Mumbai, November 19, 2025 – In a day of heightened volatility in the Indian equity markets, multiple midcap and smallcap stocks from diverse sectors tumbled sharply, trading perilously close to or at their 52-week lows. While benchmark indices Nifty 50 and Sensex managed modest gains driven by IT and banking heavyweights, selling pressure intensified in chemicals, construction equipment, infrastructure, tyres, pharma research, and pipes segments. High trading volumes accompanied the declines, signaling panic selling and potential capitulation in oversold names.

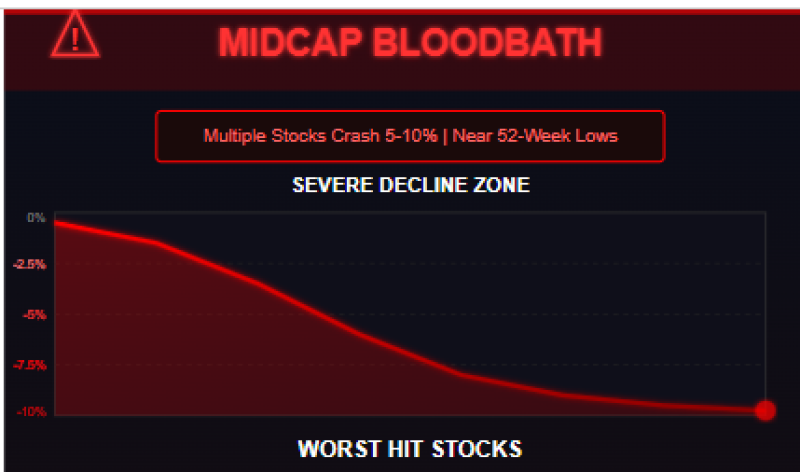

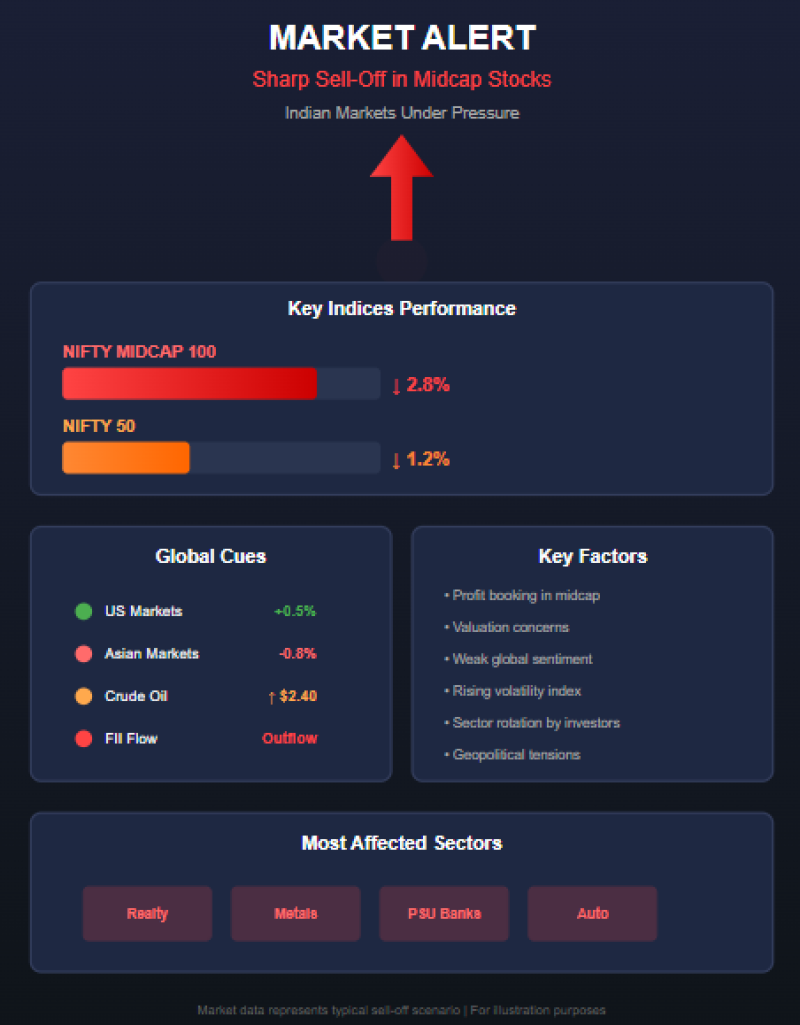

The downturn comes against a backdrop of global uncertainties, including rising US bond yields, persistent FII outflows, and concerns over slowing domestic growth. Midcap and smallcap indices underperformed significantly, with the Nifty Midcap 100 and Smallcap 100 falling 1-2%. Analysts attribute the weakness to profit-booking after recent rallies, disappointing Q2 earnings in select sectors, and valuation corrections in high-beta stocks.

Key Stocks Trading Near 52-Week Lows (as of ~16:35 IST on Nov 19, 2025)

| Stock | LTP (₹) | Decline Today | Distance from 52W Low | Volume (shares) | Key Trigger/Notes |

|---|---|---|---|---|---|

| Gujarat Fluorochemicals | 3,512.60 | ↓ ~10% | ~0-2% above low | 42,736 | Weak demand in refrigerants & fluoropolymers; Q2 margins squeezed by high input costs and China dumping fears. Stock down ~25% from 52W high of ~₹4,500+. |

| Action Construction Equipment | 972.40 | ↓ ~5% | Near 52W low (~₹917-950) | 16,756 | Correction after sharp YTD fall from ₹1,600 highs; slowdown in infra capex and high valuations post-rally. |

| Afcons Infrastructure | 388.95 | ↓ ~1% | ~0-1% above 52W low (~₹387-390) | 1,01,660 | Post-IPO listing blues; recent debutant hit by negative cash flows and order execution delays in marine/infra projects. |

| Balkrishna Industries | 2,317.60 | ↓ ~10% | Near 52W low (~₹2,157-2,300) | 89,635 | Sharp fall in off-highway tyre demand globally; Q2 profits down amid inventory pile-up and competition from Chinese players. |

| Syngene International | 634.85 | ↓ ~10% | ~2-5% above 52W low | 7,13,649 | Client-specific delays in CRAMS projects; margin pressure from higher R&D costs and forex losses. |

| Jindal SAW | 166.87 | ↓ ~5% | Near recent lows | 9,55,138 | Steel pipe demand slowdown; Q2 sales dip on lower exports and commodity volatility. |

These stocks witnessed unusually high volumes – in some cases 2-5x average – indicating institutional selling or stop-loss triggers. Gujarat Fluorochemicals and Balkrishna Industries led the downside with double-digit percentage drops, reflecting sector-specific headwinds in specialty chemicals and auto ancillaries.

Broader Market Context

- FII/DII Activity: Foreign investors continued net selling (~₹2,500 cr estimated today), extending the outflow streak amid "higher for longer" US rate fears.

- Sector Rotation: Defensive sectors like IT (+1.5-2%) and pharma large-caps held firm, while cyclicals (infra, auto, metals) bore the brunt.

- Technical View: Many of these names are oversold on RSI (<30), hinting at potential short-term bounces if global cues improve. However, breach of 52-week lows could invite further downside.

Analysts remain cautious: "While some quality names are available at attractive valuations near 52-week lows, the macro setup warrants selectivity," said a Mumbai-based brokerage head. "Watch for earnings upgrades in Q3 and policy support in the upcoming budget for a sustained recovery."

Investors are eyeing upcoming triggers like US Fed minutes, domestic GDP data, and corporate earnings revisions. Value hunters may find opportunities in fundamentally strong names, but momentum traders advise waiting for confirmation of bottoms. As always, high volatility persists – trade with strict stop-losses.