The digital asset sector is currently navigating a sharp risk-off correction, triggered by a combination of hawkish Federal Reserve signals and a "software-mageddon" in equity markets that has severely impacted crypto-correlated assets.

Index Performance & Asset Benchmarks

The market is showing a narrowed intraday decline, though structural damage from the prior week's "freefall" persists.

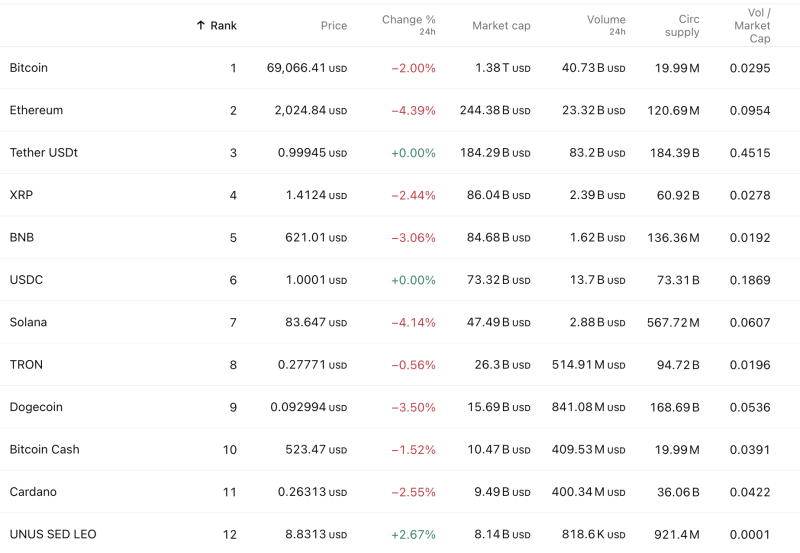

| Asset / Index | Last Value | 24H Change | Trend Summary |

|---|---|---|---|

| Bitcoin (BTC) | $69,023.77 | -1.25% | Consolidating below $70k; 45% off October high. |

| Ether (ETH) | $1,989.00 | -6.20% | Underperforming; broke $2,800–$3,000 support. |

| CoinDesk 20 Index | ~2,150.00 | -3.70% | Broad market decline; captures 90% of digital assets. |

| CoinDesk 5 Index | N/A | -3.40% | Weighted performance of top 5 assets. |

Market Breadth & Global Sentiment

The dominant market narrative is risk-off, characterized by sustained deleveraging and a lack of clear direction as shockwaves from last week’s sell-off reverberate.

Breadth: Negative. Ether is significantly underperforming Bitcoin, with its market share dropping to 10% while Bitcoin dominance holds steady at 60%.

Institutional Flows: Severe. Bitcoin ETFs have seen $1.8 billion in outflows this year, while Ether ETFs have lost $462 million in 2025 alone.

Sector Highlights: Digital Asset Treasuries (DATs) are under extreme stress; Strategy™ (formerly MicroStrategy) reported a $12.4 billion Q4 loss due to Bitcoin impairment charges.

Institutional Interpretation

Momentum: Bearish. Bitcoin has hit its longest monthly losing streak since 2018. Derivatives data confirms this defensive shift, with funding rates flipping neutral-to-negative, signaling short-seller dominance.

Volatility: Extreme Backwardation. Front-end implied volatility has spiked to 85.03%, dwarfing long-term expectations near 50%, which indicates a high premium for near-term protection against further price drops.

Sentiment: "Extreme Fear." The Fear and Greed Index recently touched 14, its lowest level in nearly three months. The nomination of Kevin Warsh as Federal Reserve Chairman has introduced further liquidity concerns, acting as a "second hammer blow" to risk assets.