Corporate activity dominated market disclosures today as SRM Energy Limited and Shah Foods Limited announced significant open offer developments, alongside global market and commodity updates.

SRM Energy Open Offer

Sobhagya Capital Options Private Limited, acting as Manager to the Offer, issued a Pre-Offer Advertisement and Corrigendum to the Detailed Public Statement for an open offer to acquire up to 23,55,600 equity shares (26%) of SRM Energy at ₹10 per share. The Independent Directors Committee has termed the offer price fair and reasonable. The Letter of Offer has been dispatched, with the offer opening Feb 11, 2026 and closing Feb 25, 2026. All public shareholders are eligible to participate.

Shah Foods Open Offer & Promoter Transition

Navigant Corporate Advisors Limited announced an open offer for 60,61,900 equity shares (26%) of Shah Foods at ₹62.50 per share, aggregating to approximately ₹37.89 crore, payable in cash.

The offer was triggered following a preferential allotment approved on Feb 10, 2026, involving issuance of 2.27 crore shares (97.44% of emerging capital). This includes share issuance to Acquirers and PACs against acquisition of Tandhan Power Technologies Pvt Ltd and allotment to public investors. Additionally, a Share Purchase Agreement was executed to acquire promoter shares.

Post-transaction, Acquirers and PACs will hold 69.39% stake, gaining promoter classification and control of the company.

Global Markets Snapshot (Feb 11, 2026)

US markets showed mixed sentiment — Dow Jones Futures rose 0.26%, while S&P 500 and Nasdaq declined 0.36% and 0.58%, respectively. Asian markets traded higher, led by Nikkei (+2.23%), with modest gains across Hang Seng, Shanghai Composite, and GIFT NIFTY.

Corporate Update

Tenneco Clean Air India Ltd will host its Q3 & 9M FY26 Earnings Conference Call on Feb 16 at 4:00 PM IST. Senior management including CEO and CFO will participate. The discussion will rely solely on publicly available information, with no unpublished price-sensitive information disclosed.

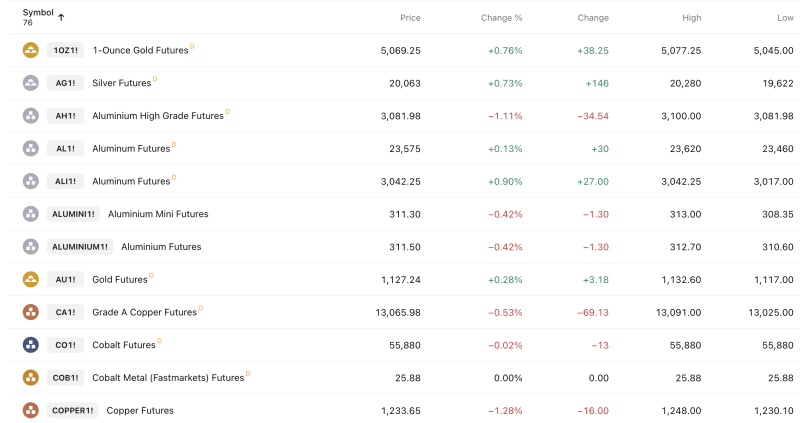

Commodities Trend

Metal prices showed mild gains. Iron ore traded at $100.63 (+0.52%), lithium at $136,000 (+0.37%, +77.4% YoY), and steel at $3,052 (+0.30%), indicating steady industrial demand despite weekly softness in some segments.