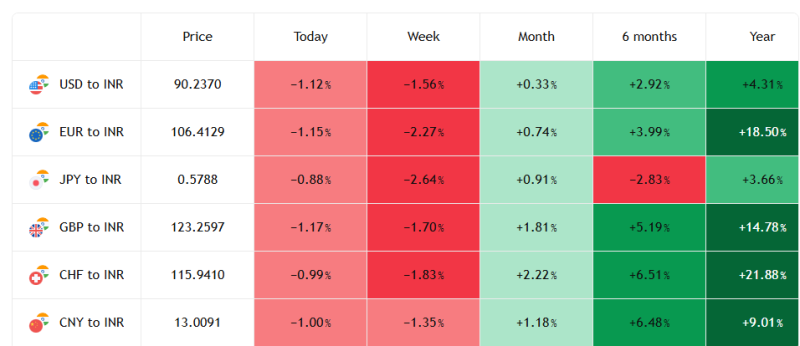

The Indian rupee showed broad short-term weakness but strong medium- to long-term resilience against major global currencies, according to the latest forex data.

On a day-on-day basis, the rupee weakened across the board, with USD/INR at 90.2370 (-1.12%), EUR/INR at 106.4129 (-1.15%), and GBP/INR at 123.2597 (-1.17%). Similar pressure was seen against JPY (-0.88%), CHF (-0.99%), and CNY (-1.00%), reflecting near-term global dollar strength and risk-off sentiment.

However, monthly and longer-term trends remain positive for the rupee. Over the past month, the rupee gained against all tracked currencies, led by GBP (+1.81%), CHF (+2.22%), and CNY (+1.18%).

The six-month performance highlights stronger appreciation, with the rupee up 6.51% against the Swiss franc, 6.48% versus the Chinese yuan, and 5.19% against the British pound.

On a year-on-year basis, rupee strength is most pronounced against CHF (+21.88%), followed by EUR (+18.50%) and GBP (+14.78%), underlining India’s relative macro stability compared to key global economies.

Overall, while short-term volatility persists, the data indicates that the rupee has delivered solid gains over medium and long horizons, supported by improving fundamentals and sustained capital inflows.