New York, Feb 12: U.S. markets witnessed a sharp divergence on Thursday, as speculative microcap stocks delivered explosive gains while heavyweight technology names pulled broader indices into the red, reflecting a risk-off undertone across Wall Street.

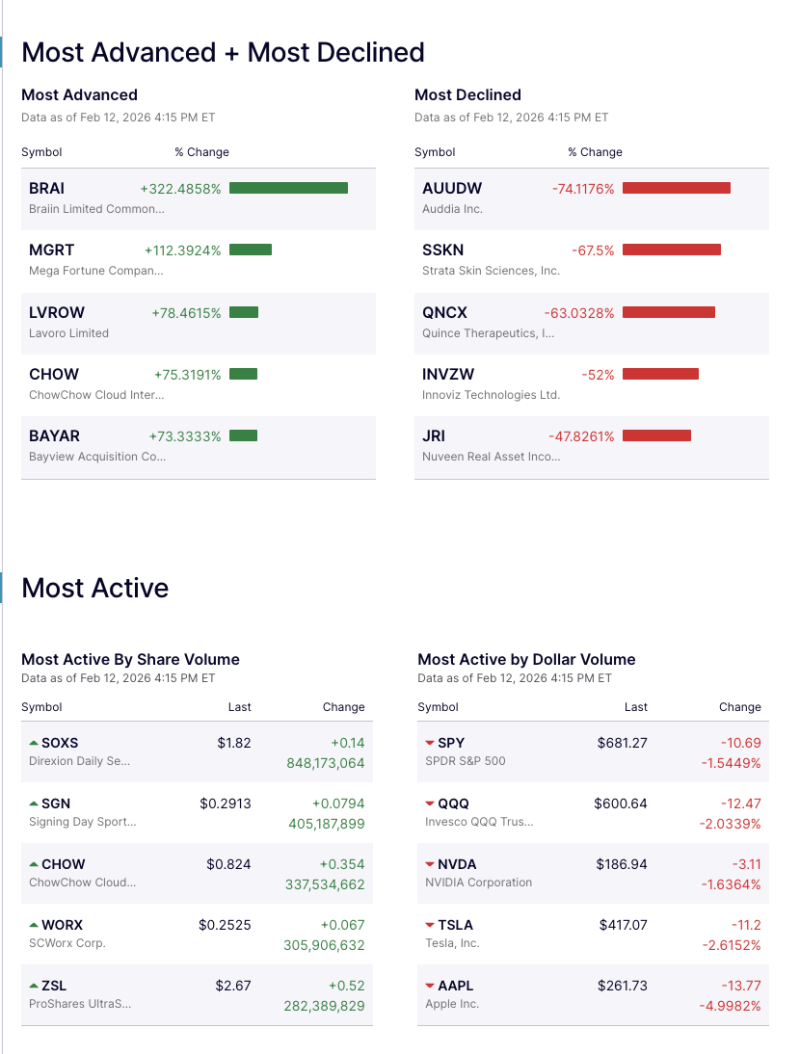

Among the session’s biggest movers, Braiins Ltd. (BRAI) surged an extraordinary 322%, leading the advance list, followed by Mega Fortune Company (MGRT) jumping 112% and Lavoro Limited (LVROW) gaining over 78%, signaling aggressive momentum in small-cap and speculative counters.

On the downside, steep losses dominated the decliners’ board. Auddiya Inc. (AUUDW) plunged 74%, while Strata Skin Sciences (SSKN) and Quince Therapeutics (QNCX) dropped 67% and 63% respectively, highlighting continued volatility in high-risk healthcare and tech microcaps.

Market pressure largely came from heavyweight technology and index-linked stocks. The Apple fell nearly 5%, Tesla declined over 2.6%, and Nvidia slipped around 1.6%, dragging the SPDR S&P 500 ETF Trust and Invesco QQQ Trust lower by 1.54% and 2.03% respectively.

In trading activity, leveraged ETF SOXS dominated share volume with over 848 million shares, reflecting heavy hedging and bearish positioning in semiconductor space. Meanwhile, index heavyweights continued to dominate dollar volume, indicating institutional repositioning rather than retail-driven panic.

Market participants remain cautious amid sector rotation, profit booking in mega-cap tech, and speculative surges in microcaps. Investors are now closely watching liquidity flows, macro signals, and earnings momentum to gauge near-term direction as volatility continues to rise across segments.