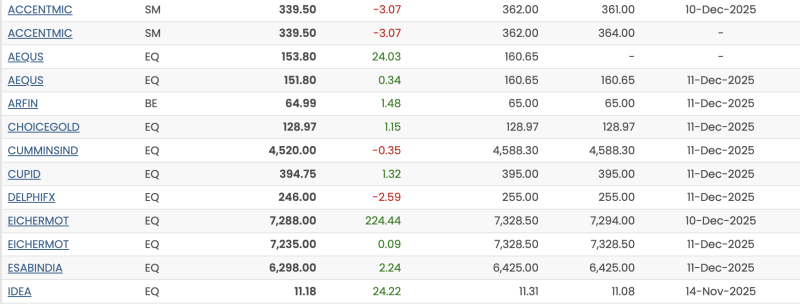

India’s mid-cap and small-cap counters witnessed sharp, high-volume moves as select manufacturing, auto, and telecom names outperformed broad market trends. Here is the snapshot of the biggest action seen on December 11, 2025.

Top Gainers of the Session

Aequs soars 24.03% to 153.80

The aerospace and precision manufacturing player delivered the day’s strongest spike following renewed optimism in defence-linked order flows. In a rare move, the stock doubled its average intraday range.

Vodafone Idea rallies 24.22% to 11.18

Telecom sentiment strengthened as investors continued to bet on the company’s turnaround roadmap, driven by tariff expectations and subscriber stability.

Eicher Motors climbs 224.44 to 7,288.00

Premium auto demand pushed the stock sharply higher, marking one of its biggest point-wise gains of the quarter.

ESAB India rises 2.24% to 6,298.00

Welding and automation stocks remained in focus amid strong industrial-capex commentary.

Arfin jumps 1.48% to 64.99

Specialty metals counters saw steady buying interest as domestic demand outlook improved.

Choice International gains 1.15% to 128.97

Broking and financial-services stocks attracted light accumulation ahead of key monthly volume data.

Cupid advances 1.32% to 394.75

The healthcare and personal-products manufacturer extended its positive trend, supported by consistent delivery volumes.

Notable Decliners

Delphi FX dips 2.59% to 246.00

Currency and payments-linked counters faced mild pressure due to global risk-off cues.

Accent Microelectronics slips 3.07% to 339.50

Chip and component names cooled off after multi-session gains, with profit-booking dominating intraday flows.

Cummins India edges down 0.35% to 4,520.00

Industrial majors remained largely stable, though the counter saw minor selling on corporate flow data.

Mid-Cap Market Mood: What’s Driving the Moves?

Overall sentiment leaned positive, led by manufacturing, auto, and telecom. High-beta names like Aequs and Idea saw outsized swings as traders chased short-term momentum ahead of year-end portfolios.