India Forex Market Overview

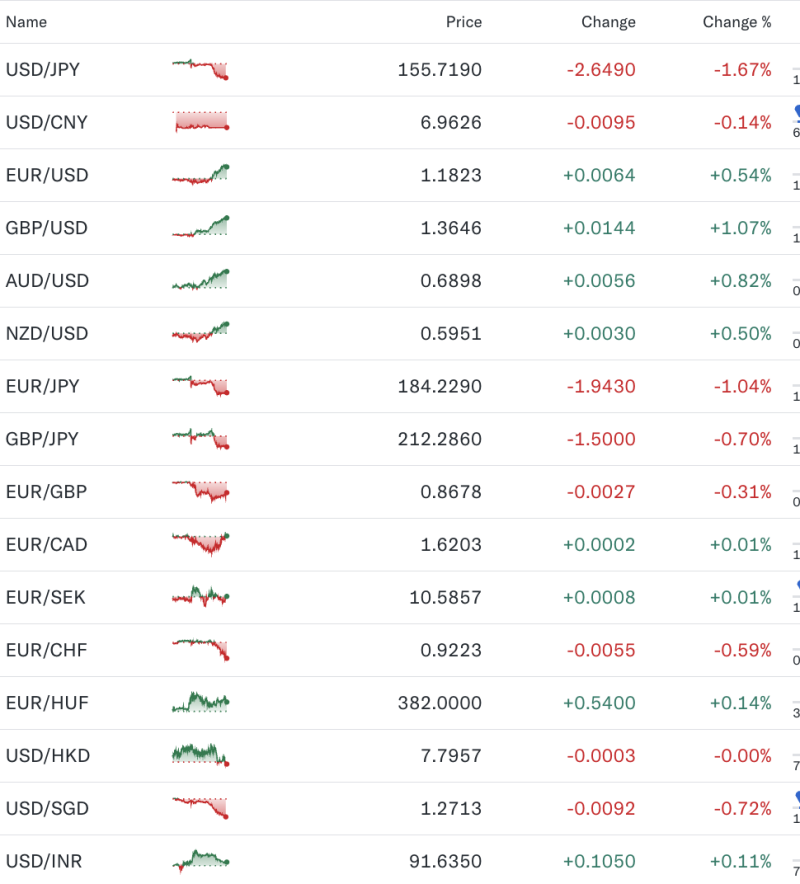

The Indian rupee traded marginally stronger against the U.S. dollar, with USD/INR quoted near 91.63, up 0.11%, as the dollar softened against major global currencies. The move reflected broader weakness in the greenback rather than any sharp domestic trigger.

The U.S. dollar saw its sharpest losses against the Japanese yen, with USD/JPY falling 1.67%, indicating reduced dollar demand globally. The dollar also weakened against the euro, with EUR/USD rising 0.54%, and the British pound, which gained over 1% against the dollar.

Global Currency Moves Impacting India

Strength in the euro, pound, and commodity-linked currencies such as the Australian dollar (+0.8%) and New Zealand dollar (+0.5%) signalled improved risk sentiment across global markets. Asian currencies remained largely stable, with limited movement in USD/CNY and USD/HKD.

The yen outperformed across the board, pressuring cross pairs such as EUR/JPY and GBP/JPY, which declined more than 1% and 0.7%, respectively.

Rupee Outlook

For India, the modest appreciation in the rupee comes amid mixed global cues. While a softer dollar provides short-term support, sustained movement in USD/INR is likely to depend on capital flows, crude oil prices, and upcoming macroeconomic data.

Market Takeaway

Overall, forex markets reflected broad dollar weakness, with the rupee holding steady to slightly stronger levels. Traders remain cautious ahead of key global and domestic economic signals.