Global equity markets presented a mixed but largely positive picture on January 13, 2026, as strong gains across key Asian indices contrasted with a cautious yet resilient tone in US markets. Meanwhile, cryptocurrencies traded with mixed momentum amid selective buying.

US Markets: Muted Movement, Tech Holds Firm

US equities traded in a narrow range, reflecting investor caution ahead of key macro and earnings cues.

Dow Jones Futures edged marginally lower at 49,579.85 (-0.02%), indicating a flat start.

S&P 500 remained resilient at 6,977.31 (+0.16%), supported by broader market participation.

Nasdaq outperformed, rising to 23,736.22 (+0.27%), driven by continued strength in technology and growth stocks.

Overall, Wall Street sentiment remained stable, with no major risk-off signals emerging.

Asian Markets: Strong Risk-On Sentiment

Asian equities saw a sharp rally, led by Japan and China, as investors responded positively to regional cues.

Nikkei 225 surged to 53,673.00 (+3.23%), marking one of its strongest single-session gains in recent weeks.

Hang Seng climbed to 26,566.60 (+1.26%), supported by buying in heavyweight stocks.

Shanghai Composite advanced to 4,165.29 (+1.08%), reflecting improved sentiment in mainland China.

GIFT NIFTY traded higher at 25,924.00 (+0.25%), indicating a positive opening bias for Indian markets.

The rally underscores renewed optimism across Asia, particularly in export- and manufacturing-linked economies.

Global Indices and Commodities: Europe Stable, Volatility Eases

European indices remained mildly positive, while global volatility indicators eased, suggesting reduced near-term risk aversion. Mining, metals, and select industrial stocks outperformed amid firm commodity prices.

Crypto Markets: Consolidation with Select Outperformance

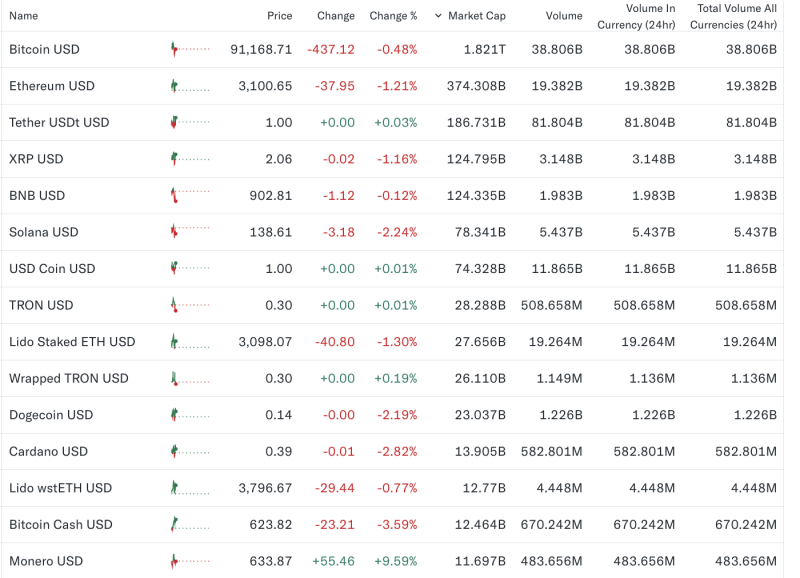

The cryptocurrency market remained range-bound.

Bitcoin slipped below $92,000, trading at around $91,168 (-0.48%), while Ethereum fell 1.2% to $3,100.

Most major altcoins traded in the red; however, Monero stood out, rallying nearly 10%, reflecting renewed interest in privacy-focused assets.

Stablecoins USDT and USDC remained steady, with USDT dominating 24-hour trading volumes.

Market Outlook

Global markets are entering the session with a cautiously optimistic tone. Strong Asian cues and stable US indices suggest continued risk appetite, though investors remain selective amid macroeconomic uncertainties and upcoming data releases.