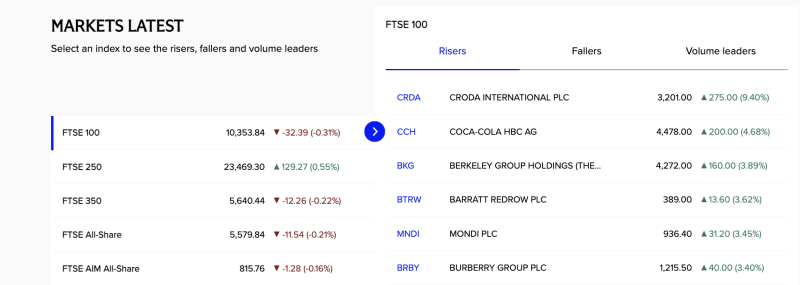

UK markets closed on a mixed note, with the FTSE 100 slipping 32.39 points (0.31%) to 10,353.84, reflecting mild profit booking in heavyweight stocks. Broader indices showed varied performance, indicating selective investor participation across sectors.

The FTSE 250 rose 129.27 points (0.55%), outperforming the benchmark, while the FTSE 350 declined 0.22% and the FTSE All-Share fell 0.21%, highlighting a mixed market trend.

Among individual stocks, Croda International Plc emerged as the top gainer, surging 9.40% to 3,201.00, followed by Coca-Cola HBC AG (+4.68%), Berkeley Group Holdings (+3.89%), Barratt Redrow Plc (+3.62%), and Mondi Plc (+3.45%). Gains in select industrial, consumer, and materials stocks supported pockets of strength in the market.

Market participants remained cautious amid global cues and sector-specific movements, with analysts noting that stock-specific action and macroeconomic signals will continue to drive near-term direction in UK equities.