Global equity markets closed on a mixed note with divergent regional performance reflecting cautious investor sentiment and selective buying. Asian markets showed strength, while the US and most European indices edged lower.

In Asia, the Korea Composite Index surged 2.58%, emerging as the top performer amid strong buying across sectors. However, Japan’s Nikkei 225 slipped 0.12%, reflecting mild profit booking after recent gains.

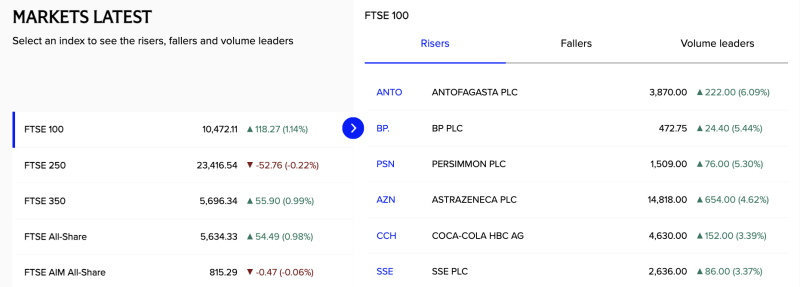

In Europe, markets largely traded in the red. The DAX fell 0.53%, CAC 40 declined 0.18%, and Italy’s FTSE MIB dropped 0.62%, indicating broad-based weakness across continental equities. In contrast, the UK FTSE 100 outperformed, rising 1.14%, supported by gains in heavyweight blue-chip stocks.

US markets remained subdued, with the S&P 500 down 0.01%, Dow Jones falling 0.13%, and the US Composite Index declining 0.16%, reflecting cautious positioning by investors amid global macro uncertainty. Meanwhile, the CBOE Volatility Index (VIX) eased 0.79% to 17.65, signaling relatively stable market risk perception.

Overall, global markets displayed a mixed trend with strength in select Asian and UK equities offset by weakness across US and major European benchmarks, suggesting a cautious but resilient global risk environment.