IndiGrid [BSE: 540565 | NSE: INDIGRID], India’s first power sector InvIT, announced its results for the quarter ended June 30, 2021. The consolidated revenue grew by 53% YoY in Q1 FY22 at INR 5,542 million supported by acquisitions worth INR 75 billion over the last year. The consolidated EBITDA for the quarter was up 53% YoY at INR 5,039 million, in tandem with revenue growth and steady operational performance. IndiGrid’s track record of accretive acquisitions, resilient operations and a strong balance sheet have resulted in a sustainable growth in distributions.

The Board of the Investment Manager also approved a Distribution Per Unit (DPU) of ~INR 3.19 (up 6% YoY) for Q1 FY22 to unitholders. The record date for the distribution is August 5, 2021 and shall be paid as ~INR 3.04 per unit in the form of interest and ~INR 0.15 per unit as dividend. With this, IndiGrid has distributed INR 48.96 per unit to its investors over the last 17 quarters since its listing, a total return of over 83% on the issue price. Total return is sum of all distributions since listing till Q4 FY21 and change in price till June 30,2021.

IndiGrid continued its track record of successful acquisitions by completing the purchase of its first solar asset (FRV) in July 2021 for INR 6.60 billion. This along with the INR 69 billion worth of acquisitions in FY21, has taken the total AUM to over INR 210 billion. In April 2021, IndiGrid raised ~INR 12.84 billion of capital by way of Rights issue which was subscribed over 1.25 times to create headroom for growth. Separately, in May 2021, IndiGrid also successfully launched the first Public NCD issue by any REIT/InvIT in the country to diversify its sources of debt and increase the debt tenure. The Net Debt/AUM as of June 30, 2021 stood at ~58%, significantly below the 70% cap as per SEBI InvIT regulations thereby providing ample headroom to fund future acquisitions.

Commenting on the financial results, Mr. Harsh Shah, Chief Executive Officer, said: “I am pleased to report that IndiGrid delivered another strong quarter with 53% growth in revenue and EBITDA in Q1 FY22 on the back of successful acquisitions. Our robust operations allowed us to maintain the growth momentum resulting in an increased distribution of ~INR 3.19 per unit in Q1 FY22.

We are also excited by the increased confidence shown by the investors and regulators in the potential of InvITs. The recent move of approving trading lot size reduction to 1 unit is a landmark step by SEBI aimed at improving liquidity and allowing efficient price discovery. Additionally, the move by IRDAI and PFRDA to enable insurance companies and NPS backed pension funds to invest in debt securities of InvITs has opened new avenues for long-term debt capital for InvITs with good quality assets. Our outlook for FY22 continues to be optimistic on the back of our strong investor base, robust pipeline for growth and a conducive regulatory environment.”

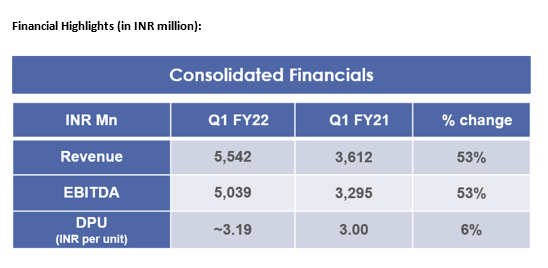

Financial Highlights (in INR million):

IndiGrid [BSE: 540565 | NSE: INDIGRID], India’s first power sector InvIT, announced its results for the quarter ended June 30, 2021. The consolidated revenue grew by 53% YoY in Q1 FY22 at INR 5,542 million supported by acquisitions worth INR 75 billion over the last year. The consolidated EBITDA for the quarter was up 53% YoY at INR 5,039 million, in tandem with revenue growth and steady operational performance. IndiGrid’s track record of accretive acquisitions, resilient operations and a strong balance sheet have resulted in a sustainable growth in distributions.

The Board of the Investment Manager also approved a Distribution Per Unit (DPU) of ~INR 3.19 (up 6% YoY) for Q1 FY22 to unitholders. The record date for the distribution is August 5, 2021 and shall be paid as ~INR 3.04 per unit in the form of interest and ~INR 0.15 per unit as dividend. With this, IndiGrid has distributed INR 48.96 per unit to its investors over the last 17 quarters since its listing, a total return of over 83% on the issue price. Total return is sum of all distributions since listing till Q4 FY21 and change in price till June 30,2021.

IndiGrid continued its track record of successful acquisitions by completing the purchase of its first solar asset (FRV) in July 2021 for INR 6.60 billion. This along with the INR 69 billion worth of acquisitions in FY21, has taken the total AUM to over INR 210 billion. In April 2021, IndiGrid raised ~INR 12.84 billion of capital by way of Rights issue which was subscribed over 1.25 times to create headroom for growth. Separately, in May 2021, IndiGrid also successfully launched the first Public NCD issue by any REIT/InvIT in the country to diversify its sources of debt and increase the debt tenure. The Net Debt/AUM as of June 30, 2021 stood at ~58%, significantly below the 70% cap as per SEBI InvIT regulations thereby providing ample headroom to fund future acquisitions.

Commenting on the financial results, Mr. Harsh Shah, Chief Executive Officer, said: “I am pleased to report that IndiGrid delivered another strong quarter with 53% growth in revenue and EBITDA in Q1 FY22 on the back of successful acquisitions. Our robust operations allowed us to maintain the growth momentum resulting in an increased distribution of ~INR 3.19 per unit in Q1 FY22.

We are also excited by the increased confidence shown by the investors and regulators in the potential of InvITs. The recent move of approving trading lot size reduction to 1 unit is a landmark step by SEBI aimed at improving liquidity and allowing efficient price discovery. Additionally, the move by IRDAI and PFRDA to enable insurance companies and NPS backed pension funds to invest in debt securities of InvITs has opened new avenues for long-term debt capital for InvITs with good quality assets. Our outlook for FY22 continues to be optimistic on the back of our strong investor base, robust pipeline for growth and a conducive regulatory environment.”

Financial Highlights (in INR million):

";