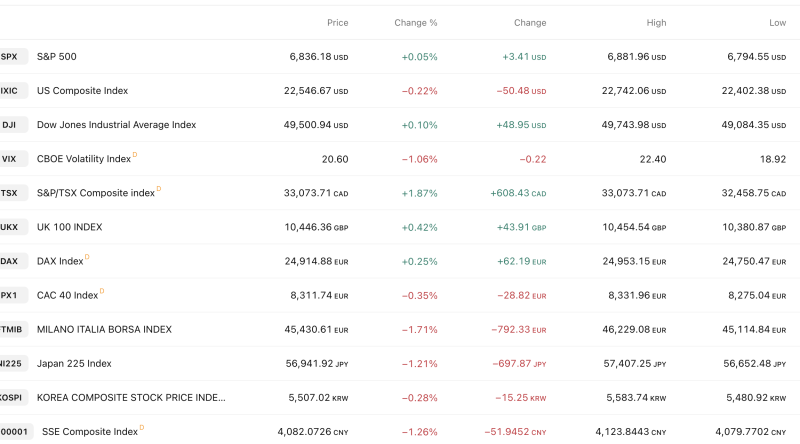

Global equities closed mixed, with US markets showing limited strength, Europe diverging, and most Asian indices ending lower amid cautious sentiment.

United States — Narrow Gains, Tech Weak

S&P 500 rose +0.05% to 6,836.18, holding near record territory.

Dow Jones gained +0.10% (+48.95 pts) to 49,500.94, supported by defensive buying.

Nasdaq Composite slipped −0.22%, reflecting weakness in tech-heavy counters.

VIX eased −1.06% to 20.60, indicating slightly lower volatility expectations.

Outcome: US markets remained range-bound with mild bullish bias, but tech weakness capped broader upside.

Europe — Mixed Performance

FTSE 100 (UK) advanced +0.42% to 10,446.36, supported by global cues.

DAX (Germany) climbed +0.25%, extending gradual gains.

CAC 40 (France) declined −0.35%, showing selective pressure.

FTSE MIB (Italy) dropped sharply −1.71%, marking the biggest fall in Europe.

Outcome: European markets showed divergence, with Italy underperforming while core indices stayed stable.

Asia — Broad Weakness

Nikkei 225 (Japan) fell −1.21%, tracking global risk-off sentiment.

Shanghai Composite (China) declined −1.26%, reflecting cautious positioning.

Kospi (South Korea) slipped −0.28%, continuing mild downside.

Outcome: Asian markets closed lower across the board, signaling cautious global risk appetite.

Key Global Signal

US stability vs Asia weakness shows uneven global momentum.

Europe remains selectively strong but fragile.

Volatility cooling slightly, yet direction remains uncertain.

Market Takeaway: Global equities remain mixed and range-bound, with defensive positioning dominating as investors await stronger macro triggers.