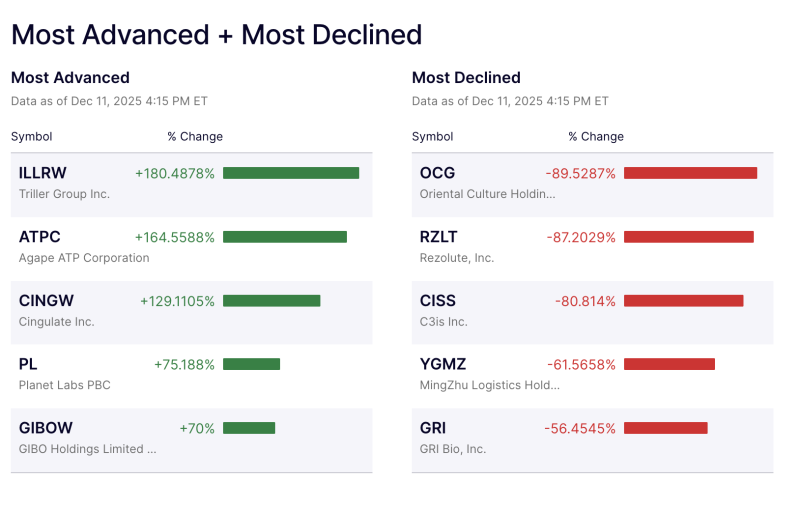

The US stock market witnessed a dramatic split in performance on December 11, 2025, with a handful of micro-cap names skyrocketing while several others plunged sharply. The “Most Advanced” and “Most Declined” lists revealed extreme intraday volatility driven by speculative trading, corporate developments, and low-float dynamics.

Top Gainers: Triller Group Leads the Charge

1. Triller Group Inc. (ILLRW) – +180.48%

Triller’s warrants staged a massive rally, becoming the day’s top performer. Low liquidity and trader momentum pushed the instrument into triple-digit gains, making it one of the most-watched tickers of the session.

2. Agape ATP Corporation (ATPC) – +164.55%

Agape ATP posted strong upside as retail interest spiked. The stock’s surge reflects renewed curiosity around the wellness and biotech niche it operates in.

3. Cingulate Inc. (CINGW) – +129.11%

Cingulate’s warrants also enjoyed a powerful rally, likely supported by corporate updates around its ADHD-focused drug pipeline.

4. Planet Labs PBC (PL) – +75.18%

Satellite-imaging company Planet Labs saw a notable jump following upbeat commentary from analysts and increased volume during the afternoon session.

5. GIBO Holdings Limited (GIBOW) – +70%

GIBO’s warrants rounded out the list of top performers, benefiting from speculative activity across low-float tickers.

Top Decliners: OCG Collapses 89%

On the flip side, several small-cap names suffered severe declines:

1. Oriental Culture Holding (OCG) – -89.52%

OCG crashed nearly 90%, the sharpest drop of the day. Heavy selling pressure and uncertainty around the company’s operations drove the collapse.

2. Rezolute, Inc. (RZLT) – -87.20%

Biopharma firm Rezolute tumbled after disappointing investor sentiment around its clinical progress.

3. C3is Inc. (CISS) – -80.81%

Shipping player CISS saw a steep decline, triggered by weak volume and profit-taking by traders.

4. MingZhu Logistics (YGMZ) – -61.56%

Logistics stocks faced broad weakness, and YGMZ was among the hardest hit.

5. GRI Bio, Inc. (GRI) – -56.45%

GRI Bio also declined sharply amid sector-wide softness in small-cap biotech.

Takeaway

The day’s scoreboard shows a classic high-risk, high-volatility environment in micro-caps, where warrants and low-float stocks led both the biggest rallies and deepest collapses. For retail investors, the divergence underscores the need for caution and disciplined position sizing in speculative segments of the market.