Abhishek Sharma, Assistant Vice President - Research, Sambodhi

"Introducing 109 high-yielding and climate-resilient varieties of 32 field and horticulture crops is a step toward increasing food availability and self-sufficiency and checking shocks due to climate change. This is a boon, especially for smallholder farmers who were most vulnerable to climate shocks."

"The initiative to introduce 1 crore farmers to natural farming over 2 years is truly pathbreaking! The success stories of these farmers will encourage others to adopt these sustainable practices and help minimize the health problems due to the indiscriminate use of synthetic chemical inputs, rejuvenate soil health, and restore the ecosystem".

The Union budget introduces promising measures for the startup ecosystem, including the removal of the angel tax, which had earlier posed challenges for emerging businesses. As an early-stage startup founder, this change can be transformative by enabling angel investments, enhancing capacities to innovate, attract talent, and scale our vision, fostering a vibrant startup ecosystem where bold ideas can flourish and contribute to the economy.

The government has taken another impactful step to strengthen data governance through the Digital India Mission, which emphasizes the collection, processing, and management of data leveraging advanced technology tools. This strategy promises to benefit many industries and open new avenues for data management. By leveraging these technologies, the food discovery segment for instance, has already witnessed significant traction, particularly in personalizing experiences using data. We are now confident that we will see greater impact in the near future.

Overall, we anticipate that these measures will create a more supportive environment for startups and contribute to a dynamic and thriving business landscape. said" Jugul Thachery, Founder & CEO, HOGR.

By, Mr. Bharath Balasubramaniam, President – Operations & Administration, Sankara Eye Foundation India

"The Union Budget has provided measures that will bolster the healthcare industry by promoting affordability, accessibility, and self-reliance in medical technology and treatments. The announcement of the changes in the Basic Customs Duty (BCD) on x-ray tubes and flat panel detectors for use in medical x-ray machines will provide advanced diagnostic tools at more competitive prices, leading to improved diagnostic services and patient outcomes. Operationalizing the Anusandhan National Research Fund will support basic research and prototype development in healthcare, fostering the creation of innovative treatments and advanced diagnostic techniques. Increased R&D funding will improve patient outcomes and drive private sector investment in healthcare solutions. Enhanced research and innovation will develop advanced healthcare infrastructure, address pressing health challenges, retain top talent, and boost India's global competitiveness in healthcare. The focus on women and youth empowerment through skill enhancement opportunities will also help bridge the talent gap in the healthcare sector,"

Palka Arora Chopra, Director, Master Capital Services Ltd-The budget strikes a decent and balanced approach, especially given the current coalition government dynamics. Allocations to Bihar and Andhra Pradesh are strategic investments that will likely generate significant revenue in the future. Increased FDI is expected to boost investment in India, while changes in the Insolvency and Bankruptcy Code (IBC) and the establishment of new tribunals will strengthen the banking sector.

The digitization of land records is a forward-thinking initiative that holds great promise.

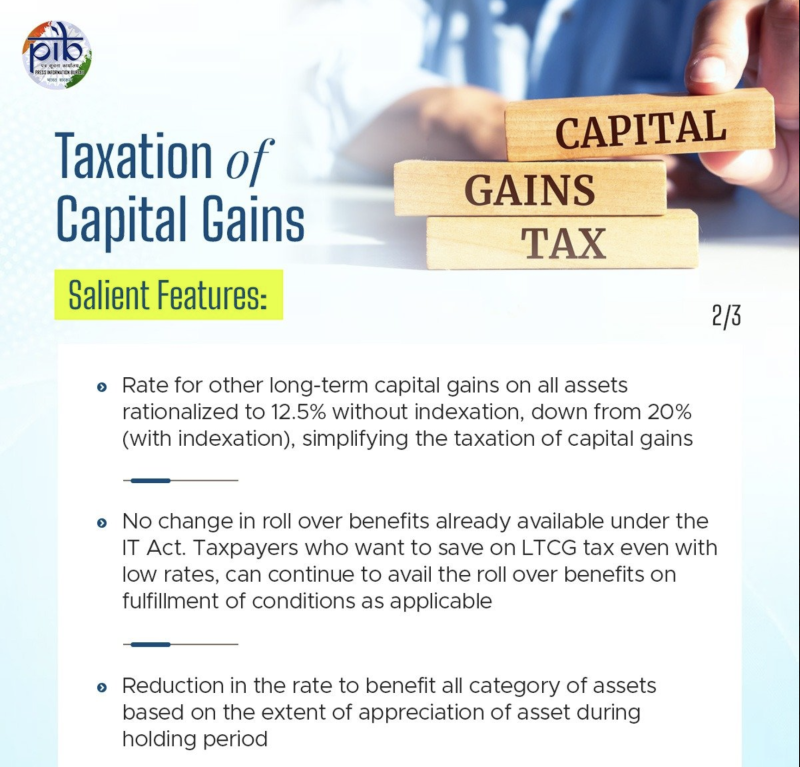

The removal of indexation benefits might negatively impact investor returns, leading to a short-term bearish outlook for the sector.

The 25% increase in the Long-Term Capital Gains (LTCG) tax is manageable and not likely to deter investors significantly.

However, the increase in Short-Term Capital Gains (STCG) tax from 15% to 20% could have a more pronounced negative impact in the medium term.

Restaurant and Food:

"The Budget 2024 announcement is a significant step forward for the agritech sector. By supporting startups throughout the vegetable supply chain and investing in digital public infrastructure, the government is laying a solid foundation for innovation and efficiency in agriculture. At The Salt Cafe, we value the role that high-quality, fresh ingredients play in delivering exceptional dining experiences. We are thrilled to see the government's commitment to enhancing connectivity, storage, and marketing for farmers, as well as the introduction of digital tools that will streamline supply chains. These measures will not only boost the growth of agritech startups but also ensure that businesses like ours can continue to source the best produce, ultimately benefiting our customers," by Aashi Gupta, Founder of The Salt Cafe.

"The budget's focus on developing street food hubs and enhancing tourism infrastructure is promising for the food and hospitality sectors. The support for agritech startups and improvements in the vegetable supply chain will benefit our industry by ensuring a steady supply of quality produce. We look forward to leveraging these initiatives to further elevate our offerings and expand our impact," Yogesh Sharma, CEO and Founder of Karigari by Chef Harpal Singh Sokhi.

"The Budget 2024 announcement is a promising boost for the agritech sector. By investing in startups that enhance the vegetable supply chain and introducing advanced digital infrastructure, the government is setting the stage for significant progress in agriculture. At Cayenne, The House of Spice, we're dedicated to providing an exceptional dining experience with the finest ingredients. This initiative will improve supply chain efficiency, from connectivity and storage to marketing, which will benefit not only startups but also businesses like ours that rely on high-quality produce. We look forward to the positive impact these measures will have on our ability to deliver outstanding meals to our guests," Saurabh Kumar, Founder of Cayenne.

"The Budget 2024 announcement is a game-changer for the agritech sector and a win for businesses focused on quality. The government's commitment to supporting startups in the vegetable supply chain and advancing digital infrastructure is crucial for enhancing agricultural efficiency. At Say Fontina, where we pride ourselves on using the freshest, highest-quality ingredients for our Italian and Mediterranean dishes, we're excited about the positive ripple effect these measures will have. Improved supply chain connectivity and storage will ensure a more reliable and sustainable source of produce, allowing us to continue offering our guests the exceptional flavors and dining experiences they've come to love," Chef Ashish Bhasin, Founder of Say Fontina.

Real Estate:

"The 2024 budget introduces impactful measures for the Logistics and real estate sector. Encouraging states to lower stamp duty for property purchases by women promotes gender equality and boosts sales. Digitizing land records with GIS mapping and introducing the Unique Land Parcel Identification Number (ULPIN) will streamline land acquisition and reduce disputes and will help in quicker due diligence of the land. Further supporting industrial and economic growth the government will develop investment ready "plug and play" industrial parks in 100 plus cities through PPP model. Additionally, the announcement of twelve industrial parks under the National Industrial Corridor Development Programme and the provision of ₹11,11,111 crore for infrastructure development (3.4% of GDP) underscore the government's commitment to enhancing infrastructure.

Apart from this on a Logistics front, the union budget has unveiled ambitious plans on the creation of dedicated e-commerce export hubs. However, with the National Logistics Policy (NLP) in place, initiatives requiring consideration include fast-tracking private sector participation with special incentives for PPPs in MMLP development, as well as concessions for land prices for industrial warehouses and logistics parks." At XRE Consultants, we are optimistic about these developments and look forward to leveraging these opportunities to better serve our clients," by Zafeer Ahmed, Founder of XRE consultant.

"The 2024 budget brings several positive changes for the real estate sector. Lowering stamp duty for women and reinstating the home loan interest subsidy under PMAY will boost property sales and make homeownership more attainable. Enhanced policies for a transparent rental market and the digitization of land records with GIS mapping will simplify transactions and minimize disputes. The establishment of twelve new industrial parks and significant infrastructure investment further demonstrate the government's commitment to growth. We are enthusiastic about these developments and eager to leverage these opportunities for our clients," Rohit Maingi, Founder & Partner at DnR.

Mr. Jay Shah, CEO & MD, M/s Jay Wood Industry -

"The Union Budget 2024-25 brings a wave of optimism and opportunities for the manufacturing sector. The new scheme aimed at job creation, particularly the initiative to link employment to first-time workers, is a visionary step. The substantial incentives for EPFO contributions, covering both employees and employers for the first four years, will significantly reduce financial strain on businesses, making it easier to hire and retain new talent.

By reimbursing employers up to ₹3,000 per month for each additional employee's EPFO contributions for two years, the government is directly boosting employment rates. This initiative, expected to benefit 3 million young people and stimulate employment across all sectors, is crucial for robust job creation, fostering a dynamic workforce, and stimulating economic growth. The scheme, which aims to incentivize the employment of 5 million additional people, has the potential to be a game-changer for the manufacturing industry. It will address unemployment and ensure that our sector thrives with a fresh influx of skilled workers, driving innovation and productivity.

Moreover, the credit guarantee scheme for MSMEs in the manufacturing sector is a significant boost. Facilitating access to term loans for purchasing machinery and equipment without the need for collateral or third-party guarantees will empower businesses to invest in advanced technologies and equipment. This will enhance production capabilities, improve efficiency, and maintain competitiveness, driving overall growth and innovation within the manufacturing sector.

Overall, these measures demonstrate a strong commitment to supporting the manufacturing industry, which will undoubtedly lead to sustainable growth and long-term success for companies like M/s Jay Wood Industry."

Neha Shah, a co-founder, Mentor, and Director at MentorMyBoard (MMB).

"The logistics and supply chain sector is crucial to India's growth, with a strong focus on infrastructure, manufacturing, and skilling for long-term development. The government's plan to establish e-commerce export hubs to help MSMEs export local products is a significant step towards driving growth through innovation. Introducing an integrated platform for the Insolvency and Bankruptcy Code (IBC) and additional tribunals will reduce delays in corporate mergers and acquisitions, improving operational efficiencies and benefiting all stakeholders with faster recovery processes and timely corporate actions."

Neha Shah also noted that the new credit guarantee scheme for MSMEs addresses the critical barrier of access to finance, promoting technological advancements and productivity improvements. She highlighted the reduction of the corporate tax rate for foreign companies to 25% and the abolition of the Angel Tax. Additionally, long-term capital gains on all financial and non-financial assets will now attract a tax rate of 12.5%, with an exemption limit set at Rs 1.25 lakh per year. Over 5-6 years, LTCG rates will range from 0% to 12.5%, with the removal of indexation for real estate.

A new skilling program aims to train 20 lakh youth over the next five years through industry-designed courses. While the budget is seen as favorable for GDP growth, Neha Shah expressed concerns that it may not be as beneficial for investors and traders, particularly due to the removal of indexation. She also noted the lack of benefits for taxpayers.

"The Union Government in the Budget 2024-25 has overlooked the critical importance of healthcare in the budget announcement. According to the Economic Survey 2023-24, India has one of the world's highest out-of-pocket expenditures resulting in poor households being pushed below the poverty line. It is concerning that there were no specific measures for the healthcare sector. While infrastructure growth is vital for any country, it is equally important to address the challenges within the health insurance sector. Statistics show that Nearly 400 million individuals in India have zero access to health insurance. These figures are alarming, and the government of India should work towards reforms that will benefit the Healthcare Industry as a whole.

Furthermore, there is a need to address the growing importance of care management services in India. The burden of hospitalisations and repeat hospitalisation takes a toll on the physical and psychological health of a person, the government should work towards improving care coordination and care management services in the country," said Dr. Suman Katragadda, CEO of Heaps.ai.

Ankur Mittal, Cofounder, Inflection Point Ventures-While we have to still read the complete change on the abolishment of angel tax but on the face of it, this action has the ability to bring lot of regulatory clarity which generally is appreciated by the investor communities across the world. This should help founders looking to raise capital both in domestic and international markets.

Reacting on the Union Budget, Mr. Shachindra Nath, Founder and Managing Director, UGRO Capital said, “Today's Union Budget is a remarkable step forward for MSME credit. At UGRO Capital, we believe MSMEs play a vital role in our economy, particularly in addressing employment challenges in a country of our size. The budget's focus on MSMEs addresses these issues head-on. Increasing the limit of MUDRA loans, the credit guarantee scheme for capital expenditure and machinery purchases, and the emphasis on public sector banks' credit assessment and solving the problem of MSME which comes under distress are all groundbreaking measures. These announcements collectively signify a significant focus on MSMEs, empowering lending institutions in priority sector to provide more credit and continue building our nation. We are hopeful that the fine print will favor lending institutions dedicated to MSMEs, allowing us to continue our mission of national development.”

Priyesh Chheda, Founder Arbour Investments

Post Budget View on Real Estate Sector from Budget 2024.

According to Priyesh Chheda, Founder of Arbour Investments, "the Union Budget 2024 has introduced several noteworthy measures that could significantly impact the real estate sector. The focus on infrastructure development, with a substantial allocation of ₹2.66 lakh crore for rural development and housing under the PM Awas Yojana, is commendable. This initiative, aiming to construct 3 crore additional houses, will likely boost the housing market, especially in rural and semi-urban areas, making homeownership more accessible to a larger population. Additionally, the proposed reduction in stamp duties by states and the further reductions in duties for properties purchased by women are steps in the right direction. These measures are expected to drive demand and foster inclusive growth in the sector. The Finance Minister announced that long-term capital gains on all financial and non-financial assets will attract a tax rate of 12.5%. Additionally, the limit of exemption for capital gains will be set at ₹1.25 lakh per year, which is expected to encourage more investments in real estate.

Moreover, the simplification of Foreign Direct Investment (FDI) rules and the emphasis on using the Rupee for overseas investments can attract more foreign investments into the real estate sector. The development of transit-oriented projects in 14 large cities and rental housing initiatives for industrial workers under the Public-Private Partnership (PPP) mode will enhance urban infrastructure and address housing shortages. The emphasis on the digitization of land records using GIS technology will enhance transparency, reduce disputes, and streamline the land acquisition process, benefiting developers and buyers alike. Furthermore, the fast-tracking of changes in the Insolvency and Bankruptcy Code (IBC) with additional tribunals and an integrated tech platform will ensure quicker resolution of insolvency cases, improving liquidity and stability in the real estate market. Overall, the Budget 2024 reflects a balanced approach, aiming to stimulate both supply and demand in the real estate market, which could lead to sustained growth and stability in the sector."

“The budget put the spotlight on our youth as one of the important pillars to be strengthened for India’s growth. The allocation of Rs.1.48 lakh crore towards education, skilling and employment will give a major boost to upskilling the youth and ensuring that they are employment-ready. The loan assistance of up to Rs.10 lakh to pursue higher education in Indian Educational Institutes and the revision of the Model Skill Loan Scheme to facilitate loans up to 7.5 lakh will help eligible students overcome financial barriers and fulfil their dreams.

The initiative to provide internships to 1 crore youth will be a game-changer and enable students entering their first job to get relevant industry knowledge and experience beyond the usual classroom learning, which will be beneficial in their professional journey.”

- Siddharth Shahani, Co-Founder and Executive President, ATLAS SkillTech University

Ms. Kavita Shirvaikar, Acting Managing Director, Patel Engineering Limited.

Overall Infrastructure announcement.

The Union Budget's emphasis on infrastructure development marks a significant leap toward our nation's future. The substantial allocation for capital expenditure and long-term interest-free loans to states reflects a forward-thinking strategy aimed at stimulating economic growth and innovation. Encouraging private sector participation through viability gap funding and market-based financing frameworks will foster a dynamic environment for infrastructure advancements. These initiatives are poised to significantly improve connectivity, boost productivity, and create numerous job opportunities across various sectors. By prioritizing sustainable development and leveraging both public and private investments, this budget positions India on a robust path to becoming a global leader in infrastructure excellence.

On the Pumped Storage Policy Addressing the Intermittency in Renewables

The Union Budget's emphasis on promoting pumped storage projects is a pivotal step towards a sustainable and resilient energy future. The introduction of a new policy to support electricity storage will significantly enhance the integration of renewable energy sources, ensuring a stable and reliable power supply. This forward-thinking approach not only addresses the challenges of renewable energy intermittency but also positions India as a leader in innovative energy solutions. By fostering investment in pumped storage and other renewable energy technologies, the government is paving the way for a greener and more sustainable future. We are confident that these initiatives will accelerate the transition to clean energy, reduce our carbon footprint, and create substantial opportunities for growth and employment in the energy sector.

On the Promotion of Private Sector Investment for Infrastructure Growth

Finance Minister Nirmala Sitharaman's focus on public-private partnerships represents a pivotal shift for the infrastructure sector. The government's efforts to simplify FDI norms aim to attract and retain private investment in India. By emphasizing and encouraging Foreign Direct Investment, the government is creating a favourable environment for investors. Collaborating between the government and private entities allows us to harness the strengths of both sectors to improve project execution, drive innovation, and enhance efficiency. This strategy not only accelerates development but also ensures that infrastructure growth remains sustainable and inclusive. The substantial budget allocation for infrastructure highlights the government's dedication to laying a strong foundation for India's future, and Patel Engineering Ltd. is eager to play a role in this national initiative.

Mr. Pradeep Misra, Chairman & MD of Rudrabhishek Enterprises Limited (REPL).

"The 2024 budget shows a strong focus on inclusive development around infrastructure focus, taking into account both local needs and global economic conditions. The big investment of ₹11.11 lakh crore for infrastructure, which is 3.4% of GDP, shows the government's commitment to growth through infrastructure spending. This ongoing focus on infrastructure in recent budgets is likely to have a positive effect on many parts of the economy.

The ₹10 lakh crore plan for PM Awas Yojana-Urban 2.0 is a big deal for housing and construction. This, along with tweaking in income tax, could bring more people into the affordable housing market, boosting demand and creating jobs in construction. Several announcements have been made for the generation of employment and skill enhancements. These will ultimately increase the disposable income at the household level that will push growth in overall economy, especially the housing segment.

The focus on improving water supply, sewage treatment, and waste management in 100 big cities offers good opportunities for companies working in urban infrastructure. The ₹2.66 lakh crore for rural development could help balance out growth between cities and rural areas. Additionally, the launch of Phase 4 of the PM Gram Sadak Yojana to provide all-weather roads to 25,000 rural habitats is a significant step towards improving rural connectivity and economic opportunities. However, we were expecting the announcements related to the fund outlay for Smart City Mission 2.0. The plan to develop TOD in 14 large cities will also definitely help in creating industrial and commercial hubs in these catchment areas. Digitalization of Land records in urban areas with GIS mapping will increase the transparency and provide the better administrative services.

Encouraging private investment through funding support and new financing options is a smart move. This could bring more private money into infrastructure projects, leading to new ideas and better efficiency. However, for this to work well, the government needs to address issues like land acquisition and environmental clearances.

While the budget sets big goals for infrastructure growth, keeping the government's spending in check will be a challenge. The attention given to small and medium businesses is also important, as it supports a key part of the Indian economy. The mandatory TReDs registration turnover criteria has been lowered to Rs. 250 Crore which will bring a big cash flow relief to MEMEs if implemented properly.

Overall, this budget could greatly change India's economy through infrastructure development. The key will be to carry out these plans effectively and keep focusing on them in the coming years."

"In the Union Budget 2024, the Finance Minister's focus on uplifting the poor, women, youth, and farmers aligns with India's aspirations towards a developed nation. It reflects the government's commitment to 'Viksit Bharat' and is poised to benefit the tech sector. The proposed reduction in the Basic Customs Duty (BCD) on mobile phones, mobile PCDA (Printed Circuit Design Assembly), and mobile chargers to 15% expected to make mobile devices and accessories more affordable, thereby boosting consumer demand and driving growth in the tech industry. Additionally, the increase in duty on printed circuit board assemblies (PCBA) for specific telecom equipment from 10% to 15% aims to encourage local manufacturing. Government’s prioritization on jobs, agriculture and energy sector will provide long term growth opportunities to tech & durables sector."

The quote will be attributed to Anant Jain, Head of Customer Success - India, GfK – an NIQ company.

Dr Chandril Chugh, Senior Consultant Neurologist And Director Of Good Deed Clinic said "The 2024-25 Indian budget shows a strong commitment to healthcare by introducing important customs duty exemptions for cancer medicines and reducing duties on key medical devices like X-ray tubes. These changes aim to make treatments more accessible and affordable. However, the ongoing issue of high out-of-pocket expenses, despite a drop from 64.2% in 2014 to 48.2% in 2019, remains a significant problem. This financial burden highlights the need for more public investment in healthcare. The budget's increases in funding for primary healthcare projects like PM ABHIM and PMSSY are positive. Still, the small rise in the National Health Mission's budget suggests that more investment is needed to close existing gaps. Overall, while the budget's measures are encouraging, more improvements in public health funding and infrastructure are essential for fair and effective healthcare access"

Union Budget Reaction Quote from Randstad India from Viswanath PS, MD & CEO, Randstad India, a talent company

"The sharp focus on employment in this year's budget, particularly through the Employment Linked Incentive Schemes, is a transformative step for job creation in our country. By investing in skilling and bridging the talent demand-supply gap, the budget paves the way for a more robust and future-ready workforce. The provision for internships with top 500 companies, coupled with an internship allowance, will empower our youth with the necessary skills and experience for the ever-evolving job market. Furthermore, the creation of industrial parks in 100 new cities along with the establishment of dormitories and women's hostels will ensure that companies have access to the right talent, while also enhancing women's participation in the workforce. The decision to allow companies to use their CSR funds for training and internships is a commendable move, reinforcing the commitment to fostering a skilled and employable generation. All in all, there are a lot of positive takeaways for both employers and the talent community from the announcements made in this budget. It is indeed a significant milestone in driving employment-led growth and shaping a prosperous future for India."

Shakir Haq, CEO of NKP Empire Ventures Pvt Ltd-

Quote: "The government's focus on sustainable agriculture and technological integration is a game-changer for the F&B industry. The push towards natural farming and establishing bio-input resource centres align perfectly with the growing consumer demand for organic, sustainably-produced food. This shift will not only enhance the quality of our raw materials but also open up new market segments for health-conscious consumers. The emphasis on agri-research, particularly in developing climate-resilient crop varieties, is crucial for ensuring a stable supply chain in the face of environmental challenges. As a food company, we're excited about the potential of the 109 new high-yielding varieties across 32 crops, which could diversify our product range and improve food security.

The Digital Public Infrastructure for farmers is a revolutionary step. It will streamline our sourcing processes, enabling us to work more closely with farmers and reduce intermediaries. This, coupled with the support for FPOs and start-ups in the vegetable supply chain, will lead to more efficient operations and potentially lower costs.

The focus on shrimp production and export facilitation through NABARD is particularly promising for the seafood industry, potentially boosting India's international market presence. As an expanding firm, we intend to take advantage of the employment and upskilling incentives proposed. Largely, this is a good and balanced budget that will boost the industry overall."

Rishi Das, Co-founder, IndiQube.

" "Transit Oriented Development plans for 14 large cities with a population above 30 lakh is bound to enhance ease of connectivity and reduce commute time. This will further enhance the catchment area for flexible workspace providers, thereby further enabling "Walk to Work".

Abolition of angel tax is also a welcome move providing much needed impetus to the startup ecosystem at large especially when geo political and macro-economic uncertainties are at their peak. This is bound to drive investments and growth in the startup space which eventually would drive demand for supporting industries including flexible workspaces""

Dr. Monika Soni, Assistant Professor, Institute of Management, JK Lakshmipat University.

"The latest budget's education initiatives reflect a strategic shift towards employability-focused learning. Upgrading 1,000 ITIs and introducing extensive internship programs demonstrate an understanding that our traditional academic model is not fully aligning with industry requirements. The provision of financial support for higher education loans is a commendable move, as it will alleviate financial pressures on students and their families, thereby encouraging more young people to pursue higher education.

The introduction of employment-linked incentives stands out. By incentivizing first-time hires and supporting employers, the focus is moving from supply-side to demand-side interventions in education. Nevertheless, there are concerns about execution, particularly in coordinating large-scale internship programs with industry. The success of these initiatives will depend on how well we can bridge the gap between classroom learning and workplace demands. This is an ambitious plan, but if implemented effectively, it could profoundly transform our educational landscape."

Mr. Jatinder Paul Singh, CEO & Co - Founder of Viacation Tourism:

We warmly welcome the 2024 Union Budget, which underscores a visionary approach to enhancing India's tourism sector. FM Sitharaman's commitment to developing Nalanda and the Nalanda-Rajgir corridor as premier tourist destinations is a significant step in reviving and promoting our rich cultural heritage. The proposed comprehensive development of the Vishnupad and Mahabodhi Temple Corridors, modeled on the successful Kashi Vishwanath Temple Corridor, promises to elevate these spiritual sites to world-class pilgrim destinations.

The focus on transforming Rajgir into a comprehensive development hub highlights the government's dedication to preserving and showcasing our historical and religious landmarks. Additionally, the support for Odisha's tourism infrastructure reflects a broader strategy to leverage India's diverse attractions, from its scenic landscapes to its vibrant cultural and historical sites.

These initiatives not only aim to position India as a global tourist destination but also to create significant job opportunities and stimulate investments across various sectors. We applaud this forward-thinking approach, which will undoubtedly enhance India's global tourism profile and drive economic growth.

Atanuu Agarrwal - CEO & Co-founder, Distil

The Union Budget 2024 was in line with the Government's consistent effort to nurture startups and manufacturing in India.

A significant move in the right direction is the abolition of the angel tax. It eliminates unnecessary administrative hassle for both startups and investors, and can make the fund raising process much more efficient. In the long term, having more stability on taxation and reducing avenues for potential disputes only reduces hurdles for money to flow to our fledgling startup ecosystem.

Further, this budget acknowledges the importance of generating employment through high-paying manufacturing jobs. Rationalising duty structure on key intermediates, promoting investment in R&D, and enhanced credit support to MSMEs are all crucial steps toward Viksit Bharat.

Quote attributed to Mr Madhav Krishna, CEO and Founder of Vahan.ai :

"The Government earmarking a provision of ₹1.48 lakh crores for education, employment and skilling is commendable. Budgetary support and focus on skilling initiatives are essential to ensure that the youth of the country are employable. Such skilling programs should also keep in mind the nature of future jobs, which will arise in the future due to the advancement of technology and AI, and ensure that the youth are equipped and upskilled for the same as well. Additionally, the reforms in the factors of production as promised could greatly incentivise entrepreneurship and lead to greater economic development.

Hopefully, post the budget, the Government will also prioritise investment in research and development in key areas like AI and Machine Learning. I look forward to the Government making specific guidelines on increasing investments in AI-focused startups, whether through public-private partnerships, dedicated research institutions, or other means. By taking these steps, the government can sow the initial seeds for a thriving domestic AI ecosystem, fostering innovation and ensuring responsible development of this transformative technology."

Mr Ajay Gupta, Founder & CEO, Bachpan Play School.

"Analysing the Education Budget 2024, it feels great to see that the government is striving to take a balanced approach that equally values knowledge and innovation along with vocational training and technical skills. Such an approach aims well at the long-term progress of our nation and is much needed.

All these initiatives like the revision of the Model Skill Loan Scheme, the provision of educational loans of up to 10 lakh for higher education, and the setting up of more medical colleges are sure to give a boost to our knowledge-based aspect of the economy. They will elevate our intellectual capital as well as research capabilities.

Further, the upgradation of around 1000 ITIs with advanced training programs and design, the creation of 1 crore internships for the youth along with good stipends and incentives, and the specialised training for around 20 lakh young people over a 5-year period also heralds a new chapter in our skill-based aspect of the economy.

Thus, I would say that this year's Education Budget fares quite well in bridging the gap between theory and practical application. However, that being said, there are bigger gaps to bridge when it comes to creating accessible school infrastructure and digital access, and the modest increase in budget allocation to education, upskilling, and job creation (from 1.12 lakh crore last year to 1.48 lakh crore this year) doesn't seem up to standard. Nevertheless, we have come a long way, and the future looks promising."

Mr. K V Srinivasan, Executive Director and CEO, Profectus Capital Pvt Ltd

"This budget is a bonanza for MSMEs. Measures like vastly enhanced Credit Guarantees up to Rs 100 cr. and an increase in MUDRA limits should facilitate capital expenditure for the expansion and modernisation of MSMEs in the manufacturing sector. Wider coverage of TReDS and credit for MSMEs in the early stage of stress should help them manage working capital and cut cash flow cycles. Abolishing Angel tax is another welcome measure that would help bring more FDI into the start-up sector. The availability of well-trained manpower and providing formal employment to them has been a serious challenge faced by MSMEs. EPF subsidy and measures for skill enhancement should make this task easier. All in all, it is a very MSME-friendly budget."