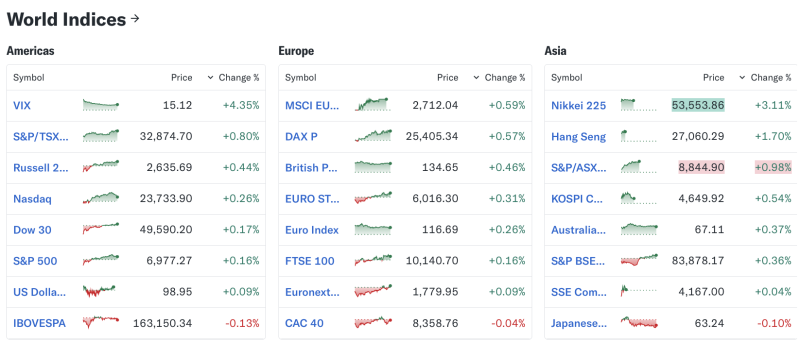

Global equity markets ended mostly in the green, with Asian indices outperforming, Europe posting steady gains, and US markets showing cautious optimism amid a spike in volatility.

Asia markets take the lead

Asian equities were the strongest performers in the session. Japan’s Nikkei 225 surged over 3%, crossing the 53,500 level, driven by sustained buying in heavyweight stocks and supportive currency dynamics. Hong Kong’s Hang Seng climbed nearly 1.7%, while Australia’s S&P/ASX 200, South Korea’s KOSPI Composite, and India’s S&P BSE Sensex posted moderate gains, reflecting improved regional risk appetite.

Europe trades with measured optimism

European indices advanced modestly, indicating stable investor sentiment. The DAX, FTSE 100, and MSCI Europe index rose between 0.4% and 0.6%, supported by selective buying in industrials and financials. However, France’s CAC 40 edged slightly lower, emerging as a marginal underperformer amid stock-specific pressure.

Americas show mixed trends

US markets recorded narrow gains, with the S&P 500, Dow Jones, and Nasdaq inching higher, suggesting consolidation after recent rallies. At the same time, the VIX volatility index jumped over 4%, pointing to growing investor caution. Canada’s S&P/TSX moved higher, while Brazil’s IBOVESPA slipped marginally, reflecting uneven sentiment across the region.

Overall, the market action underscored Asia’s leadership, Europe’s stability, and a cautious but positive tone in the US, as investors balanced growth optimism with rising volatility concerns.