US markets witnessed sharp stock-specific action with extreme volatility in microcap and speculative counters, even as benchmark-linked heavyweights showed mixed movement.

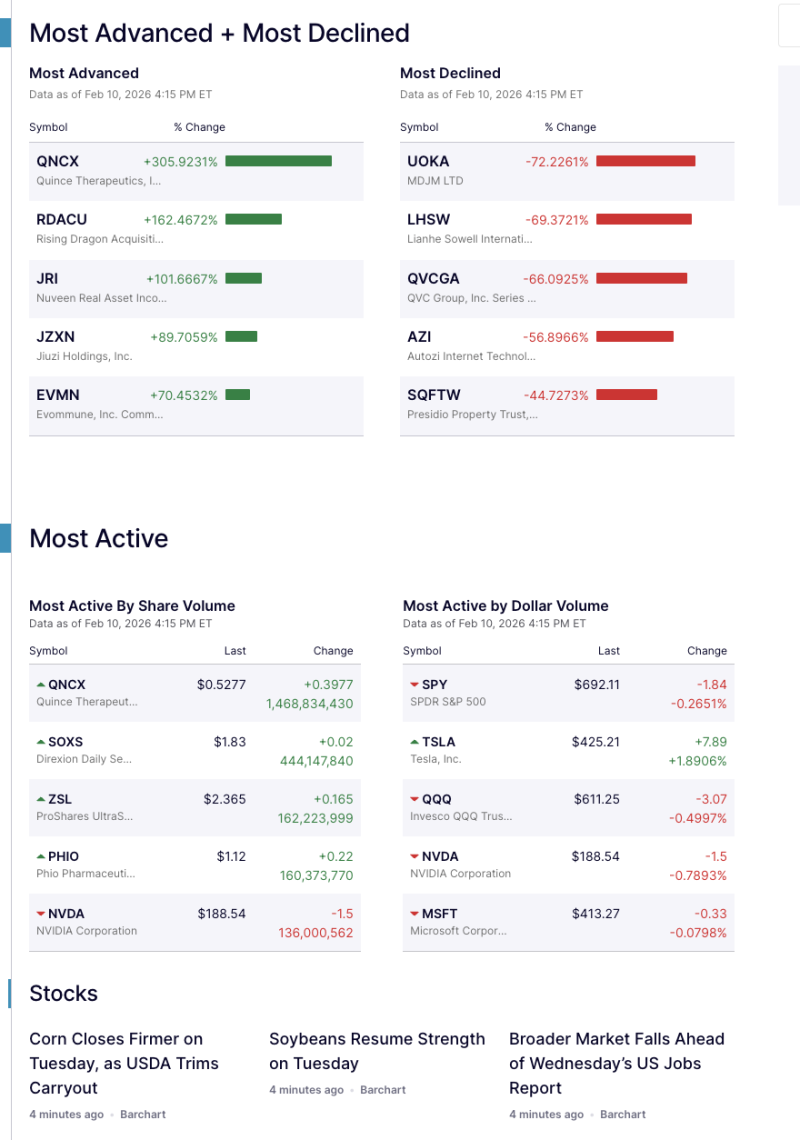

Among the top gainers, Quince Therapeutics (QNCX) surged an extraordinary 305.92%, leading the rally, followed by Rising Dragon Acquisition (RDACU) (+162.47%), Nuveen Real Asset Income (JRI) (+101.66%), Jiuzhi Holdings (JZXN) (+89.71%), and Evommune (EVMN) (+70.45%), reflecting strong momentum in select small-cap and biotech-linked names.

On the losing side, MDJM Ltd (UOKA) plunged 72.23%, emerging as the biggest decliner, followed by Lianhe Sowell International (LHSW) (-69.37%), QVC Group (QVCGA) (-66.09%), Autozi Internet Technology (AZI) (-56.90%), and Presidio Property Trust (SQFTW) (-44.73%), highlighting sharp downside volatility in speculative stocks.

In terms of activity, Quince Therapeutics topped the list by share volume, while SPDR S&P 500 ETF (SPY) led in dollar volume despite a mild decline. Tesla (TSLA) saw gains of nearly 1.9%, while Nvidia (NVDA), Microsoft (MSFT), and Invesco QQQ (QQQ) ended lower, reflecting mixed sentiment among large-cap technology stocks.

Market participants noted that high volatility in microcaps and selective action in mega-cap tech continue to dominate near-term US market trends, with investors closely tracking macro cues and liquidity conditions.