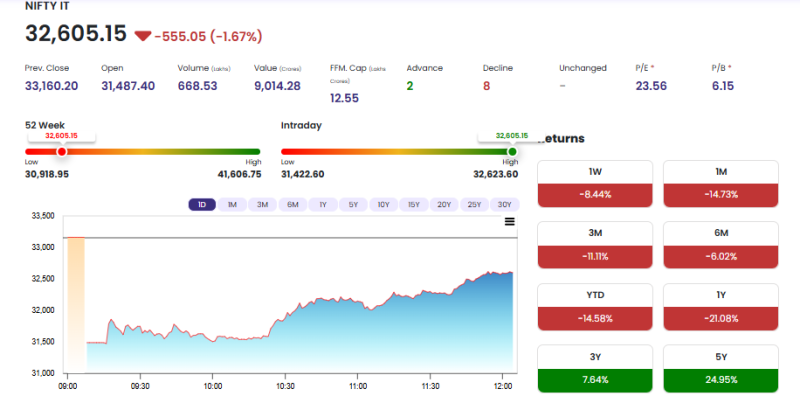

The NIFTY IT index closed lower at 32,605.15, declining 555.05 points (-1.67%), reflecting sustained selling pressure across major IT stocks. The index opened weak at 31,487.40 and traded within a narrow intraday band, hitting a low of 31,422.60 before attempting a mild recovery toward the session high near 32,623.60.

Market breadth remained negative with 8 stocks declining against only 2 advancing, highlighting broad-based weakness in the IT pack. The sector continues to face pressure amid global tech uncertainty and cautious investor sentiment.

Short-term performance remains weak, with the index down 8.44% in one week, 14.73% in one month, and 14.58% year-to-date. Even the 1-year return stands at -21.08%, indicating prolonged underperformance. However, the longer-term trend still shows resilience, delivering 7.64% returns over 3 years and 24.95% over 5 years.

From a valuation perspective, the index trades at a P/E of 23.56 and P/B of 6.15, suggesting selective accumulation may emerge at lower levels, though near-term volatility is likely to persist.