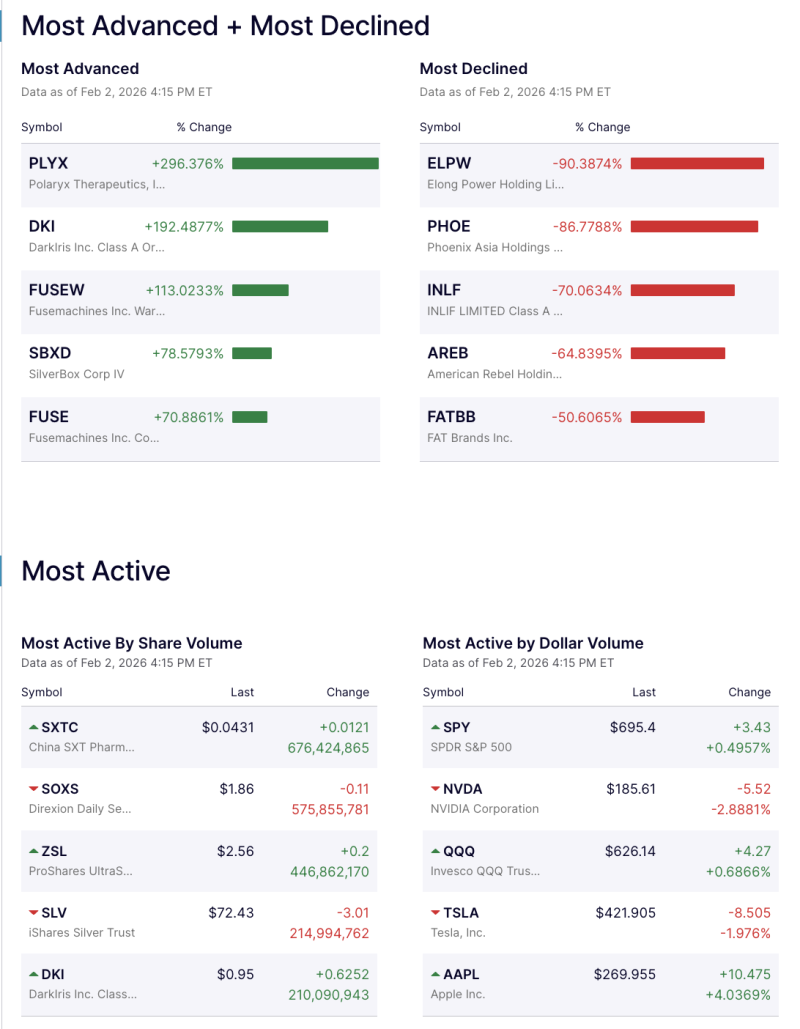

Market Snapshot (Data as of Feb 2, 2026 | 4:15 PM ET)

US equity markets witnessed extraordinary stock-level divergence, with speculative microcaps delivering triple-digit gains, while several counters collapsed by 50–90%, highlighting elevated risk appetite and sharp positioning ahead of key macro and policy cues.

Biggest Gainers (Day % Change)

| Stock | % Change |

|---|---|

| PLYX (Polaryx Therapeutics) | +296.38% |

| DKI (DarkIris Inc.) | +192.49% |

| FUSEW (Fusemachines Warrant) | +113.02% |

| SBXD (SilverBox Corp IV) | +78.58% |

| FUSE (Fusemachines) | +70.89% |

Expert view:

Such outsized moves are typically driven by low-float dynamics, speculative momentum, corporate actions, or event-led trading, rather than broad-based fundamentals.

Steepest Decliners

| Stock | % Change |

|---|---|

| ELPW | -90.39% |

| PHOE | -86.78% |

| INLF | -70.06% |

| AREB | -64.84% |

| FATBB | -50.61% |

Expert view:

Sharp collapses of this magnitude often reflect delistings, failed restructurings, capital dilution, or regulatory concerns, underscoring heightened downside risk in thinly traded names.

Most Active Stocks: Where Money Flowed

By Share Volume

SXTC: 676M shares traded

SOXS: 575M shares

ZSL: 446M shares

SLV: 214M shares

DKI: 210M shares

By Dollar Volume

SPY: $695.4 (+0.50%)

QQQ: $626.14 (+0.69%)

AAPL: $269.96 (+4.04%)

NVDA: $185.61 (−2.89%)

TSLA: $421.90 (−1.98%)

Expert takeaway:

While headline indices remained relatively stable, institutional flows stayed concentrated in ETFs and megacaps, even as retail-led speculation dominated microcaps—a classic late-cycle volatility signal.

Bottom Line

Markets are showing two-speed behaviour:

Stability at the index level

Extreme volatility beneath the surface

Investors should remain cautious, as such dispersion often precedes sharp mean reversion or regulatory intervention.